How to Create Your First Trading Strategy

Trading in the financial markets requires the ability to correctly identify opportunities to improve your portfolio. However, in a 2023 survey by CySEC, one in three investors said they regretted making an investment decision, while 26% believed they had committed more capital than they could afford to lose. The absence of a dependable trading strategy can result in bad trading experiences. A trading strategy is a plan for executing orders and should be objective, quantifiable, and verifiable. Here are 6 steps to creating your first trading strategy.

Step 1 – Determine Your Risk Appetite

This is the degree of risk you are willing to take for the opportunities presented by the financial markets. Your risk appetite or risk tolerance may change during your trading journey. It’s important to continue assessing it as you gain confidence in the markets.

To understand your risk appetite, consider the capital you have available for trading and can afford to lose if the market moves against you. When you have this figure, consider the profits you want to make with it. For instance, if you’re willing to deposit $1,000 and make $200, then your risk-reward ratio is 1000:1200 or 1:1.2. Placing a numeric value to your risk appetite and risk-reward ratio will help you make better trading decisions.

Did you know?

Day traders typically trade with lower risk levels per trade and a larger number of trades, while longer-term investors accommodate higher risk levels.

Step 2 – Decide the Timeframe

This depends on how much time and capital you can devote to trading. You can always change your timeframe and trading style to suit your changing abilities. Scalpers open and close trades in seconds, while day traders take positions for a few hours and swing traders may hold positions open for days. After some practise, you may find that you are more comfortable with high-frequency trading or prefer to observe end-of-the-day charts to make trading decisions.

Step 3 – Choose the Markets to Trade

There are several asset classes, including forex, commodities, stocks, indices, metals, and cryptocurrencies. New traders often begin their journey with forex as they are familiar with currency pairs, the forex market has low barriers to entry, and is easier to understand. Longer-term investors tend to favour commodities and metals.

Once you have identified the asset class to trade with, it’s time to begin learning about it. Know what factors move the market and the options available. For instance, if you have decided to begin with forex trading, you can learn about the factors that move difference currencies and then identify the currency pair you want to begin with. Learning the nuances of the market will help sharpen your instincts.

After you have chosen assets to trade, you can decide whether you’d like to trade them directly or via derivatives like CFDs. When you trade via CFDs, you do not need to buy and own the underlying asset and you can target trading opportunities in both rising and falling markets.

Step 4 – Select the Tools

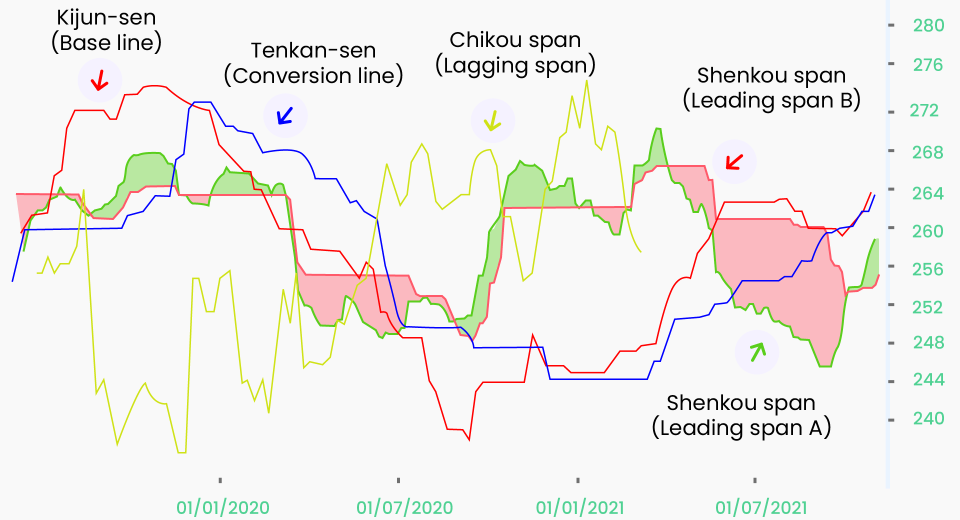

Technical indicators are used to gain deeper insights into past price movements to help predict the future direction of prices. There are five categories of technical indicators, namely trend, mean reversion, relative strength, volume, and momentum. The most popular for beginners are simple moving averages (SMAs), exponential moving averages (EMAs), Bollinger Bands, Relative Strength Index (RSI), stochastics, and on-balance volume (OBV).

Avoid choosing indicators that are too complex. Instead, begin with the simplest ones to take positions in a trending market. You can always add more as you refine your trading strategy. Try using different indicators on price charts to determine which you are most comfortable with.

Using one indicator may not give you reliable trading signals. You may want to use one to determine entry and exit points and another to confirm your decision. Aside from indicators, there are some other useful tools, like the economic calendar, news updates, and sentiment analysis tools.

Step 5 – Risk Management

Knowing when to exit a trade is as important as deciding entry points. Often new traders delay exiting a position even when the market continues to move unfavourably, with the hope of recovering their losses. However, this not only results in more losses, but also makes it difficult to accept losses.

The most popular risk management tools are stop loss and take profit. Stop loss ensures that the trade will close automatically at a predetermined price, when a prediction goes wrong. A take profit order helps book profits when the market moves as per your calculations. It prevents you from losing out on profits in case the market suddenly reverses.

Step 6 – Test Your Strategy

Although your first trading strategy may be very simple, it’s a good idea to write down the trading rules. Incorporate these into your trading plan. Open a demo account and start practicing your trading strategy. This will help you to gain confidence and follow the trading strategy consistently and with discipline.

Keep a record of the trades, as this helps you learn from your mistakes and discover what you’re good at. Practising on a demo account also provides you with a record of your trading strategy, which can be useful when you are ready to refine it.

Financial markets are exciting and present numerous opportunities. The number of assets and trading options can seem overwhelming to a beginner. Following these six steps can simplify and ease your entry into the world of trading.

To sum up

- Determine how much risk you are willing to take.

- Consider the time you can invest in trading.

- Learn about the markets and what moves them.

- Decide which assets you would like to begin with.

- Select the indicators and other tools you are most comfortable using.

- Choose your risk management technique.

- Practise when you are ready and keep learning.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.