4 Smart Strategies to Trade Precious Metals

Gold has enjoyed the status of a storehouse of value for generations. The shiny metal is accompanied by silver, platinum, and palladium to form the precious metal category. Due to their scarcity, longevity, multiple applications, and sentimental value, precious metals have evolved into a distinct class of commodities traded around the clock.

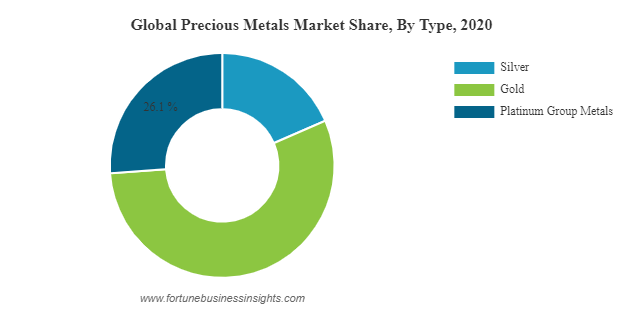

Precious metals, specifically gold, are popularly considered safe-havens and traded to hedge against market uncertainties and inflation. The precious metal market is expected to reach a valuation of $403.08 billion by 2028, growing at a CAGR of 5.6% from 2021.

Image Source: https://www.fortunebusinessinsights.com/precious-metals-market-105747

Precious metals are an essential part of a well-diversified portfolio. Seasoned traders who have high exposure to the forex and/or equity markets often add precious metals to hedge risks. When trading precious metals, it’s important to know that they typically respond differently than other asset classes to various global events. While you may use the same or similar strategies to trade all instruments in your portfolio, it’s good to know what moves their markets.

Understanding the Market

Before going into trading strategies, here’s a look at the most popular precious metals. Gold and silver are the most heavily traded metals and are among the top ten traded commodities by volume.

The gold market is highly liquid, with an average daily trading volume of almost $131 billion in 2022. Given the yellow metal’s high liquidity, the spreads are generally tight, and the market does not exhibit too many erratic price movements.

The silver market is often much more volatile than other precious metals. This is because silver’s unique properties of being highly conductive, anti-bacterial, and malleable make it the ideal choice for different industries, which affects its demand. Silver is used in semiconductor chips, batteries, dentistry, pharmaceuticals, and water purification.

Remember

Experienced traders choose between gold and silver by looking at the price ratio between them. The gold-silver ratio indicates the amount of silver that is needed to buy an ounce of gold. Traditionally, this ratio is taken as 15:1. If the current ratio is higher, say 25:1, it indicates that more silver (25 ounces) is needed to buy an ounce of gold, suggesting that the price of the yellow metal is high. A lower ratio means silver is more expensive and it’s a good time to buy gold.

Trading Precious Metals with a Sound Strategy

#1 – Position Trading

This involves holding the asset for a longer period. Position trading is popular for precious metals because they are typically bought for hedging risks in the rest of the trading portfolio. For position trading, you will need to determine the long-term price trend, ignoring the price fluctuations taking place in minutes or hours.

For position trading, you will need to know the factors that impact precious metals, rather than depending purely on technical analysis. Here’s a look at the factors that impact the price of gold, silver and other popular precious metals:

Global Economic Landscape: When there is a slowdown in the global economy or there are concerns around the growth of major economies, the demand for precious metals tends to increase. This is sometimes counterintuitive for new traders. For instance, gold is used for making jewellery, which is a luxury item, and should ideally decline when there are macroeconomic challenges. Similarly, silver is used in various industries and its demand should be negatively impacted by an economic slowdown. However, the demand for both these precious metals increases because of their safe-haven appeal. Traders add more of these metals to their portfolios to hedge the increased risks associated with economic headwinds.

Remember

Although palladium or platinum do not enjoy a safe-haven status, their demand is also not negatively impacted by an economic slowdown. This is because these metals have much wider applications in more defensive sectors, like pharma.

Movements in the US Dollar: Trading between countries usually takes place in US dollars. All assets trading in financial markets is also quoted in US dollars. As a result, movements in the greenback impact all countries and all markets. When the US dollar strengthens, all precious metals become more expensive for holders of other currencies. This exerts pressure on demand and, consequently, their prices. For Gold, the inverse relationship with the US dollar is even stronger. This is because gold and the US dollar compete for a place in investor portfolios as safe-haven assets.

Remember

Announcements by the Federal Reserve have the greatest impact on the US dollar. While a rate hike announcement lends upside to the greenback, comments by policymakers on quantitative easing exert downward pressure.

#2 – News Trading

News has a deep impact on market sentiment. This is what news traders aim to use to their advantage. This strategy involves keeping in touch with the news and placing trades accordingly. Traders may go long or short on precious metals ahead of an expected announcement and sell immediately after the news has broken. They tend to hold the position for only a few minutes or even seconds.

For news trading, you will need to keep an eye on the economic calendar, as data releases and central bank announcements have a significant impact on the price of precious metals, especially gold. If a data release is short of projections, gold prices tend to rise. Better-than-expected economic data will bring gold prices lower.

Remember

The most market-moving economic releases are the US NFP (nonfarm payroll) report, inflation data and Federal Reserve announcements.

#3 – Trend Trading Strategies

These strategies are based on technical analysis to identify the direction of price movements. This uses historical price action to determine the trend. The assumption is that trading instruments continue to move in the same direction.

#4 – Price Action Trading Strategies

These strategies use technical analysis to identify trading opportunities. This also uses historical price action to make predictions but uses a much shorter timeframe than trend trading strategies. The price action is typically plotted on candlestick charts and technical indicators are used to make the predictions.

Remember

Moving averages, Relative Strength Indicator (RSI), and Bollinger Bands are the most popular technical indicators used by new and experienced traders alike.

Traders can decide on a trading strategy for precious metals based on their risk appetite, financial goals and exposure to other asset classes. Whatever you choose, it’s a good idea to test your strategy on a demo account before trading in the live market.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.