How Do Pivot Points Influence Trading?

Pivot points in trading are price levels that are considered by traders as indicators of possible market movement; turning points of market momentum. During times when computers and charting software didn’t exist, these indicators were used by pit traders (floor traders in equity and commodity exchanges) to identify market directions. Today, it is a vital part of technical analysis on all major trading platforms.

What is a Pivot Point?

Pivot points are calculated as an average of all significant prices of market performance in the previous trading session. Of the many methods to calculate them, the five-point system is the most popular. It includes the high, low and closing prices of the previous session, along with two support and resistance levels. The equations are:

- Pivot Point (P) = (H+L+C)/3; Previous Highs, Lows and Close

- Support 1 (S1) = (Pivot Point x 2) – Previous High

- Support 2 (S2) = Pivot Point – (Previous High – Previous Low)

- Resistance 1 (R1) = (Pivot Point x 2) – Previous Low

- Resistance 2 (R2) = Pivot Point + (Previous High – Previous Low)

Sometimes, it is the simple arithmetic mean of the previous session’s high, low and close (which is the first formula above) although support and resistance levels add much more accuracy. For instance, in an uptrend, the pivot point, along with the resistance level, may represent a price ceiling, beyond which the trend is no longer sustainable, leading to a reversal in the near future.

Traders might opt for a third set of price and resistance levels, but a fourth set is rarely used. Major charting platforms will do these calculations for you. Such software also helps in case you want to do some back-testing on how the levels have fared in the past.

Interpretation of Pivot Points

There can be two ways to use pivot points:

- Defining the overall market trend

- Defining the entry and exit points of trades (used rarely for entry points)

The second way can also, alternatively, be modified as a means of risk management by traders. Forex traders often use them to determine their stop-loss levels. If prices drop through the pivot points, it signifies a bearish market. Conversely, if the prices break through the pivot points in an upward movement, the market is bullish. Here, the first resistance level is often considered a good place to exit a trade.

Support and resistance lines here work like the traditional ones. If the price gets too near one of the support levels, there is a huge probability that it will bounce and reverse. So, a trader can put a stop-loss at the support levels, or even a limit order, in case the price breaks at the resistance levels. In case a market is not going in any particular direction, prices fluctuate around the pivot points until a breakout takes place.

Pivot points are quite suitable for forex markets due to sheer market liquidity. High liquidity makes it harder for any kind of market manipulation. In addition, these support and resistance levels are time-tested tools that are respected by traders around the world.

Pivot Point Strategy in Range Trading

Just like the normal support and resistance levels, here too, price tests the levels to determine their strengths. The greater number of times the price touches a pivot level to reverse, the stronger is the level. In case you see a pivot point holding like this:

- You can assume a short position when the price nears the upper resistance level and place a stop-loss above this resistance level.

- You can assume a long position when the price nears a support level and place a stop-loss below this level.

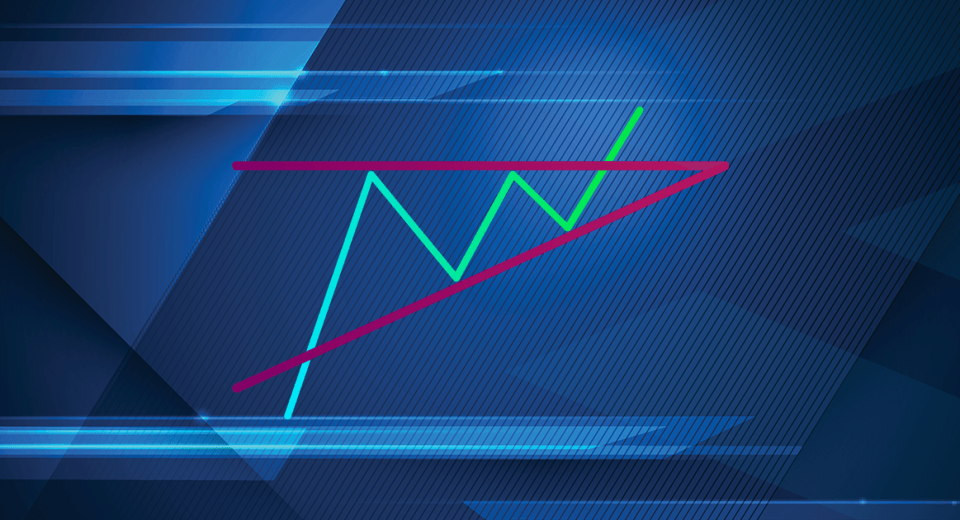

Pivot Point Strategy in Trading Breakouts

Pivot points do not hold forever, so they can be used for range trading only to an extent. To enter a breakout trade, you could place a stop limit order at the point where the price breaks through a pivot point level. In case the breakout is bearish, it’s wise to assume a short position and, similarly, if the breakout is bullish, go long. Try holding on to the breakout trades, until the price action goes to the next level.

Unlike range trading, where traders look for pivot point breaks in support and resistance levels, here strong and quick movements are seen. Remember, theoretically, when a level will break, it will become a “support-turned-resistance” level or vice versa. This is called a “Role Reversal” in pivot point strategies. Unless a big economic event occurs, it is rare for prices to breakout at all pivot point levels.

Things to Consider in Pivot Point Strategies

- Early mornings are best suited for these strategies. For instance, London open or 8:00 AM GMT. Many big banks open for the day’s trade at this time. Floor traders in the past used this time to adopt a boundary to analyse the market, based on the previous trading session, which provided them opportunities. Even the modern market algorithms today use some form of pivot point strategy.

- When trading breakouts, there are always risks associated. You might enter with the assumption that the markets are rising, and then get caught up in a downtrend. Fake breakouts can also be caused by the release of important news, so make sure you have an economic calendar to stay notified of the day’s events.

- The longer the timeframe of a pivot level, the more important it is.

- Quarterly pivots could give you levels that are not found through other methods. They could offer the bias for a 3-month trading period. However, quarterly pivots are generally not present in standard packages.

- Experts suggest that placing stops exactly at the support levels, and not slightly below, is a common mistake that you should refrain from. Similarly, avoid the tendency to overtrade, and try to exit trades at the pivot point levels.

- It is vital that you use the pivot points to figure out if you are in a losing trade. For instance, if the price breaks out on one of the resistance levels and you are in a long position, check if the price rolls over and immediately goes down below this level. If it does, then you are in a risky position.

- Focus not only on the data from the current day’s trading, but also on the previous day’s pivot points.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than invested capital.