How To Install Custom Indicators on MT5

Custom indicators help identify the trend, momentum, volatility, or support/resistance levels, and play a key role in making sound trading decisions. In June 2021, MetaTrader 5 surpassed MetaTrader 4 to become the most popular trading platform. If you’re using MT5, you already have access to a vast library of indicators to choose from. Here’s everything you need to know on how to use indicators on your MT5 charts.

How to Choose a Custom Indicator?

Choosing the correct indicator can be tricky. Start by checking trader communities and learn as much as you can about the indicators to choose what fits your trading strategy and style the best. You can check online reviews to verify that they do not fail under certain market conditions or when used with other indicators. You may wish to avoid hard-coded indicators as they fail with changing market conditions.

There are both free and paid custom indicators. Among the paid ones, there are one-time payment and subscription based indicators. Some involve a smaller one-time payment and levy a fee for updates. Make your decision based on your trading strategy first, and then the budget.

Steps to Install Custom Indicators on MetaTrader 5

Here are the steps to download, install and test a custom indicator on MT5.

Step 1: Download the Indicator

There are two ways of downloading a chosen indicator:

Directly from the Terminal

- Open the Toolbox window in your MT5 platform and locate the list of all indicators and expert advisors (EAs).

- Choose the indicator from the list. People who create custom indicators keep adding to this list.

- Click Download.

- The MT5 website will open. If you don’t already have an account, create one. Else, log in with your username and password.

- Download the .myql5 file with the indicator’s name.

- In case, it’s a paid indicator, the payment process will be initiated before you can download the file.

From the MT5 Website

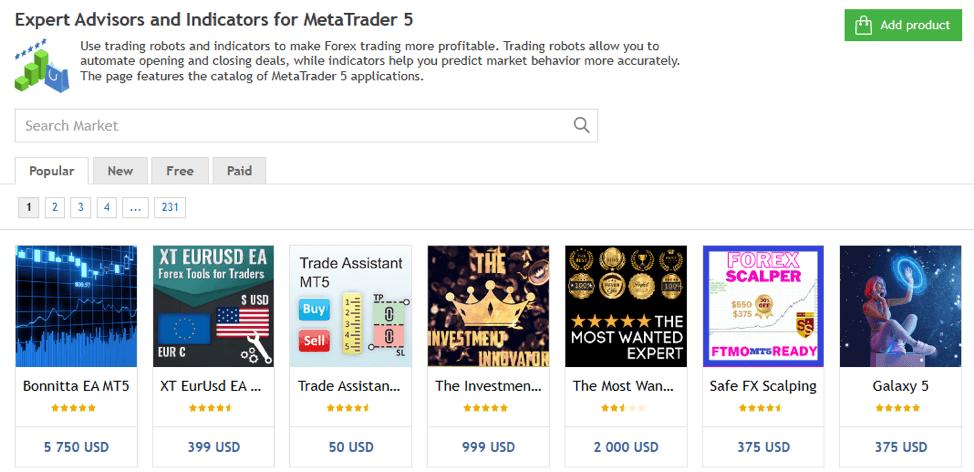

- Open the MT5 website and go to Marketplace. There are four tabs here: Popular, New, Free and Paid.

- You may click on the relevant tab and scroll through the list or simply search by typing in the name of the indicator in the search box.

- Once you see it, download the .mql5 file.

If you know how to code, you can build your custom indicator. To do that, you’ll need to learn MQL5 (the MT5 programming language). You can even connect with the coding community to clarify any doubts. Whether you’ve downloaded the .mql5 file from the MT5 Marketplace or created your own file, you’ll need to follow the same steps to install the indicator on the terminal.

Step 2: Go to the Indicators Folder

- Open the Terminal and log in with your credentials.

- Go to the File Tab and click on Open Data Folder. Alternatively, you can directly open the data folder by pressing Ctrl+Shift+D on your keyboard.

- Open the MQL5 folder.

- Open the Indicators folder.

Step 3: Copy

- Go to your Downloads folder and copy the downloaded indicator(s).

- Come back to the Indicators folder and paste the .mql5 file/s here.

You can also open both folders simultaneously and drag and drop the files. As soon as the files are copied, their extension will change to .exe.

Step 4: Reload MT5

You can refresh or close and reopen the MT5 terminal to set up the indicators.

Step 5: Install the Indicator

Once you reopen the terminal, your indicators are ready to be used.

- Open the price chart of the asset you wish to use the indicator for.

- Go to the Insert Tab and click on Indicators.

- Click on Custom. A list of all the indicators you have (in your File -> Open Data Folder -> MQL5 -> Indicators) will appear.

- Click the chosen indicator and then OK. You can also simply drag and drop the indicator on the Chart Window.

Steps to Remove an Indicator from a Chart

Deleting an indicator is highly intuitive on MetaTrader5.

- Right-click on the indicator.

- Click on Delete Indicator.

Alternately, open the Context Menu, select the indicator from the list and click Delete. This will permanently remove the indicator from the chart.

Learn the Indicator Before Using in Live Markets

Trading indicators are designed by coders. Some developers create them with their level of trading expertise, while others are paid by experts to customise as per their strategy. In both cases, it is important to know how well the indicator fits your trading plan. You can do this with thorough backtesting.

You can backtest the indicator with any price chart from the History section or with your own prepared test sets. Run the indicator and track its performance. Some indicators have customisable parameters that you can adjust, to match your requirements. If the indicator fails to work in the desired way, you can try another indicator.

Make sure that you backtest across a wide dataset involving ranging and trending markets, with high and low liquidity and momentum. This will help you identify their shortcomings. It’s a good idea to use more than one indicator, to confirm the identified signals.

Avoid Using Too Many Indicators

Strategically chosen indicators that give primary and confirmation signals are a powerful tool to enhance your trading experience. When combining more than two indicators, make sure they do not give redundant information, as you will be unnecessarily burdening the processor, which will impact speed. More is not always better, as this will also make it more confusing when making trading decisions in the often fast-moving financial markets.

To Sum Up

- Choose indicators after thorough research.

- Download custom indicators from the MT5 Terminal or Marketplace.

- Add it to the Indicators’ folder in the Terminal.

- Drag and drop the indicator on the price chart to use it.

- Backtest the indicator before using it.

- Avoid using too many indicators simultaneously.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.