Everything You Need to Know About Support and Resistance Levels

Through technical analysis, traders try to predict the direction of asset price movements by considering historical price data. This helps them identify key entry and exit points for their trades. Support and resistance levels are one of the most commonly used tools in this regard. These are used to identify price levels on charts that act as barriers, preventing the asset price from being pushed further than a level in a certain direction.

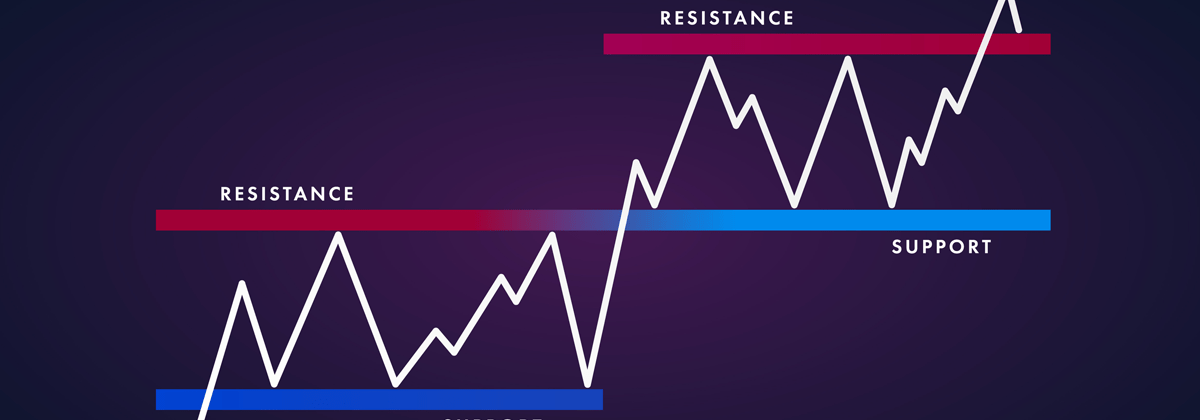

For instance, the price tends to stop declining at the support level and goes back up, while the price usually stops rising at the resistance level and goes back down.

Once these levels are identified, they can act as potential points to enter or exit a trade. This is because after hitting these levels, the price could either bounce back or break the barrier to move and hit new support or resistance levels. Traders use technical analysis to predict one of these two outcomes while planning their trades.

Market Psychology that Establishes Support and Resistance Levels

The support zone is the level where buyers tend to enter the market and where demand appears concentrated. Due to elevated buying interest, an ongoing downtrend is expected to pause. Buyers are in higher numbers than sellers at this point, which pushes the asset price up. At the resistance zone, buyers’ exhaustion sets in and sellers enter the market. Concentration of supply occurs and the uptrend is likely to pause temporarily. Sellers are higher in number than buyers, which pushes the price downwards.

If the price breaks through either of these levels and bounces back quickly, it means that the price is testing those levels. But, if the price breaks beyond either level for a longer duration, the likelihood of a new support or resistance level being created increases.

Resistance can Become Support and Vice Versa

In stronger trends, the price might often ignore the support and resistance levels completely. When the price breaks through either level, their roles are reversed. For instance, if the price breaks above the resistance zone and continues in the same direction, the resistance level could become a new support level and vice versa.

So, traders who had entered short positions at these levels may be looking at losses. They could consider closing their short positions, by placing a buy order in the opposite direction. So, the previous sellers are now buyers at the same level. This is how resistance levels can become support levels and support levels could become resistance levels.

How Do These Levels Work?

The more the price hits a level, the more the level is considered to be reliable and, therefore, useful for predicting future price trends. Also, as a greater number of traders start buying and selling at these levels, they become psychological barriers, thereby strengthening the role of support and resistance levels in analysis.

Overall, traders tend to prefer to make trading decisions around these levels, making the levels very important.

Understanding and identifying support and resistance levels accurately can impact trading outcomes. For instance, if a trader can predict when the bullish trend in a currency pair will end, they can reduce their market exposure or exit the market in a timely manner, limiting losses. If traders understand precisely at what levels a trend will pause, they can set tight stop-losses, providing their trades just enough room to perform well. This can improve the risk/reward ratio.

Ways to Find Support and Resistance Levels and Use Them in Strategies

Support and resistance levels could be great tools to improve trading strategies and market interpretation. There are many ways in which traders determine support and resistance levels.

Emotional Price Levels – Previous Support and Resistance Zones

Historic events, like record price highs or lows, and round numbers are some of the emotional price levels that traders tend to gravitate to. Previous support and resistance zones can, therefore, be used to plan entry and exit points. They also attract a lot of interest, which contributes to higher trading volumes around these levels.

Moving Averages (MA) Can Provide Dynamic Support and Resistance Levels

Moving averages can be used to identify support and resistance areas. These are called dynamic levels, since they smooth out past price data. The moving average line can behave as a composite view of the overall market trend. It usually acts as a resistance in a downtrend and as a support in an uptrend. Some common choices for these lines include the 9-day, 50-day and 200-day moving averages. These can be simple (Simple Moving Average or SMA) or exponential (Exponential Moving Average or EMA). Two lines can be used to create responsive zones.

The 200-MA moves slowly, but can be more reliable than the 50-day or 20-day MA. If the price lies above 200 MA, it could signal an uptrend, while if it starts going back towards the line, it could confirm a ceiling on the prevailing uptrend. This line can be added in combination with the 20 MA and 50 MA crossover strategy, to generate more reliable signals.

Fibonacci Support and Resistance Levels

Fibonacci retracement levels can be used as support and resistance levels. Some common ones include the 23.6%, 38.2%, 61.8% and 78.6% levels. The 50% level is also used sometimes, although not a Fibonacci number. In trending conditions, these numbers can be used to set profit targets and entry strategies. Following a significant movement of the price, upwards or downwards, it could retrace a major portion of the original direction. As this happens, the support and resistance levels often occur near the Fibonacci levels.

The indicator joins two significant price points, such as highs and lows, which makes it useful. A simple strategy using these lines would be the price moving higher and then retracing to 61.8%. After this retracement, it could start going upwards again. Since at this level, the bounce happened during an uptrend, the trader could decide to enter a long position. A stop loss can be placed at 61.8%, since a bounce back below this level could indicate that the rally has paused.

Fibonacci retracements are an advanced indicator. Support and resistance levels can also be drawn using up and down trendlines. To get a usable trend line, traders need to ensure that the trendlines are drawn using two or three peaks and troughs. Here, the uptrend line will be the support level, while downward trend line could act as the resistance level.

Support and resistance levels are best used with other technical indicators to confirm trend momentum and volume. Stops and limit orders can be placed just below the support level and above the resistance level, so that traders can close positions quickly when the price breaches these levels.