Guide to Using Technical Analysis to Trade the Trend

Range trading and trend trading are two popular strategies employed by traders to understand and manoeuvre the financial markets. In range trading, they seek to leverage both upward and downward price movements, between established ranges (support and resistance levels) in the short term. Trend trading, in comparison, is a longer term strategy, where positions are established along a cycle of price movements, either in the upward or downward direction.

Traders choose to trade in a price direction they assume would continue over a long period in the future. At the same time, the aim is to avoid losses due to sudden price breakouts from an established range.

Compared to range trading, where traders can stay limited within a particular price band, trend trading requires immense patience. This is because trends are established over a long period of time and sufficient evidence is required to establish that the trend will continue for long. Moreover, there is always the possibility of trend reversals or stagnation, when important news releases occur, which results in a change in market sentiment.

Fortunately, there are plenty of technical indicators that can help in identifying and evaluating trends. Here’s a look at some of them.

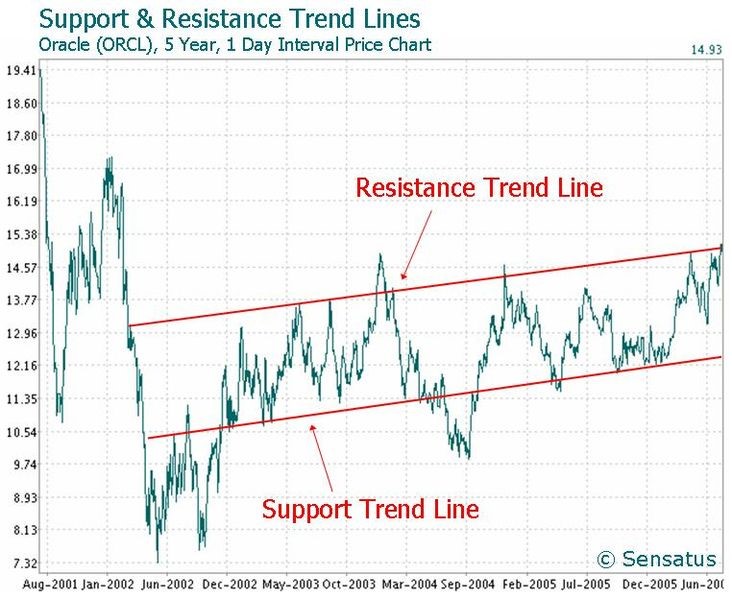

Trend Lines

The first step is to learn to draw and apply trend lines. Trend lines are straight lines that join two or three price peaks and troughs (pivot highs and pivot lows). These can be further extended to become key support and resistance levels. Two basic forms of trend lines exist: upward sloping trend lines and downward sloping trend lines. An upwards trending line is created by joining consecutive swing lows, where each low should be higher than the previous low. This line acts as the support level, indicating greater demand for the asset, which translates into higher prices.

Downward sloping trend lines are formed by joining swing highs, where each high is lower than the previous one. These can act as resistance levels, indicating increased supply of an asset, leading to a gradual price decline. For a trend line to be valid, it should tangentially touch at least 3 price points. The more the price points, the stronger the trend.

Source: https://en.wikipedia.org/wiki/File:OracleSupportResistanceTrendLineChart.JPG

Trend lines are important for a number of reasons:

- To determine current price direction

- To determine the strength and weakness of one trend with respect to another, or even to compare trends between different asset classes

- Can be employed across different timeframes, intervals and asset classes.

Moving Averages

Traders attempting to identify buy and sell signals, look at moving averages (MA). The MA lines can indicate whether an existing trend is still in action. However, they are unable to predict trend shifts. There are several methods to apply MA, such as the angle of the MA lines.

A line that is angled upwards indicates an uptrend. If these lines move horizontally for a long time period, the market is said to be ranging. The 50-day MA and 200-day MA lines are widely used to identify buy and sell signals. When the 50-day MA crosses over the 200-day MA, a buy signal is generated. Conversely, when the 50-day MA falls below the 200-MA, a sell signal is indicated.

Moving Average Convergence Divergence (MACD)

MACD is a momentum oscillator, primarily used to trade trends. Two lines on the chart appear to oscillate without boundaries and the crossover of these two lines gives signals to buy and sell, much like moving averages.

The two lines could be fast (26-period EMA) or slow moving (12-period EMA). When the fast line crosses through and above the slow line, it indicates a buy signal. If the fast line crosses through and below the slow line, it indicates a sell signal. The indicator also gives an idea of the market sentiment. This is made possible through a signal line (9-period EMA). MACD is the difference between the 12-period EMA and the 26-period EMA. EMA here stands for Exponential Moving Average.

Source: https://fr.m.wikipedia.org/wiki/Fichier:MACDpicwiki.gif

- MACD crossing above the zero mark is considered bullish, while if it crosses below zero, the market is considered bearish.

- When the MACD line crosses the signal line from below to above, the indicator is bullish. The more the line comes below the zero level, the stronger the signal.

- When the MACD line crosses the signal line from above to below, the indicator points towards bearish conditions. The further it comes from above the zero line, the greater the strength of the signal.

- MACD whipsaws during range trading.

Relative Strength Index (RSI)

This is another oscillator, the values of which range between 0 and 100. It measures the strength of the current price trend, in comparison to previous prices. During strong uptrends, the price might reach levels beyond 70 for long periods of time or the price could stay at 30 or below, in case of downtrends.

If the RSI crosses the oversold line of 30, a trader might consider it a buy signal. When the RSI line crosses below the overbought line of 70, this could be a signal to sell. Depending on the timeframe, the number of buy and sell signals generated by the RSI might decrease or increase.

Source: https://en.wikipedia.org/wiki/Relative_strength_index

RSI divergences are another method to estimate trend strength and take short or long positions.

- If both RSI and price appear to be rising, and RSI crosses above the 50- level, traders tend to choose to enter long positions.

- If both RSI and price appear to be falling, and the RSI crosses below the 50-level, this could be an indicator to enter a short position.

Many traders combine the stochastic indicator with RSI to identify potential buy and sell signals.

Indicators can be used in various ways, together with other tools, to identify and predict trends. It could be useful to test them on a demo account before applying them in the live markets. A defined stop-loss or take-profit strategy is always a good idea, regardless of the trading strategy. Lastly, too many indicators could sometimes provide contradictory signals, which is why traders prefer to focus on a single strategy and stick to it.

References: Commodity.com, Harry Nicholls, Investopedia