Start Commodity Trading Here

The standard deviation of year-on-year growth of commodity terms of trade (CToT) stayed near the 1% level between 1981 and 2019. It rose to 1.85% during 2020-2021. CToT measures the volatility of the commodities market. In 2022, geopolitical tensions, banking crises and supply-chain disruptions drove commodity prices, inducing volatility. Although previously, most commodity price surges were accompanied by fiscal expansions, this time, it came with a slowdown in growth and amplified swings in inflation rates globally.

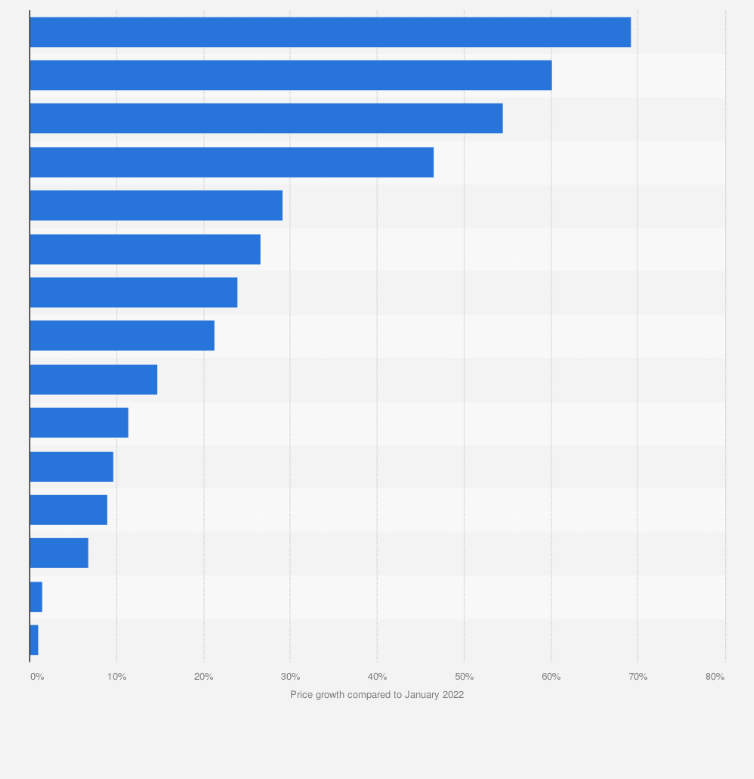

Change In Price of Different Commodities from January 2022 to June 2022

Source: https://www.statista.com/statistics/1298241/commodity-price-growth-due-to-russia-ukraine-war/

Higher volatility and a unique global economic atmosphere are attracting traders to capitalise on the volatility-induced opportunities in the commodities market. Are you ready to speculate on commodity price fluctuations? Here’s a guide to help you get started.

Types of Commodities

Commodities are broadly classified as hard and soft.

- Hard Commodities:These include natural resources, extracted and refined for use, such as oil and metals.

- Soft Commodities: These are agricultural products, dependent on seasonal conditions or growers’ capacity, such as livestock products and agricultural produce.

Traders prefer to classify commodities based on their behaviour under various market conditions.

Metals

Metals are used in multiple industries. Precious metals, such as gold and silver, witness distinct trading conditions and opportunities. Metals used extensively in industries, like copper and iron, move differently.

Energies

Crude oil and natural gas see worldwide demand. But being non-renewable sources of energy, their market is affected either by their refining capacity or the availability and usability of alternate sources of energy.

Agricultural Produce

Crops such as sugar, cotton and wheat, or products derived from livestock, such as dairy and silk, are included in this category. Crops are further classified as food, non-food, or industrial, such as cotton.

Advantages of Trading Commodities

- Commodities are traded daily in physical form, ensuring consistent liquidity and volatility in the financial market. This creates a multitude of trading opportunities.

- Commodity trading suits many intraday trading techniques, including scalping, arbitrage, range and news-based trading.

- Commodities are fundamental to the global economy. Therefore, they are popular as hedging instruments.

- Commodities sustain uncertain markets and form a crucial part of the hedging strategy for intraday traders. These assets are great for portfolio diversification due to their inverse correlation with stocks and the US dollar.

For traders adept at fundamental analysis and updated on international events, commodity trading can be effective even with little technical analysis.

Commodity Price Movements

Commodities generally follow a cyclic pattern, with their prices soaring and declining through the year. However, it is important to understand what drives these cycles to speculate on price movements effectively. This helps build an efficient trading plan. The top reasons for price movements of commodities include:

Supply

The commodity supply depends on the amount of produce, the geopolitical backdrop and the weather (for agricultural products). The oil supply, for instance, is controlled by the OPEC, which attempts to minimise major swings in oil prices while ensuring profitability for member oil-producing nations. Agricultural production is affected by suitable or poor weather conditions and natural calamities.

Demand

The demand for goods is often dictated by industrial demand or the global economy’s health. For instance, energy demands soar during winter, while gold demand picks up due to inflation or recessionary fears. Metals such as gallium and germanium saw higher demand in 2023, since China, the largest producer, banned supply to the US, the largest importer and user of these metals, especially in the AI-dominant tech industry.

Supply Chain

The supply chain is a critical element in commodity trade. The inter-dependence of nations for different kinds of produce requires disruption-free trade. For instance, the sanctions on Russia imposed in 2022 resulted in high energy prices across the Eurozone, especially in Italy. This was due to the heavy dependence of the EU block on Russian supply.

Strength of the US Dollar

Since the greenback is the global reserve currency, its price impacts every financial instrument. When the dollar strengthens, commodities become costlier to purchase for other nations. When nations start using their reserves, commodity prices fall due to a loss in demand.

How to Trade Commodities

Utilising tangible assets, traders can gain exposure to commodities through various means, such as trading gold bullion, shares of companies active in the commodities segment, or via futures or CFDs.

CFD trading is one of the most popular techniques because:

- It allows traders to gain exposure to their chosen instrument without owning the commodity. CFD trading significantly lowers entry barriers into the commodities market.

- CFDs facilitate speculating on both rising and falling prices.

- CFDs are traded with leverage, which amplifies profitability. However, it also amplifies potential losses, and traders should use leverage wisely.

Steps to Start Commodity Trading

The below steps can help you build your commodity trading strategy.

Step 1

Identify the commodities you want to trade. Consider your existing portfolio and choose a commodity that works best to hedge the risks of your existing portfolio.

Step 2

Learn how the commodity of your choice moves. Understand the fundamental and technical indicators that can help you speculate on the price movements of your chosen commodity.

Step 3

Choose the indicators that can help you identify trading opportunities and make informed decisions for your commodity of choice. Choose from trend trading, news trading, price trading, or breakout trading strategies, based on your chosen instrument and commodities.

Step 4

Open a demo account and practice trading the commodity, technical and fundamental analysis, and risk management techniques such as stop loss and take profit. Track your trades to refine your trading plan according to your trading goals.

Step 5

Fund your live account and start trading.

To Sum Up

- Commodities are a popular way to gain exposure to a wide class of assets to build a trading or hedging strategy.

- Commodities are classified as either hard or soft, based on their nature/use, such as metals, agricultural produce and energy.

- CFDs are a popular method to trade commodities without owning them and with low entry barriers.

- The price of commodities moves based on supply, demand, supply chain and the strength of the US dollar.

- Use a demo account to build your trading strategy and practice risk management to strengthen your trading plan.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.