Top Economic News Traders Must Not Ignore

Data releases from a country establish the basis for understanding the health of an economy. It reveals the performance and patterns in the past, which traders use to speculate on the future of the economy and the markets. This is because the release of economic data can potentially change market sentiment, traders’ risk tolerance, and, hence the trading decisions of market participants. Here’s a deeper dive into trading with economic news.

Vast Impact Space of Economic Data

Economic data can be released weekly, monthly, quarterly, half-yearly, or annually. Each economic update affects various assets and even other economic data. For instance, improved numbers of building permits signal improvement in job opportunities, a reduction in unemployment numbers, increased consumption, and a strengthening of the local currency. Each of these impacts other economic releases. For instance, in the above case, enough building licenses may boost the nation’s GDP, a major economic update that moves the domestic markets.

How do Traders Use Economic Data?

Before an economic release, analysts speculate on the potential numbers based on leading financial figures. This speculation is called the market consensus or estimate. Therefore, an economic release has a dual effect – first, due to the release and second, due to any deviation from the estimates’ actual numbers. Traders may open trades based on consensus and market sentiment, and later adjust their positions or risk measures once more data is out.

Types of Economic Indicators

Based on whether an economic release predicts economic health or assesses it, the economic indicators are classified as leading, coincident and lagging.

Leading

These predict changes in business cycles before they actually happen. Policymakers use to adjust monetary and fiscal policy to ensure growth, control inflation, etc. These include the yield curve, central bank interest rates and share prices.

Coincidental

Coincidental indicators show how the economy is currently performing. These are used to confirm a trend that is underway. Trade balance, Producer Price Index (PPI) and Consumer Price Index (CPI) belong to this category.

Lagging

These releases lag the current cycle and give information on the previous cycle to help traders and analysts speculate on the economy’s performance in the current and/or upcoming cycle. Unemployment figures and inflation are lagging economic releases.

In short, leading indicators act as the windshield, coincidental as the side windows, and lagging as the rear-view mirror, if economic health were a car.

Top 4 Economic News Updates Traders Must Not Ignore

Now that you appreciate the fundamentals of macroeconomic data releases, you must remember that certain releases are high-impact while others are not. This is because these releases affect a larger section of the financial markets. Here are the top 4 to stay updated on:

1. US Non-Farm Payroll (NFP)

The NFP tends to impact most markets across the globe. It is released on the first Friday of every month by the US Bureau of Labor Statistics. This report also includes average hourly earnings, providing insights into purchasing power. Notably, the NFP is closely related to the GDP, which is released quarterly and is a lagging report. Since the Federal Reserve considers stable prices and maximum employment critical to the economy, the NFP affects its interest rate decision.

2. Central Bank Interest Rate Decisions

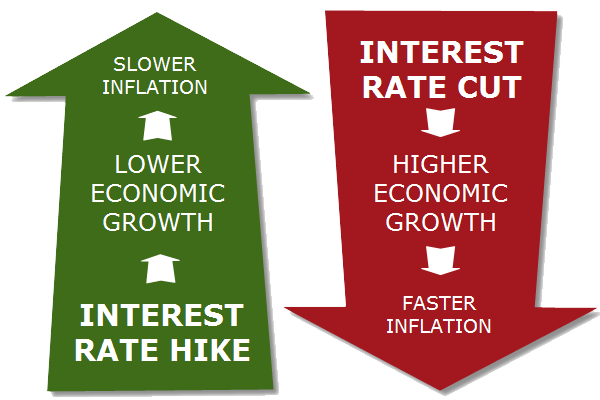

The central bank of each economy tweaks interest rates to curtail inflation while ensuring growth. Decisions by the Fed and ECB tend to have ripple effects across markets. A nation’s interest rates are likely to affect its foreign exchange rate, influencing the financial markets. Interest rate decisions drive or discourage foreign investment, directly affecting a country’s economy. Higher foreign investment with increasing interest rates lifts the currency and vice versa. Also, high interest rates discourage internal credit and borrowing, which slows growth.

3. Inflation Rates

Inflation is a direct reflection of the health of an economy. Inflation measures the change in prices and is a major market mover. Most central banks have a target level for inflation, and their fiscal and monetary policies aim to achieve this goal. Implicit price deflator, a data point released with the GDP, is used to gauge how fast (or slow) the economy is approaching this target. However, this data is released only quarterly, so traders prefer the CPI or PPI to estimate inflation and develop their trading strategies accordingly.

- Headline Inflation is a measure of the overall inflation in an economy.

- Core inflation removes highly volatile market segments, such as food and fuel, eliminating the transitionary noise.

Source: https://www.babypips.com/learn/forex/interest-rates-101

Experienced traders prefer to use core inflation while making decisions.

4. Gross Domestic Product

GDP is the most effective indicator of the economy despite being a lagging one. Since it is a delayed report, it does not directly move the markets. However, deviations from the consensus may induce volatility. Since it is the widest measure of economic activity, it helps analysts and traders understand the state of expansion or contraction of the economy. Analysts make predictions while traders adjust their trading strategies based on whether the economy is growing or contracting.

How Traders Manage Their Positions When an Economic Announcement Is Due

- Stay Neutral: Traders wait for the news to be released and then take positions after the initial reaction of the market fades.

- Tighten Stops: Economic releases may drive a market in a certain direction. Traders with positions on the other side of the trend can use pre-market data to tighten stops and limit losses.

- Widen Stops: When traders know their positions are on trend, they widen their stop losses to ride out any news-induced volatility.

To Sum Up

- Economic data releases are popular among news traders.

- Macroeconomic data releases offer insights into the health of an economy.

- Economic indicators may be leading, lagging or coincidental.

- The most popular economic releases traders follow are the US NFP, GDP, interest rate decisions and inflation rates.

- Based on consensus expectations, traders may wait out, tighten stops or widen stops right before an economic release to limit losses or amplify profits.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.