Using the Kelly Criterion to Plan Your Trades

“Trading correctly is 90% money and portfolio management.” ~ Michael W. Covel

Covel’s statement above emphasises that a great risk model can yield better results even if your strategy is mediocre. On the other hand, if risk management is subpar, even a great strategy may fail.

The Kelly criterion comes in handy for sizing your positions according to your risk limits and making better trading decisions. Before making any trading decision, there are two questions you need answers to:

- Is there a profitable opportunity that fits my trading goals?

- What should be the size of the position to capture this opportunity?

For most traders, finding the opportunity is easier than accurately sizing their positions, keeping risk appetite at the centre. This is because technical indicators and signals help answer the first question but don’t take the second into account. Here’s where the Kelly percentage comes in, to help you size your positions right.

The Kelly Percentage

The Kelly criterion is based on a trader’s history of at least 100 trades. The Kelly percentage is calculated using:

The Win Ratio (W): This is the probability of a trade having positive returns. It is calculated as a ratio of profitable trades to total trades.

W = Number of winning trades / Total number of trades

The Win-to-Loss Ratio (R): This is the ratio of the amount won to the amount lost in the trades under consideration.

R = Amount gained in winning trades / Amount lost in losing trades

The Kelly Formula (K)

K = W – [(1-W) / R]

Here,

K is the Kelly percentage

W is the Win Ratio

R is the Win-to-Loss Ratio

According to the Kelly Criterion, K is the percentage of capital you can allocate to a position for the asset under consideration.

An Example of the Kelly Percentage Calculation

Assume that in the 100 trades you made, 54 were winning trades and the others made losses. For the purpose of simplicity, let’s assume that the amount lost or gained per trade is $100. The means your gains are $5,400 and losses are $4,600.

Then,

W = 54/100 = 0.54

R = 5400/4600 = 1.174

K = W – [(1-W) / R]

K= 0.54 – [(1-0.54)/1.174]

K= 0.54 – [(0.46)/1.174]

K= 0.54-0.392

K = 0.149

K% = 14.9 (K*100)

In this case, the Kelly criterion says you can invest a maximum of 14.9% of your capital in the position.

The Kelly criterion is the upper limit of the capital that you may commit to a single trade. It is not the ultimate, exact, or required amount. So, knowing your risk appetite and using risk management techniques like stop loss and take profit are essential. Experienced traders avoid risking more than their risk level even if the K% says so. If in doubt, it’s best to stick to the 2% rule, which says that you should not allocate more than 2% of your capital to any single trade.

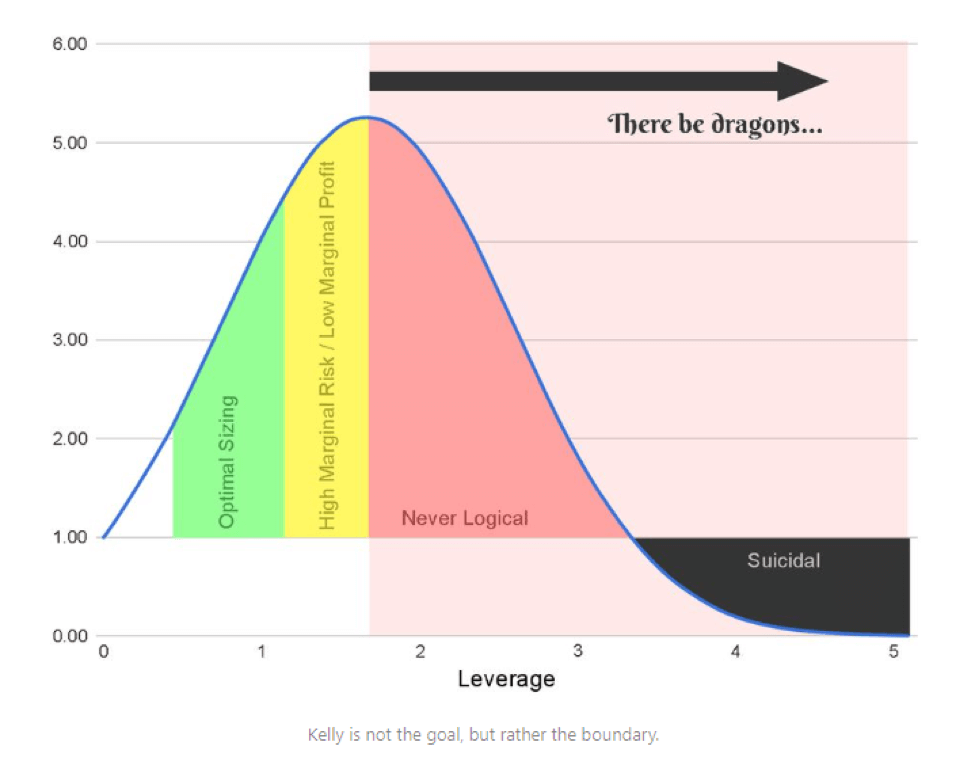

The Kelly Criterion Graph

The graph describes how profit potential initially grows to reach an optimal level and subsequently starts to decline.

Image Source: https://nickyoder.com/kelly-criterion/

How to Use the Kelly Criterion?

John Kelly, the pioneer of the criterion, developed the formula to calculate the percentage of capital to be allocated for each position to maximise the geometric growth rate of the portfolio. Now, his theory is used for short-, medium-, and long-term trading and investment plans.

Renowned investors, including Warren Buffet, Charlie Munger and Bill Gross, have mentioned that the formula is very useful for determining allocation of funds to different assets in their investment portfolios.

Here are a few things to keep in mind when using the Kelly criterion:

- Experienced traders tend to use half the K% to size their positions, especially if they’ve experienced winning trades with their previously used trading strategy. This is known as the Half-Kelly trading formula.

- When the Kelly criterion generates a negative number, it can be used to determine the size of a position in the opposite direction. This is useful when trading derivatives like CFDs.

- Always take market conditions into consideration, rather than using the criterion in isolation.

- You can use past trades as the base set for markets that move cyclically. However, some markets are more erratic, like cryptocurrencies.

- The formula works better for similar market conditions. For instance, if there is an uptrend, it’s better to use data from your previous 100 trades from when the market was last trending higher.

- When you record data of your previous trades, do remember to log everything, including position size, profit target, stop loss limit, direction, and outcome.

- If you’re a beginner, you can use data from your demo trading history.

- Remember that the Kelly criterion ignores the trading strategy. For instance, scalpers tend to use a much lower percentage than day traders or position traders.

When Not to Apply the Kelly Criterion

Markets are volatile and a single formula cannot hold true in all situations. It’s good to know when the Kelly criterion may fail:

- If you’ve been on a winning or a losing streak, the data may not work. Such streaks are often not repeatable, even by the most experienced traders.

- The Kelly percentage does not consider the asset you are trading, and you need to use your discretion. For instance, if you have low risk tolerance and are trading cryptos, you may want to limit your exposure to 2% of your portfolio, even if you get K% = 15%. Similarly, if you know there is high market uncertainty due to some event, you may want to increase safe havens like gold in your portfolio, even if you get K%=2%.

- The Kelly criterion does not fit black swan events. These are market moving events that cannot be predicted, like the spread of the pandemic, a natural disaster or the breakout of war.

- If you’re using leverage, the Kelly criterion may not work. This is because your profits or losses are more than what you could have recorded using your capital alone.

To Sum Up

- The Kelly Criterion is a formula that helps traders size their positions to maximise profits while adhering to their risk tolerance limits.

- K = W – [(1-W) / R], where the win ratio (W) and win-to-loss ratio (R) are that of the last 100+ trades in similar market conditions.

- Traders typically use the Half Kelly, or K/2, to determine the percentage of capital to allocate to each trade.

- The Kelly percentage must be calculated using results from similar market conditions.

- The Kelly criterion is not suitable during black swan events.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.