What is the Inside Bar?

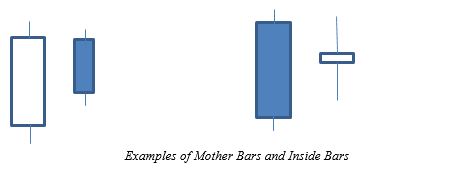

One popular forex trading strategy, which employs pure price action data, is the Inside Bar pattern. This is a two-bar candlestick pattern, where we see a candle on the chart, completely enclosed within the previous bar, representing price consolidation. Inside bars usually have higher lows and lower highs than the previous candles.

The Psychology Behind the Inside Bar Strategy

Inside bars are helpful for traders who are big fans of price action strategies. They serve as powerful tools to find entry and exit points, when used correctly. Depending on where they are situated on a chart, they offer effective reversal or continuation trade signals. Whichever way you look at them, they signify one major aspect – price congestion. This means the bulls are not being able to create higher highs and, at the same time, the bears are finding it difficult to bring about lower lows. This means an absence of significant buying/selling pressure, which could break the previous bars’ high or low. The market is consolidating itself, after a large directional trend.

This strategy is one of the high-chance forex trading strategies available, offering a good risk-reward ratio for traders. Experts believe that they require smaller stop-losses than other strategies enjoying low-risk areas of trade entries and logical exit points.

Inside Bars as Continuation Patterns

One of the best times to use inside bars is when a powerful trend is in progress; say, a vital trend seen in 4-hour charts. For inside bars to be considered a continuation pattern, two conditions have to be satisfied:

- There has to be a well-established trend; bullish or bearish.

- The bars should not be close to any major support/resistance levels.

Once these two conditions are satisfied, traders can find good positions for entries. Before deciding to trade on inside bars, we have to wait for the daily close and observe if the highs and lows of the inside bar are within the range of the first candle. The first candle is often referred to as the “Mother Bar” by traders.

Mark the low and high of the inside bar consolidation range, as these levels are key areas that trigger a trade position. If an uptrend is interrupted by this price action pattern, then go long (inside bar buy signal) and in case a downtrend is interrupted by it, go short (inside bar sell signal).

Stop losses have to be used, irrespective of the strategy you use. Usually stop losses are put at levels above or below the high and low of the mother bar, respectively, depending on whether you have a long or short position.

Inside Bars as Reversal Patterns

One of the ways the market re-groups is through a period of consolidation within a broader trend. Price consolidation occurs in uptrends, when market players who are long start selling for profits. This causes the market to pull back. New buyers come in and buy, which maintains the higher price levels. This continues as long as buyers outperform the sellers and drive the market higher. It could even go on for months at a time.

Some of the best inside bars are formed at the breaks in consolidation. For inside bars to be considered as reversal patterns, the following conditions need to be fulfilled:

- It forms around a major price level.

- It is a major support and resistance area.

This is the situation where we know the market has lower volatility. We can opt to trade the breakouts, hoping that the previous highs and lows are broken, so that we can initiate a strategy. The strategy here is:

- Placing an entry to buy, if the previous high is broken (slightly above the high of previous bar).

- Placing an entry to sell, if the previous low is broken (slightly below the low price of previous bar).

All this is in expectation of the price breaking out to form a new high or low beyond this point. Stop-loss orders are mandatory here as well. Another way to place them would be near the 50% level of the mother bars (middle of the high and low of mother bars). Remember to use smaller or tighter stop losses, in case the mother bars are not too big. Smaller mother bars signify greater chances of breakouts.

Things to Consider in Inside Bar Trading

- A favourable risk-reward ratio has to be considered for all trading plans. Your stop loss cannot be more than 100 pips away from your entry price, if your profit levels are 200 pips. This means keeping your risk at half the potential gains.

- Select inside bars that are created near the lower or upper range of the mother bars, if you are following an aggressive risk-management strategy.

- The size of the inside bar relative to the mother bar is vital. Experienced traders prefer smaller inside bars, relative to the mother bars. The tighter the consolidation, the greater the volatility in the following breakout. Of course, it doesn’t always happen this way.

- Sometimes, there is more than one bar within the mother bar range, such as inside bars with 2-4 bars within the same mother bar structure. This simply means a longer period of consolidation. At times like these, the breakouts are stronger. Complex candlestick formations like Hikkake are an example of such patterns.

- It doesn’t matter whether the inside bar itself is bearish or bullish in nature. In case you are trading a bullish trend, it doesn’t matter if the inside bar within the large bullish candle is bullish or not. Only the mother bar matters here.

- Inside bars usually work well on daily charts. In lower timeframes, there are too many bars; many of them giving signals of fake breakouts.

- Start identifying inside bars on demo charts, before proceeding to the live markets. New traders should start with daily charts and choose trending markets.

With practice and the right risk management measures in place, inside bars could prove to be a useful trading strategy.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than invested capital.