Predictions for a Global Economic Recovery in 2021

“Don’t Panic” were the words emblazoned on The Hitchhiker’s Guide to the Galaxy (in Douglas Adams’s book of the same name). “Don’t Panic” would be an equally appropriate inscription on a book of economic lessons from 2020. The initial covid-19 slump sent markets into freefall and companies into crisis. The Q2 annualised US GDP growth hit historic lows of -32.9%. The US Federal Reserve projected a GDP contraction of 6.5% for the year, and economists drew parallels with the Great Recession. Let’s see the predictions for a global economic recovery in 2021.

Despite the “panic,” GDP recovery has been equally swift, and global stimulus efforts have reignited many sectors of the economy that had ostensibly been frozen by lockdowns. Optimism reigns over markets globally. We examine the breakdown of GDP factors that might play into continued productivity growth in 2021. Are the reasons for panic behind us?

Personal Consumption

Developed Economies

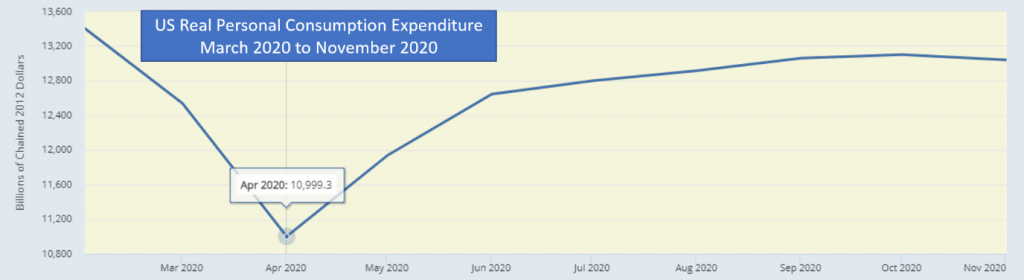

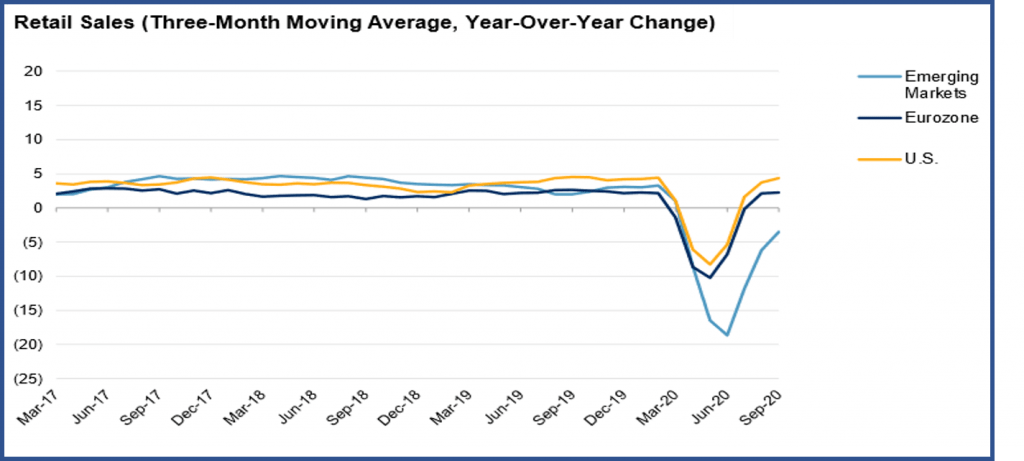

Personal Consumption Expenditure (PCE) was one of the first victims of the economic crisis, as restrictions to prevent the spread of the pandemic shutdown service industries. On the flip side, average household income has surpassed pre-covid levels in the US and seen stable strength in the EU. In these developed countries, this signals pent up demand. Consumers are expected to flock to restaurants, malls, and travel once there is a vaccine rollout.

The downside risk is high unemployment (6.7% in the US in November and 7.6% in the EU in September). Unemployment is likely to make consumers prudent with their wallets even as the economy opens up. In the US, October personal savings rates were high, at 13.6%. Experts expect US PCE to recover after Q2 2021, as the job market gains strength.

Emerging Markets

In emerging markets, PCE growth has been more sluggish during the pandemic, with household spending lagging that of developed nations. Experts at Standard and Poor’s attribute this to smaller government stimulus programs in these countries.

Looking at 2021, vaccine rollout is expected to be slower in emerging countries, especially given the challenges and costs in storage and logistics. This is likely to hinder reopening efforts.

Government Spending

Developed Nations

Both the US and EU have embarked on massive monetary and fiscal stimulus campaigns. The US government sanctioned a record $6.5 trillion in 2020, according to data released by the Treasury Department. This includes the $900 billion follow-up aid package that is still pending presidential approval. Meanwhile, the EU approved a $2.2 trillion package in December 2020. Much of this is targeted at allowing individuals and SMEs to recover lockdown losses.

Further stimulus is expected in 2021. However, the scale and targeting depend on political pressures. An encouraging sign for additional stimulus is unprecedented monetary intervention from the Federal Reserve and the European Central Bank (ECB) to keep government borrowing rates low across maturities. For example, the US Fed has become a dominant participant in the treasury markets, increasing their holding by 79% from March 18 to October 21.

Developing Markets

Fiscal spending has been mixed in emerging markets. Chinese fiscal spending has been directed at infrastructure after the nation’s quick actions to subdue the pandemic. While monetary intervention is likely to be reeled in, fiscal measures are expected to be growth supportive and infrastructure focused in the new year.

The IMF’s October 2020 Fiscal Monitor projects an increase in the debt to GDP ratio to 65% (up 10%) in 2021. This can restrict these governments’ ability to extend further fiscal support since most tax revenues will be absorbed by servicing this ballooning debt. In countries with low inflation, a monetary stimulus may be preferred.

Business Investments

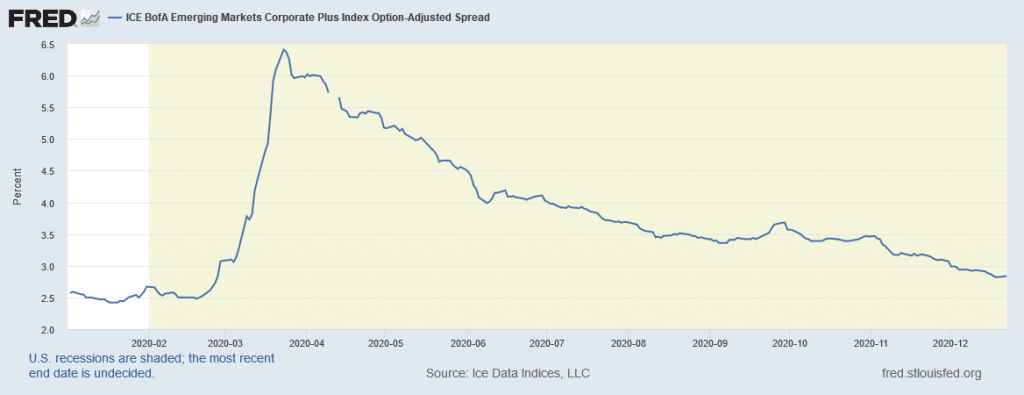

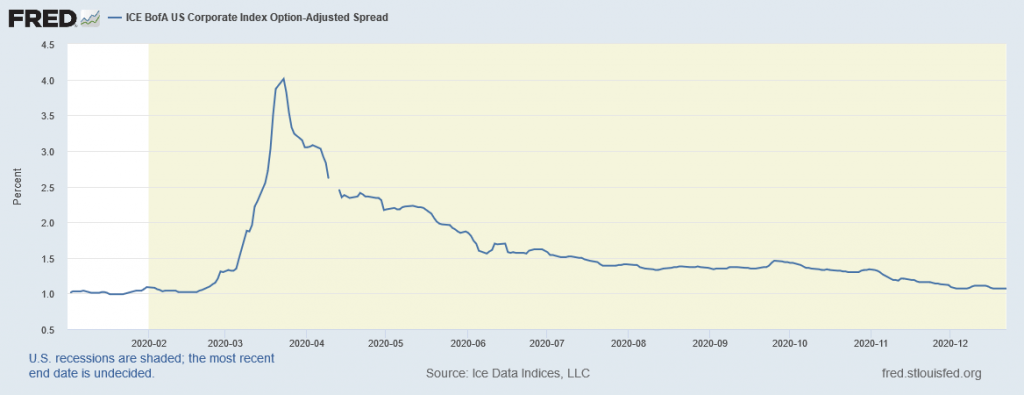

Equity markets are reflecting optimism around the vaccine rollout, translating to better business earnings. Gina Martins of Bloomberg Intelligence says staff analysts expect earnings growth of 12% in 2021 in US Equity. Morgan Stanley’s Chief European Equity Strategist Graham Secker forecasts a European average EPS growth of 30% in 2021. This forecast is partly driven by improvements in margins with recovering inflation and a rotation of investment to smaller companies. Similarly, fiscal stimulus is also likely to be in favour of small companies. We could therefore expect growth in disposable cash and hence investment in smaller, more flexible companies. Andrew Sheets, Chief Cross-Asset Strategist for Morgan Stanley Research, notes that small-cap stocks doubled the return of the S&P 500 coming out of 2010. In further favour of small companies, their high-yield debt instruments are more likely to be picked up in current tight credit spread environments.

Nov 2020 – Credit Spreads returning to Pre-Covid levels – Image Source: Federal Reserve Bank of St.Louis

Further, business investments globally are likely to continue getting a boost from bond market interest rates kept low by central banks. Businesses have taken advantage of this to build defensive reserves and move to re-shore foreign supply chains. Retailers have expanded their online distribution infrastructure. These trends are likely to continue in 2021.

Global Trade

Commodity prices have recovered structurally since their covid-19 slump. Jeff Currie, head of Commodities Research for Goldman Sachs Research, says that their team is bullish about commodities for 2021. This expectation is based on the trends in oil and metal prices, propped up by currently recovering trade and the repletion of forex reserves globally. Morgan Stanley’s Global Economic Outlook notes that trade-dependent economies like Korea and Taiwan are already well into their recoveries.

Global trade is not expected to dramatically rise beyond pre-covid-19 levels, partly because of geopolitical tensions with China. The International Monetary Fund (IMF) forecasts a subdued global trade growth of 8% in 2021, citing the trend of “reshoring production to reduce reliance on foreign producers.” The IMF also emphasises that nations where tourism plays a critical role are likely to remain under pressure in the first half of 2021.

Overall GDP Impacts

The IMF projects that output in advanced and emerging countries apart from China is likely to remain much below the 2019 levels in 2021.

Morgan Stanley projects global GDP growth of 6.4%, firmly emphasising a belief that a V shape recovery is well underway and entering a self-sustaining phase. They forecast that recovery is likely to be synchronous, with emerging markets recovering first, and the US and EU economies following. They predict 5.9% growth in US GDP and 5% in Europe, highlighting a conservative EU prediction based on Brexit uncertainty.

Not all estimations are as optimistic. The Organization for Economic Cooperation and Development (OECD) feels that the initial vaccine rollout may not be immediately followed by a return to normalcy. The group forecasts a more modest 4.2% US GDP growth and 5.1% for the Eurozone. If the group’s expectations are correct, we are likely to see a more K shaped recovery. The shape expectation is because industries like travel and jobs that require social interaction are likely to recover much slower. For an extreme example, online retail sales may continue to thrive while cruises may not make a comeback anytime soon.

These predictions are conditional on various macroeconomic and administrative assumptions such as inflation, political manoeuvring, and no further major pandemic shocks. Countries that embrace the lessons of the pandemic are more likely to break out after recovery rather than cascading into a double-dip W. The period of panic might be behind us, but there are fundamental questions that still need to be answered to determine how successful the recovery might be.

Reference Links

IMF, Bloomberg, CNBC, GoldmanSachs.