How to Pick an ICO Scam

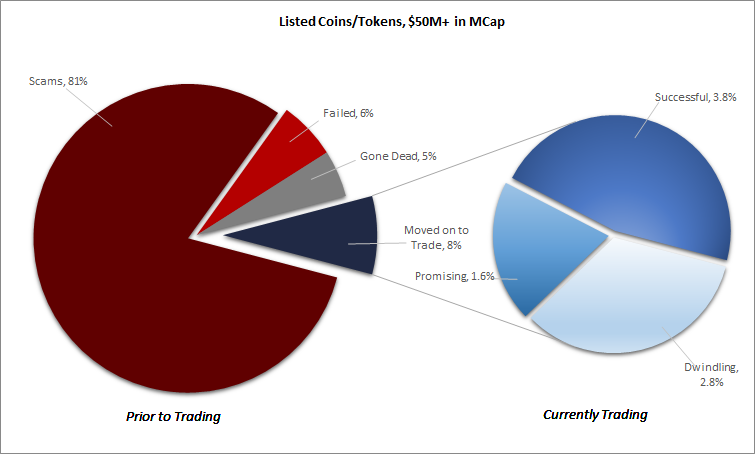

Leading ICO advisory firm, Satis Group, released the findings of their recent ICO study in an article published on March 22, 2018. According to the report, 81% of all ICOs are scams, while 6% fail even before their launch. This, coupled with several high-profile cases of founders disappearing with ICO funds, highlights how important it is to be aware of malicious activities.

Source: https://medium.com/satis-group/ico-quality-development-trading-e4fef28df04f

Yes, ICOs are one of the biggest developments in the crypto world with legitimate businesses offering amazing investment opportunities – but how can you spot a valid ICO from a fake one? Here are some things you should check before making an investment.

The Website and the Whitepaper

A poorly designed website and a badly written, insufficient whitepaper are huge red flags. These are two important sources of information for an ICO detailing the project’s concept, technology, mission, vision, team and roadmap. So, if critical information is missing or has been plagiarised in some way – the venture might be a scam. This is also true of cases where the content is packed with keywords but doesn’t really make sense – in other words it has not been written for a specific target audience. If you cannot understand what the project is all about and what its realistic future prospects are, it is best to avoid it.

The Team

For an ICO venture to succeed it needs a skilled and passionate team with the required knowledge and experience. So, the website and the whitepaper should provide extensive information about core team members. Ideally, you should also be able to double-check facts and professional profiles on well-known business platforms such as LinkedIn. If details of the team behind the development of the project and its token are not available, this should be considered a red flag. The online activity of individuals and a company can help identify a legitimate business idea from a scam, so it’s worth doing your research.

Unrealistic Goals & Unclear Roadmap

A genuine ICO project will always give you information about the development of the project, offering clear targets and goals. If you can’t find this information, it might be safer to assume that this venture is only interested in a short-term financial gain which is another warning sign for investors. When investing your hard-earned cash, you need to know exactly where a project is heading, so don’t take an unnecessary risk by diving in the deep end without all the facts.

The Concept & the Token

Even if you are new to the crypto space you should always research a token and the concept behind it before making an investment. Some things to consider include:

- Who are the project’s competitors already in the market and what value does the project add to existing solutions?

- Will the blockchain technology-based project bring innovation and value to traditional or existing solutions in the same industry?

- How long has this project been under development, what progress has it made so far and what is the timeline for its completion?

- Is the proposed token slated to be supported by one or more exchanges? If so, which ones? Any token that claims to already be listed on an exchange can be checked by comparing exchange listings.

- How many tokens will be issued? How will the tokens be distributed? For instance, bitcoin has a cap of the total number of coins that will ever be in circulation which, in turn, affects the value of the coin.

- How will the token be used within the project’s ecosystem?

Unless you fully understand the reasons behind a token launch, it is best to steer clear of the ICO. Also, unless a new token offers a real advantage over existing options, it is unlikely to succeed, even if the ICO is not a scam. Therefore, it is best not to invest in the ICO.

Always delve deep into an ICO before expressing interest and understand what you’re getting involved with. There are great opportunities out there but you don’t want to fall victim to a scam.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than your invested capital.