Top 5 Trading Tools for Unprecedented Volatility

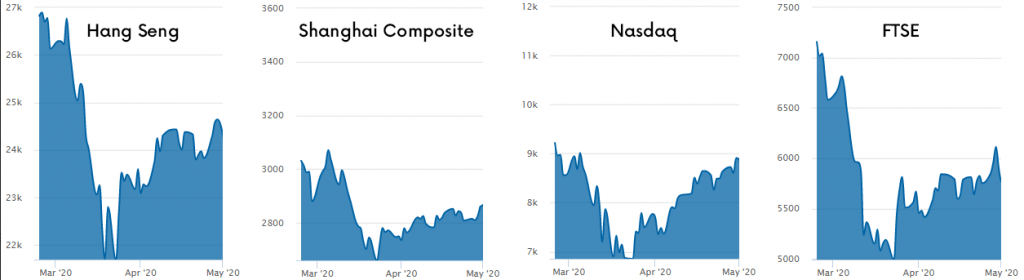

As the covid-19 spread from a regional crisis in a Chinese province to a global pandemic, it created history for the financial markets. Widespread uncertainty led to a massive tussle between the bulls and bears, resulting in unprecedented volatility. The US stock market plummeted so steeply that circuit breakers were hit four times in March, when trading had to be halted on the Dow and Nasdaq. The market was so brutal that a Senior Economic Analyst at Bankrate, Mark Hamrick, described it as “a bit like a boxer taking body blows and just trying to stay off the mat”.

Since then, the Dow and Nasdaq have soared. In fact, the tech-laden Nasdaq has achieved 34 record closing so far this year, already higher than the number of record closes in the past two years. This performance is not limited to US equities. The global financial markets have seen wide swings in prices, as investors and traders have used every opportunity presented by volatility. Viewing declining prices as attractive entry points and diversifying their portfolios more than usual, traders have become even more active after the coronavirus outbreak.

Trading volumes had spiked during the 2008 financial crisis and have surged again amid the pandemic. The reason is simple. Although volatility presents a greater degree of risk, it offers far more attractive trading opportunities than when markets are largely flat. To harness such opportunities, one needs to have the right tools in place. So, here are five tools for the covid-19 induced market volatility.

Volatility Indices

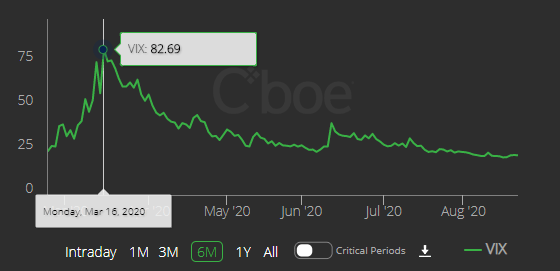

Widely known by different names like “fear index” and “fear gauge”, the CBOE Volatility Index (VIX) created by the Chicago Board Options Exchange is a real-time index that provides a measure of volatility, or the level of market risk and investor/trader sentiment. The index is closely viewed by traders, investors, and portfolio managers as an indicator of market volatility over the next 30 days.

For instance, on March 16, 2020, the CBOE Volatility Index soared to 82.69, amid concerns around the impact of the widespread covid-19-induced lockdowns on the global economy. The markets were highly volatile over the next 30 days.

Amid the pandemic, keeping an eye on VIX can help traders gauge volatility. Any value greater than 30 is considered as indicative of high volatility, resulting from uncertainty and perceived risk. VIX values below 20 suggest relatively stable periods in the markets.

Other region-specific volatility indices include the AXVI Index for Australia, VHSI Index for Hong Kong and VSTOXX Index for Europe.

Expert Advisors

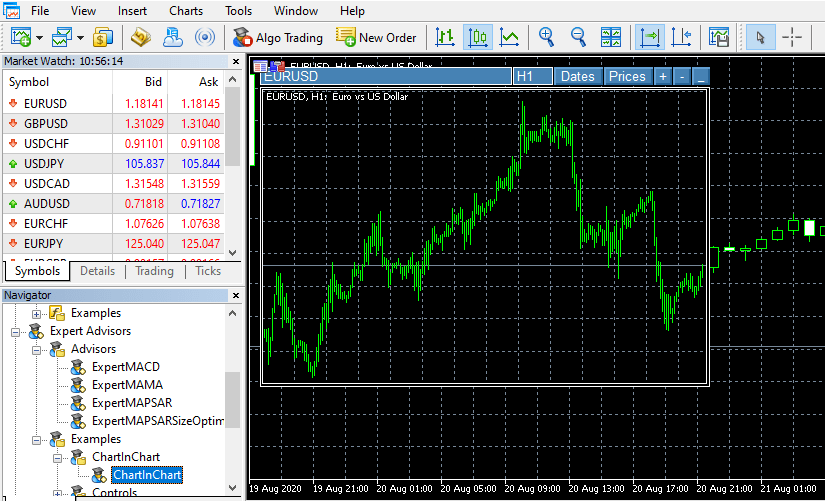

During periods of high volatility, wouldn’t it be terrific if experts were in your corner to help you make more informed trading decisions? The icing on the cake would be if the experts advised you without charging a penny. That’s exactly what you get when you use Expert Advisors (EA) on the MetaTrader 4 (MT4) platform. These are essentially programs based on smart algorithms that automate the process of mapping trends and analysing charts, taking into account news, market sentiment and more.

These bots can also be set up to identify trading opportunities based on parameters defined by you, taking into account your trading goals and risk appetite. Once an opportunity is found, they either notify you or automatically open a position on your behalf. EAs can also add close conditions, like stops, limits and trailing stops.

While there are paid versions of EAs, several free expert advisors are also available. Amid the covid-19-induced volatility, EAs can help traders keep emotions out of trading decisions. Moreover, traders can use EAs to simultaneously monitor a few key markets.

Risk Management Tools

The covid-19 induced market volatility has made it even more important to use robust risk management strategies. Here are a few simple techniques that can lower a trader’s risk when markets are volatile:

Reduce the size of your trade. You can use the one-percent rule, which says to avoid putting more than 1% of the capital present in your trading account into a single trade.

Be disciplined about placing stop-loss and take-profit orders. To reduce the impact of volatility, traders can place stop-loss and take-profit points just before a market-moving event. For instance, if you hold US dollars, you may decide to sell just before the report on initial jobless claims is released. Moving averages are the most popular indicators used to set stop-loss and take-profit points.

Diversify and hedge your trades. Diversify across instruments, industries, and geographies. This helps manage risk, while also presenting more opportunities amid volatility.

Economic Calendar

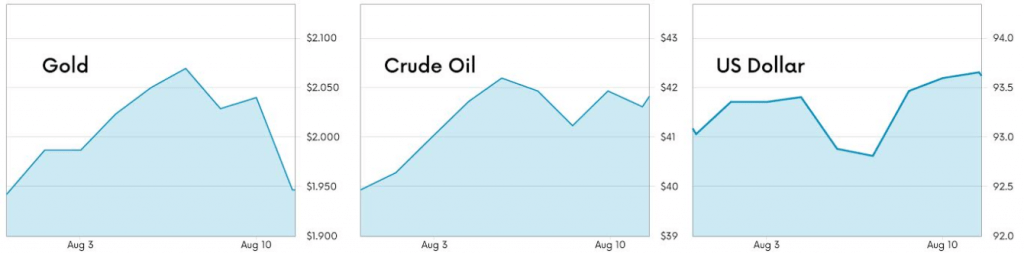

Given the covid-19 induced volatility, depending purely on technical analysis may not be the right approach. Economic data released by various countries can impact the market much more now than during more stable times.

NFP (nonfarm payroll), released by the US Labor Department on the first Friday of every month, has historically been the most market moving economic release. In anticipation of weak NFP data reported on August 7, traders and investors turned to safe-haven options. Gold prices started climbing a couple of days before the report, breaching the $2,000 mark for the first time in history, only to rise to $2,069 on August 6. After the NFP report was released, gold prices made a sharp decline. Crude oil prices followed an opposite trajectory, while the US dollar also experienced its share of volatility.

The other important releases include central bank rate decisions, inflation, GDP, PPI, retail sales and trade balance.

These data releases have causes extreme volatility, irrespective of whether the reports are above, below or in-line with expectations. Traders need to keep an eye on the economic calendar to determine whether they’d like to trade the volatility or close their orders while the market responds to the data.

Demo Account

Often underappreciated, the demo account offers a number of benefits and can come in handy when trading amid the covid-19 volatility.

While novice traders use demo accounts to get familiar with the platform and practice trading, seasoned traders can use them to test new strategies for trading the current market volatility, before live trading. Demo accounts also help to back-test strategies. Even a well-planned strategy may not hold in a volatile market. Back testing a failed strategy helps traders identify where they went wrong.

To take advantage of trading opportunities presented by volatility, it’s important to have the right approach and mindset. These tools may help you get there.

References: Marketplace, Refinitiv, Kellog Edu.