Bitcoin Price Rises above 10K

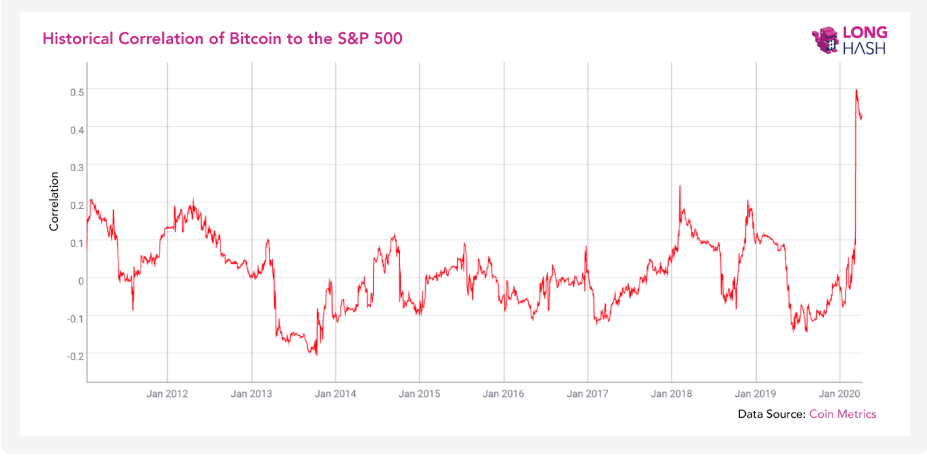

Will the Coronavirus pandemic finally make cryptocurrencies “rise and shine”? Bitcoin, the biggest cryptocurrency in the market was turning out to be a disappointment for traders until recently. Up to April 30, 2020, “digital gold” was still down 30% from the highs it saw in February 2020. BTC was meant to act as a safe haven during economic turmoil. Instead, Bitcoin was showing an increasing correlation with the S&P 500, with the Pearson correlation coefficient hitting 0.5 in March 2020. Experts said that BTC can be considered as a hedge against the collapse of the fiat currency system, but not a recession.

Image Source: https://www.longhash.com/en/news/3316?f=r

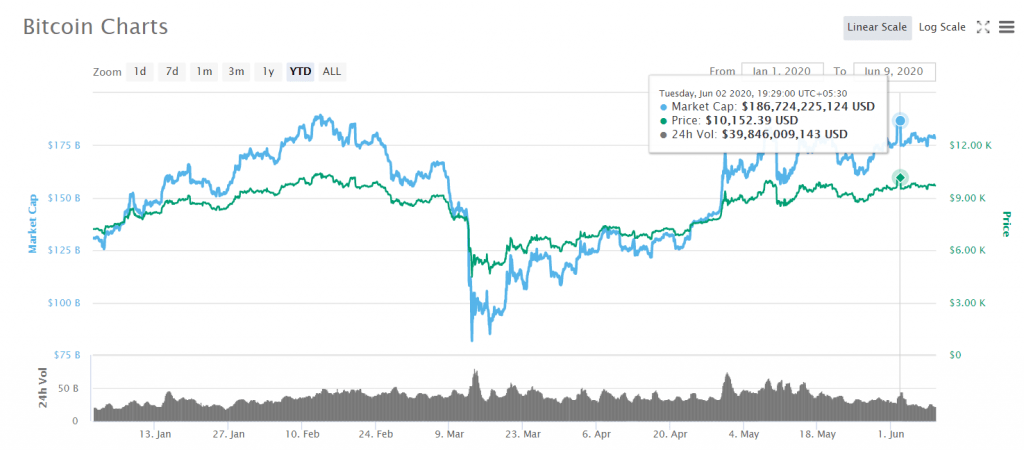

However, since May 2020, BTC has been consistently trading above the $8,000 mark. And on June 2, 2020, it broke the $10,000 barrier, trading at $10,152, with a market cap of $186 billion.

The spike saw the largest cryptocurrency exchange, Coinbase, became inaccessible due to a 5X traffic increase in under 4 minutes. According to Bitcoin analyst PlanB’s stock-to-flow BTC pricing model, the third halving event in May 2020 has begun an 18-month price cycle, where BTC could reach $100,000 in value before 2021. A Bloomberg analyst has predicted, more conservatively, that the cryptocurrency could hit the $20,000 mark before 2020 ends.

A lot of factors could be behind this price surge. For instance, many projects in blockchain, in the areas of finance, gaming, web apps and infrastructure, were started in the 2017 crypto cycle. As these projects get launched in the near future, the value of BTC could rise. The pandemic and subsequent economic devastation will also create a necessity for a new way of conducting financial transactions. Perhaps COVID-19 will finally bring in a new age of mainstream cryptocurrency use.

Less Reliance on Traditional Assets

With a finite supply of 21 million coins, BTC’s value increases with its decreased supply, over time. On the other hand, fiat currencies, like the US Dollar, can be printed in trillions, as is currently being done to support the US economy. The US Congress has authorized the printing of several trillion USD for pandemic-fighting stimulus programs.

Not just the US, China has also announced a $500 billion fiscal stimulus and EU leaders are working on borrowing €750 billion from the public markets. This has sparked fears of hyper-inflation and currency devaluation. BTC is considered as a hedge against inflation. On May 11, 2020, macro-investor Paul Tudor Jones confirmed that he was investing at least 1% of his portfolio in BTC, to protect against inflation.

Investors, institutional traders and hedge fund managers are exploring alternatives to traditional assets now to store their wealth, with the Federal Reserve’s aggressive fiscal policy raising concerns over the future direction of the US stock market.

Even gold, which is considered a safe haven asset, managed to rise only 20% YTD till May 2020, while BTC gained 163% in the same timeframe.

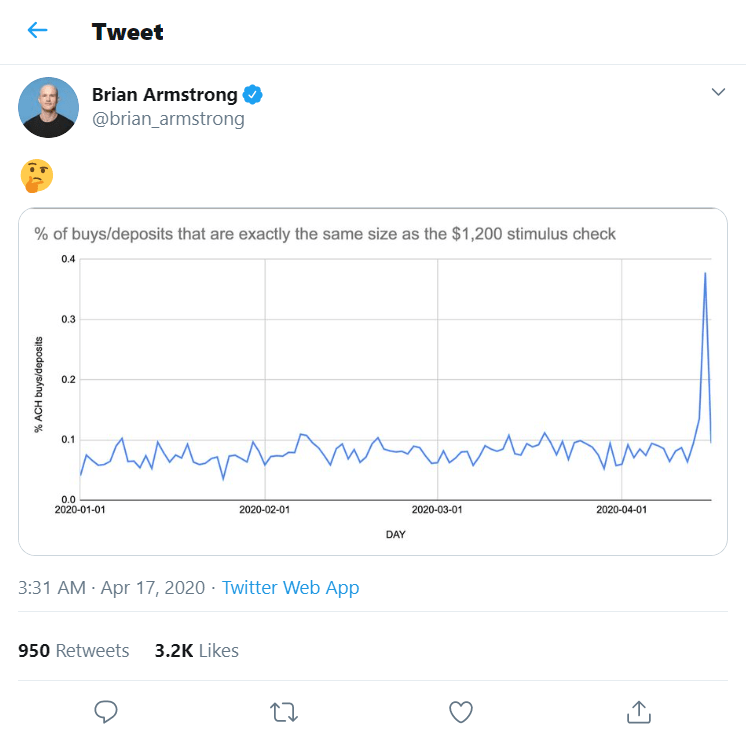

After the US government decided to distribute $1,200 stimulus cheques to 80 million US citizens, to help them through this crisis, Coinbase reported an increase in $1,200 deposits, signifying that US citizens are bullish on BTC. They are actually using their stimulus cheques to park their savings in BTC, rather than making essential purchases.

Image Source: https://twitter.com/brian_armstrong/status/1250907110730170370

The Halving Event is Fuelling Prices

In May 2020, the number of BTC rewards to block miners in the network was reduced by 50% from 12.5 to 6.25, in the network’s third halving event. BTC’s price trajectory, following the halving, has been similar to the 2016 peak, when the second halving took place. After the 60% decline in BTC value in 2014, the halving event took the price back above the 2013 peak. Now, after an almost 75% decline in 2018, the current halving event could take BTC to the $20,000 levels once again, by the end of 2020.

The halving event is further expected to reduce the BTC inflation rate to 1.8%. Currently, this is lower than that of the US Dollar. This will further strengthen Bitcoin’s role as a deflationary asset, as unprecedented stimulus measures and low interest rates worldwide create hyper-inflation in fiat economies.

Maturation and Greater Role in the Post-Pandemic Markets

For decades, debt levels worldwide have continued to grow, and this pandemic will not make things any better. Infinite stimulus measures, announced by major Central Banks like the US Fed and sharp decline in the oil market has impacted people’s trust in traditional forms of finance. It seems like the 2008 recession didn’t change a thing.

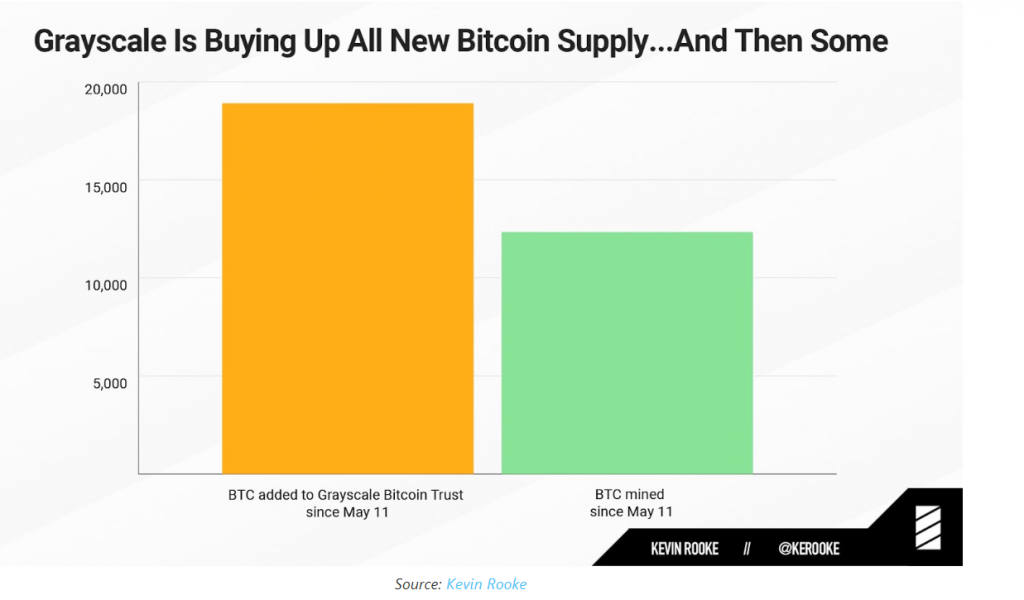

For starters, the Coronavirus pandemic has triggered institutional adoption of BTC. Institutions like Grayscale, the world’s largest BTC investment trust, has shown greater interest in buying and holding BTC. From May 11 to May-end, 2020, the company bought 19,000 BTC and mined more than 12K.

Image Source: https://cryptobriefing.com/institutions-are-buying-massive-amounts-btc-grayscales-bitcoin-trust/

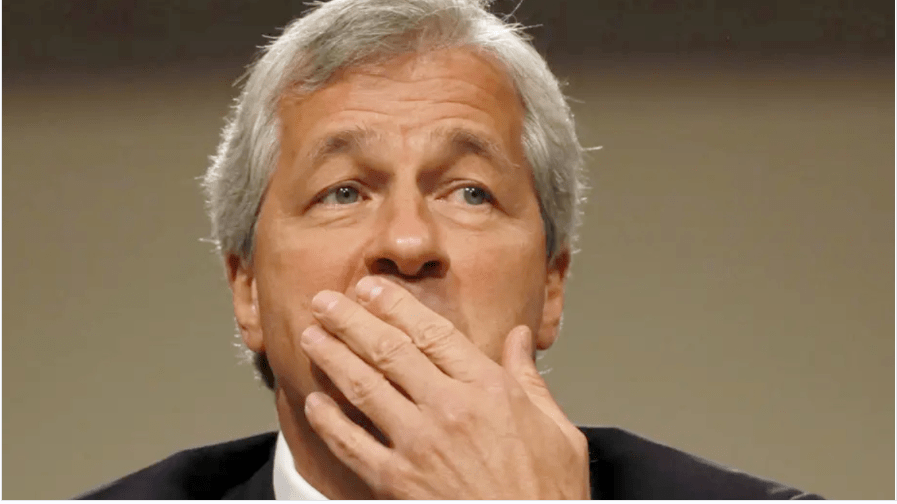

Growth in the BTC futures market might also help ease volatility and boost the maturity of the asset. JP Morgan Chase’s CEO, Jamie Dimon, who called Bitcoin a fraud in September 2017, has now started accepting clients from the cryptocurrency industry. In May 2020, the bank announced that Coinbase Inc. and Gemini Trust Co., two prominent BTC exchanges, had become banking customers of JP Morgan Chase. Of course, the bank has also shown an interest in developing its own digital currency in the recent past. JP Coin is expected to be exclusively backed by the US Dollar.

Image Source: https://news.bitcoin.com/jpmorgan-chase-bitcoin-businesses/

Cryptocurrencies like Bitcoin can provide a more open financial system, with global access, instant money transfers, reduced fees and hugely secure customer transactions. Many new developments in this area promise to take consumer privacy to the next level too. Such features would be valuable in the post-pandemic revival of economies.

This is why countries are reviving their efforts to regulate cryptocurrency exchanges. These exchanges will be treated as financial services by regulatory bodies, irrespective of whether consumers use non-custodial wallets or privacy coins. The UK FCA’s new AMLD5 regime, launched in 2020, is a new dawn in the country’s crypto regulation.

Bitcoin could record new highs, riding on greater mainstream adoption, increased network speed, lower supply and, most of all, its sustainable value in the era of quantitative easing. Debasement of the US Dollar’s value would also propel BTC price. Investors should, however, continue to tread with caution in these volatile market conditions.

Reference Links:

- https://www.forbes.com/sites/billybambrough/2020/06/06/bitcoin-will-appreciate-unless-something-goes-really-wrong-price-expected-to-double/#c64bd6510508

- https://cointelegraph.com/news/coinbase-exchange-inaccessible-due-to-5x-traffic-spike-during-bitcoin-surge

- https://cointelegraph.com/news/veteran-investor-says-bitcoin-price-surge-to-467-000-is-achievable

- https://cointelegraph.com/news/bitcoin-crosses-9k-as-paul-tudor-jones-confirms-1-btc-portfolio

- https://coinmarketcap.com/currencies/bitcoin/

- https://www.wsj.com/articles/jpmorgan-extends-banking-services-to-bitcoin-exchanges-11589281201

- https://www.pymnts.com/cryptocurrency/2020/pandemic-sparks-mainstream-interest-in-bitcoin/

- https://cointelegraph.com/news/fcas-new-aml-regime-uks-crypto-market-will-have-to-adapt-in-2020