Market News

January 13, 2023

January 13, 2023

Categories

Index trading can be a great way to diversify your portfolio with a single trade, while gaining exposure to an entire market segment. In fact, stock […]

January 13, 2023

January 13, 2023

Categories

Whether you’re trading stocks, forex, commodities, or any other asset, technical analysis is the foundation of making informed decisions in the financial markets. While a strong […]

December 29, 2022

December 29, 2022

Categories

Oil prices peaked at $119.62 in March 2022, only to plunge to $71.053 per barrel in the first week of December. Despite such price fluctuations, the […]

December 29, 2022

December 29, 2022

Categories

The forex market in 2022 was characterised by an extremely strong US dollar as investors embraced a risk-off sentiment. The US dollar index surged to a […]

December 20, 2022

December 20, 2022

Categories

The Bank of England (BoE) seems to have gotten off to a smooth start to its quantitative tightening (QT) process in early November 2022. After years […]

June 8, 2021

June 8, 2021

Categories

The US Treasury bond yields have been rising, exerting pressure on stocks. The yields also impacts currencies, which can affect all other asset classes. Here’s what you need to know.

May 25, 2021

May 25, 2021

Categories

The cup and handle chart pattern is a powerful tool to trade price breakouts and reversals. Here’s what you should know about trading the pattern.

May 4, 2021

May 4, 2021

Categories

Trading the financial markets and interpreting the outcome is risky. Self-discipline can help you successfully tame the volatility in the market currents. How to Become a More Disciplined Trader?

April 28, 2021

April 28, 2021

Categories

Forex traders looking for long-term and reliable platforms choose an ECN broker. Here’s a look at the reasons why ECN brokers are so popular.

April 20, 2021

April 20, 2021

Categories

Here’s a detailed guide about Flag Patterns, the structure, types and trading strategies. Everything You need to know about them.

April 1, 2021

April 1, 2021

Categories

US Dollar Outlook - Here’s Why All Eyes are on the Treasury Yield. Will the greenback finally emerge from its multi-year lows?

March 29, 2021

March 29, 2021

Categories

Pin bar Indicator can be a great tool for identifying market reversals. Here’s how to use them in your trading strategy.

March 1, 2021

March 1, 2021

Categories

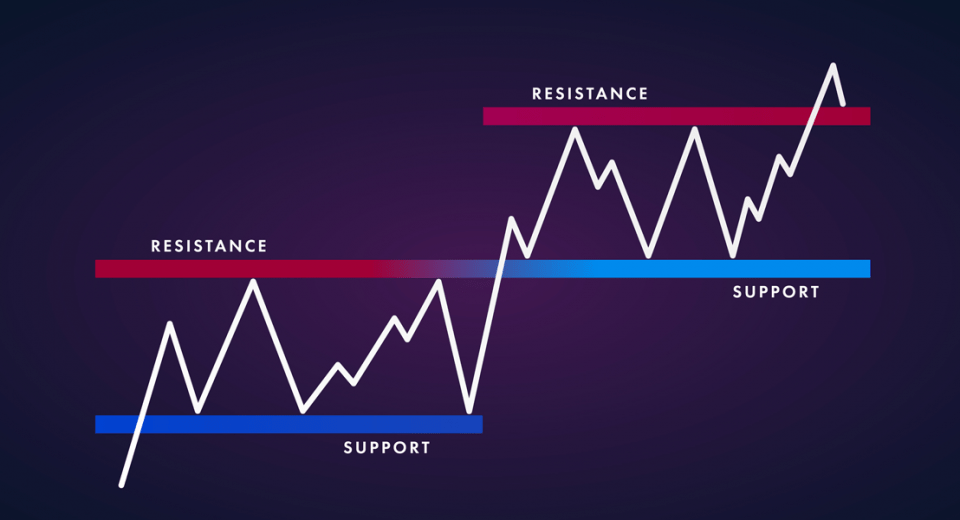

One of the key technical indicator tools are support and resistance levels. They prove helpful for all types of trading styles and strategies. Read on to understand more about the basics of this tool and how it can be used for effective chart analysis.

February 8, 2021

February 8, 2021

Categories

What started as a social media discussion, led to one of the biggest short squeeze events in the US stock market. The GameStop drama puts light on the rise of retail trading and the power of collective capacity in market manipulation.

January 27, 2021

January 27, 2021

Categories

US dollar hits multi-year lows. The world’s reserve currency and popular safe-haven asset has been on a downward spiral through 2020 and 2021

January 13, 2021

January 13, 2021

Categories

Global recovery has already begun. There are several factors to consider. Here the Predictions for a Global Economic Recovery in 2021.

January 12, 2021

January 12, 2021

Categories

Hammer candlestick patterns are one of the best tools for bullish markets. Here’s a look at hammer patterns for beginners.

January 7, 2021

January 7, 2021

Categories

Bollinger Bands is a powerful and popular technical indicator to gain insight into price volatility. Top Bollinger Bands Trading Strategies

January 4, 2021

January 4, 2021

Categories

Choosing Between Gold and US Dollar to Hedge Risks in Your Portfolio. Which one would you choose – gold or the US dollar?

December 7, 2020

December 7, 2020

Categories

Trading patterns are a great tool for determining CFD trading strategies. Here’s a look at the top 5 trading patterns for trading CFDs.