Technical Indicators

July 22, 2025

July 22, 2025

Categories

The financial markets are sensitive to geopolitical tensions like the ones arising out of the ongoing war between Russia and Ukraine, Israel and Palestine, and the […]

June 11, 2025

June 11, 2025

Categories

In April 2025, US President Donald Trump’s threat to impose tariffs on various countries led to heightened volatility in the global financial markets. The popular VIX […]

March 13, 2025

March 13, 2025

Categories

Trend reversals popularly serve as entry and exit points for traders. The morning and evening star are among the most commonly used candlestick chart patterns to […]

December 17, 2024

December 17, 2024

Categories

Trend trading is a popular forex strategy, especially among beginners. When the price shows a clear direction, upwards or downwards, that’s your opportunity to ride the […]

November 14, 2024

November 14, 2024

Categories

Comprehensive trading strategies require the use of diverse technical indicators. A combination of trend, volume and momentum indicators is popular among traders. The stochastic oscillator is […]

November 13, 2024

November 13, 2024

Categories

Candlestick chart tops and bottoms are an essential part of strategies for trading trend reversals. However, there are certain nuances to all candlestick charts, learning which […]

October 8, 2024

October 8, 2024

Categories

Trend trading, a popular forex strategy, focuses on identifying assets that are moving in a sustained direction for a period of time. The extent of gains […]

September 16, 2024

September 16, 2024

Categories

Being able to identify price patterns that indicate a change in market direction is an extremely useful skill for traders. Trend reversals enable traders to identify […]

September 10, 2024

September 10, 2024

Categories

The Aroon Indicator is a momentum oscillator developed in 1995 by Tushar Chande. Named after “Dawn’s Early Light” in the Sanskrit language, this indicator is commonly […]

May 27, 2024

May 27, 2024

Categories

Swing traders aim to capture small price movements by holding assets for a short timeframe. While intraday traders liquidate positions within a single day, swing traders […]

May 24, 2024

May 24, 2024

Categories

A Renko trading chart is similar to a candlestick chart, although it comprises “bricks” rather than candlesticks, to visually depict asset price moves. It can be […]

March 12, 2024

March 12, 2024

Categories

Heikin-Ashi or Heiken-Ashi means ‘average pace’ in Japanese. So, from its name, you already know that the indicator uses average price data to plot candlesticks and […]

February 29, 2024

February 29, 2024

Categories

Identifying market trends and correctly predicting changes in them are essential for making better trading decisions. This enables you to enter or exit the market at […]

January 13, 2023

January 13, 2023

Categories

Depth of Market (DoM) is the extent to which a large order can impact the price of a security. Securities with deeper markets are less susceptible […]

January 13, 2023

January 13, 2023

Categories

Trading knowledge that can directly translate into decision-making is an essential part of financial education. Candlestick Patterns Candlesticks are the most popular way of identifying price […]

November 23, 2020

November 23, 2020

Categories

Demo accounts are an amazing tool to learn how to trade and to continue growing as a trader. Top Tips to Get the Most from Your Demo Account.

November 16, 2020

November 16, 2020

Day trading offers great opportunities but it comes with its own risks as well. Day Trading Patterns can be very useful in making decisions.

January 28, 2020

January 28, 2020

Categories

One of the many technologies to disrupt the global financial markets is automated trading or algorithmic trading. A recent report says that the global algorithmic trading […]

January 23, 2020

January 23, 2020

Categories

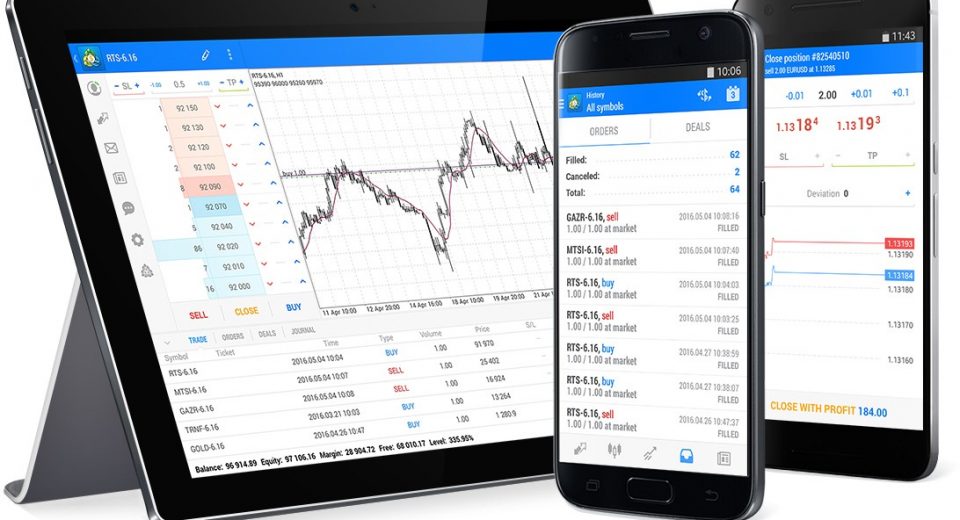

MT4 and MT5 are both trusted names in trading industry. They are multi-asset platforms equipped with strong tools for fundamental and technical analysis.

January 23, 2020

January 23, 2020

Categories

Analysing price action from chart patterns could be a difficult task. Spotting trends early on as they develop takes experience. Moreover, this analysis is subjective. Not […]