What is Causing a Weak US Dollar in 2020

Only a few things are certain in life: death, taxes, and the US dollar as a safe haven investment. Well, the third one might not be so true in 2020. In fact, in March 2020, the dollar experienced one of its worst crashes in history. Although the dollar experienced a sudden recovery after that, it has experienced a slump once again, since recovering from the mid-March chaos.

Source: MarketWatch

Since its March peak, the dollar fell 10% against other currencies including a 5% slide in late June. The US dollar has fallen to its lowest values since early 2018. Some are even suggesting that the dollar might lose its status as the world’s reserve currency at this rate. So, what lies behind this massive slump? Here are some of the main reasons for the sliding USD.

The Coronavirus Health Impact

The coronavirus had a devastating impact on the world. But some nations fared better than others. For instance, in Japan and most of the Europe, stringent measures were taken early in the pandemic to control the spread of the virus. This helped them “flatten the curve” and promote economic recovery. However, the measures in the US appeared half-hearted and delayed, and many businesses were even forced to reopen early. This meant that cases have been constantly spiking and the economy suffering.

2020 Tech Bubble

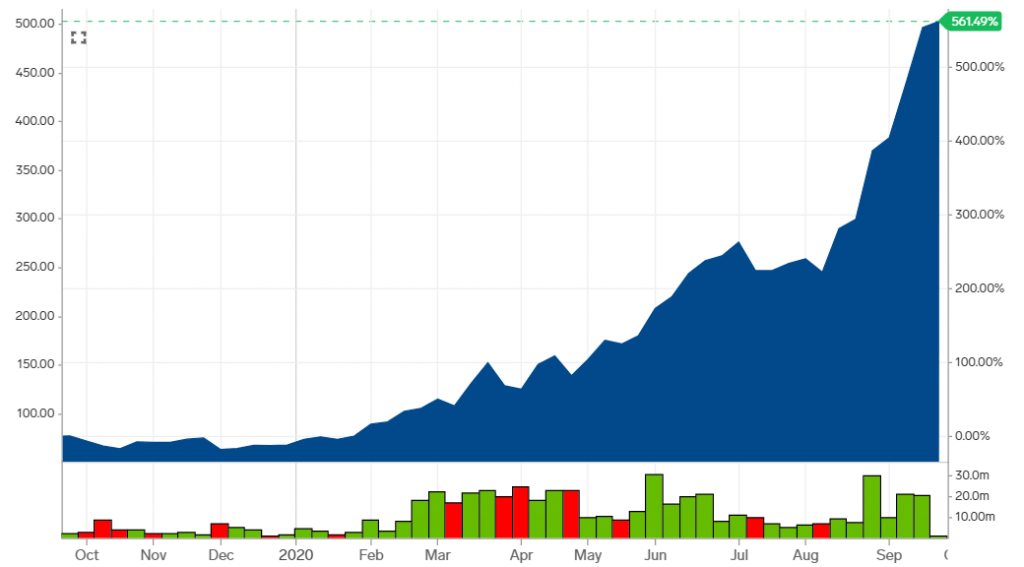

Almost 20 years after the dot com bubble burst, many believe that the tech bubble is about to burst. In 2020, tech companies have had a great run. The pandemic accelerated the adoption of technology, with people increasingly turning to digital solutions to avoid human to human contact. Businesses moved to a work from home model, with video conferencing emerging as a powerful tool to keep communications going. This helped Zoom achieve a massive 355% increase in revenue. In August, Apple’s valuation crossed the $2 trillion mark, while Netflix shares rose 65% YTD. In fact, tech stocks have been driving a large part of the stock market performance since the slump in March.

Zoom Stock Performance. Source: Business Insider

But many believe that such growth is not sustainable. It has all the ingredients of a tech bubble that is waiting to burst. In September, US tech stocks suffered their worst sell off since March 2020. This saw Elon Musk’s wealth decrease by $16.3 billion. This is almost as much as China used for tracking the coronavirus in March. Jeff Bezos also lost $7.9 billion. With the bubble appearing to shrink, the markets spiralled down and the US dollar’s value plunged.

High Inflation

When inflation rises in a nation, the value of its domestic currency decreases. This is because with inflation, the prices of goods and services, such as transportation, food, clothing, consumer staples and housing, increase. In short, the same amount of money now buys you less. Therefore, inflation lowers the value of the currency, whereas deflation leads to appreciation in the currency’s value.

In the US, the inflation rate has been low for quite some time. But the Federal Reserve has signaled that it is willing to change its policy of keeping inflation below 2%. This also erodes the value of the US dollar.

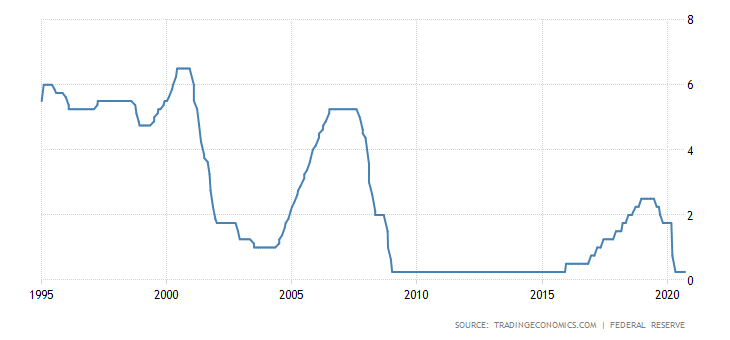

Interest Rates

Around the world, central banks, such as the Federal Reserve, Bank of England and the European Central Bank set the benchmark interest rates for their respective regions. It is one of the most powerful tools used by central banks to regulate money supply. A change in interest rates also has an effect on the value of the domestic currency. High interest rates are more attractive to investors, since they offer higher income. But in March 2020, the interest rates were cut by the US Fed. They were reduced to a range of 0% to 0.25%, a historic low. This had a negative impact on the value of the US dollar.

Source: Trading Economics

Lack of a Stimulus Package

A €700 billion stimulus package was agreed to by the European Union, which would be shared by the various member nations. However, despite being a single nation, the US Congress has been unable to agree on a second stimulus package. The Democrats have suggested a $3 trillion package, whereas the plan decided by the Republicans is closer to $1 trillion. This political squabbling has delayed the stimulus package indefinitely, causing great harm to the economy and the value of the US dollar.

Ballooning Debt

When the government’s revenue is lower than its spending, it has to resort to debt. The Covid-19 pandemic has created such a situation for the US government. The Congress cleared a $2.5 trillion stimulus package. In addition, revenues declined due to the pandemic-related economic disruptions. This caused the budget deficit to swell to $2.8 trillion in 2020. Such a huge deficit indicates a less stable economy. Plus, it stokes fears of inflation. This makes the nation a less attractive proposition for investors, impacting the value of the domestic currency.

Rising Trade Deficit

The United States has a large trade deficit, particularly with China. During the pandemic, the gap widened even further. This is partly because the US economy was opened earlier than the other economies. This meant exports fell sharply, compared to imports, leading to a trade deficit, which in turn saw the value of the currency decline.

The US dollar is expected to remain volatile until the pandemic is brought under control. But with time, experts believe that the US dollar is likely to return to its status of a safe haven investment. When it does, its value will also appreciate. In the meantime, it is best to use robust analytics tools to make forex trading decisions, while also ensuring appropriate stop loss and take profit orders.