Day Trading Series: Impulsive Wave Pattern

Trading in forex requires understanding the markets, factors driving it and the indicators that can help identify opportunities. Every trader needs to find a strategy that aids in informed decision making, and this is possible by observing and noting the events or announcements that lead to changes in the price of a currency pair or stocks. The market’s response to these events is reflected in the impulsive and corrective moves that often form a pattern, known as Elliot Waves.

The Elliott Waves Theory is highly popular and a widely used indicator for forex day trading. Impulsive waves are a five-way pattern that have at least one extended wave, with the extension referring to the longest wave. For a wave to be classified as impulsive, it has to be at least 161.8% of the next longest wave in the sequence.

Identifying an Impulsive Wave Pattern

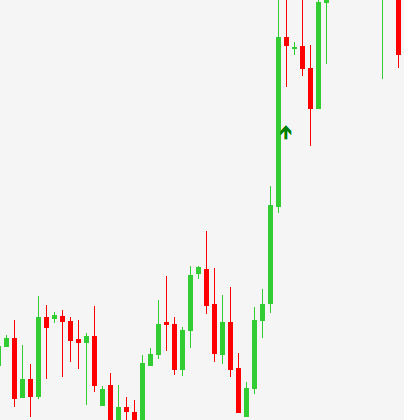

While many traders may think of the Elliot Wave theory as confusing, in impulsive and corrective waves, the terms Impulse and Corrective are used to describe trending and pullback waves. These waves can prove to be quite powerful tools if traders know how to use them. Impulsive moves or waves best represent the direction of the current trend and are three in number. The three impulsive waves, along with two corrective waves form the Elliot Wave Pattern.

During an uptrend, impulsive waves push prices higher, while during a downtrend, they drive the prices lower. A crucial step in using impulsive wave patterns to develop a trading strategy is to identify the impulsive wave that is generally the third wave in the whole structure. The price is moving quite aggressively at this time, motivating traders to participate and earn some quick profits. The whole pattern consists of five waves, wherein the buy position and call options are placed during the third wave and at the end of the fourth wave, if the impulsive move is upwards. Similarly, sell positions or put options are placed if the impulsive move is downwards. Impulsive moves signify fast and quick moves, indicating the possibility of having a fruitful trade.

The impulsive moves are followed by corrective moves, which are not that strong and work against the prevailing trend. These counter-trend moves represent a period of consolidation and are typically weaker and have relatively small bodies.

Some basic rules associated with the identification of impulse waves are:

- Wave 2 cannot retrace more than 100% of Wave 1.

- Wave 3 is generally the longest of Waves 1, 3 and 5, and can never be the shortest.

- Wave 4 cannot overlap Wave 1.

Using Impulse Waves to Trade

Once the impulse waves have been identified, one can use the information to take positions. Let’s see how.

A good option is to trade at the 40-80% retracement of Wave 2, with a stop loss being put at the origination of Wave 1. Wave 2 retraces much of Wave 1 but not completely, and in case that happens, it is not Wave 2. So, while trading, if you notice that Wave 2 has retraced Wave 1 completely, this is an indication that your wave count is incorrect and there is need to label the pattern afresh.

Another option is to trade an impulse when you are anticipating that Wave 4 is ending. One thing to remember here is that Wave 4 tends to alternate in shape, relative to Wave 2. And, since we know what Wave 2 looks like, we can easily anticipate Wave 4.

Traders should trade in the direction of impulses but refrain from doing so if the impulses are getting smaller and smaller, thus indicating lack of momentum and a possible reversal. Also, one does not need to trade every price swing, especially when the price structure is not very clear. This is important because impulse waves higher on a one-minute charge may be corrective waves against a downtrend on a five-minute chart. So, be careful while following the rules for identifying impulse waves.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than your invested capital.