Day Trading Strategies for Every Experience Level

Day trading involves making dozens of trades in a single day. It requires decisiveness and the ability to quickly identify and act on trading opportunities to capture those opportunities. Many choose day trading for the independence, mobility and market opportunities it offers, along with protection against overnight risk.

But day trading is not for the risk averse. In fact, it could prove riskier than other types of forex trading, especially if leveraged financial products are involved. This is reflected in the fact that within 2 years, only 20% of day traders continue to trade. On the other hand, risk can be minimised with the use of effective day trading strategies. The good news is that there are day trading strategies for traders of all experience levels, right from newbies to professional traders.

Things You Need to Know to Be Successful

To succeed as a day trader, there are certain concepts you need to have a clear understanding of. This is regardless of whether you are a beginner or advanced trader.

· Volatility

This is simply a measure of the expected price range on any given day. Higher volatility indicates potential for a greater number of trading opportunities.

· Liquidity

Liquidity enables you to exit or enter positions at the time and price you desire. Generally, liquidity increases with a rise in the number of buyers and sellers in the market. The financial market with the highest liquidity is the forex market.

· Trading Volume

This shows how many times an asset has been bought and sold within a particular timeframe. High trading volume indicates that there is great interest in the asset. An increase in trading volume can be an indication of future price movements, in either direction – up or down.

Best Day Trading Strategies for Beginners

If you are just starting out on your trading journey, here are some strategies that could help:

· Breakout Strategy

When the price of an asset moves above the resistance line or below the support line, it is called a breakout event. Once a breakout event occurs, the volatility rises, and the asset is expected to continue in the direction it is moving in. If there is high volume associated with a breakout, then the trend is expected to continue strongly. If the trading volume is low, the price might return to its previous trading range, signalling a false breakout.

If the price breaks the resistance level, it is recommended for traders to take a long position, while, if the price goes below the support level, taking a short position may be beneficial. You can use a triangle chart pattern or a wedge chart to confirm the breakout levels.

· Scalping Strategy

Scalping is one of the quickest strategies used by day traders. It is also one of the easier strategies to master. It aims at capturing small price changes. The trade is executed as soon as the asset becomes profitable. This is the opposite of letting your stock run. At times, you might achieve half or even a quarter of the total possible profits, but the risk is also lower.

In scalping, moving high volumes is also not advisable. As the profit levels are low in scalping, traders look for more liquid markets, such as forex, to execute this strategy. This allows them to sustain a high trade frequency.

In scalping, having an exit strategy is also vital, since one large loss could wipe out multiple small gains made throughout the day. You also need high stamina for this strategy as you have to continuously monitor the market and place trades.

Best Day Trading Strategies for Intermediate and Advanced Traders

If you are an experienced trader, the following strategies can be useful:

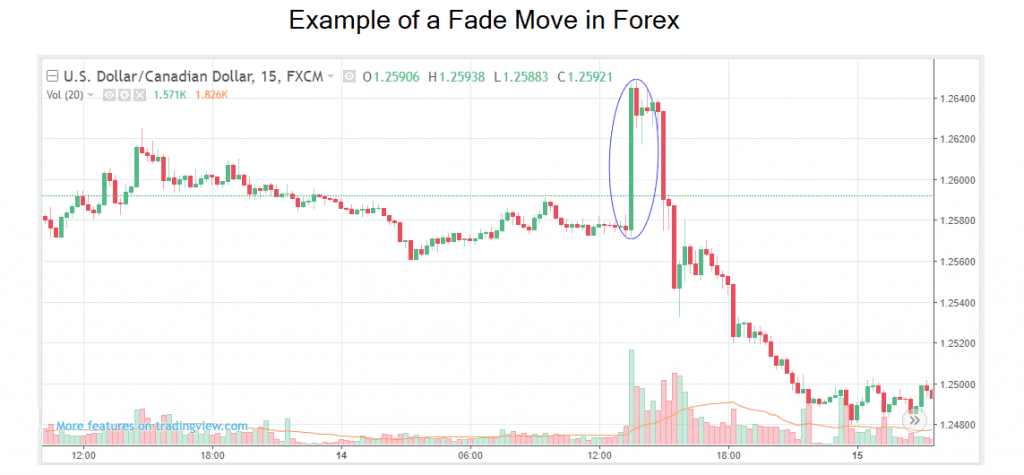

· Fading

Fading is a high-risk strategy, generally used by seasoned traders. The strategy provides the opportunity to place several trades in the short term to capture price moves. In this strategy, the trader goes against the prevailing market trends. It involves selling the asset when the price is rising and buying it during the drop. A fade trader must be able to identify market movements caused by the over-exuberance of investors, not just through the analysis of concrete price data. Fade traders often wait for the release of key indicators, such as sales projections, earnings reports, or interest rate changes to make their move.

Source: Investopedia

A fade strategy works best when there is high volatility in the market. This presents the possibility of frequent profitable corrections.

· Momentum Trading

Momentum trading is the practice of selling and buying assets, based on recent price trends. When the price of an asset increases, it attracts more attention. This pushes the price even higher. This goes on until there is a large number of sellers in the market. Momentum traders determine how strong the trend is and take positions accordingly.

Volume and volatility are the most important aspects for momentum trading. A market with high volume allows momentum traders to enter and exit it quickly. High volatility allows traders to take advantage of short-term price swings. However, momentum trading also requires a high level of discipline and market knowledge to make the right decisions. This makes it more suitable for experienced traders.

Day trading can take time to master. Therefore, it is better to stick with just a single market during the learning phase. Plus, keep the charts easy to read. By limiting yourself to only a few technical indicators at a time, you would avoid contradictory signals.

References: Daytrading, Investopedia, Brokernotes