Demystifying Oil Trading Jargon

Every industry has its fair share of technical jargon. Knowing what the commonly used terms makes participating in that industry much easier. So, if you are just beginning your trading journey in the oil markets, learning the jargon or terms common to this market is a must to understand reports and expert opinions. Here are the explanations to some of the most popularly used terms by oil traders.

1. WTI and Brent

Brent crude is used to benchmark the light oil markets across Africa, Europe and the Middle East. OPEC, the most powerful coalition of oil-producing nations, uses Brent as its benchmark. It is the global benchmark for oil prices and is traded on London’s Intercontinental Exchange (ICE).

West Texas Intermediate is the benchmark for the US light oil market and is traded on the New York Mercantile Exchange (NYMEX).

Oil traders often speculate the impact of geopolitical tensions in the Middle East or hurricanes in the US, to gauge oil price movements. For instance, the risk of the Red Sea route being closed due to rising tensions in the Middle East poses threat to regional exporters’ supply and traders speculate a rise in prices.

2. API and EIA

Both the API and EIA are US organisations that release reports on crude oil inventories of the country. The American Petroleum Institute (API) is the national trade association, a private organisation while the Energy Information Administration (EIA) is a subsidiary of the Federal Statistical System and a part of the US Department of Energy.

The scope of the API is smaller since it considers only API members and a few non-members. The EIA, on the other hand, considers all commercial crude oil inventories in the country. Although the API report is released on Tuesdays and the EIA report comes out on Wednesdays, speculating on the latter using the former’s data is not a popular practice due to its limited scope.

Oil traders usually trust the EIA more for trading decisions due to its wider scope. Oil prices rise in response to a report of a decline in stockpiles and plummet when inventories are overstocked.

3. OPEC+

The Organization of the Petroleum Exporting Countries (OPEC) is a 13-nation cartel, formed to “co-ordinate and unify petroleum policies among member countries” in 1960. The aim was to ensure profitability for producers and investors, as well as supply stability for consumers in the oil-export-dependent Middle East, against a market widely controlled and valued by the US. The US is the largest producer and consumer of oil.

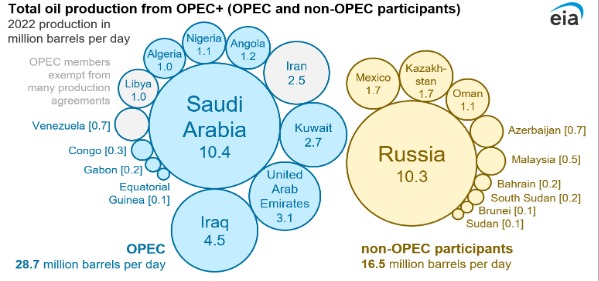

Source: EIA

In 2016, 10 non-OPEC nations, with almost equally significant oil production capacity, formed a coalition with the cartel and created OPEC+. OPEC+ now represents about 41% of the world’s crude oil production. The member states account for 49% of global exports and 80% of proven reserves.

The organisation is most popularly known for influencing oil prices. It assigns production quotas to member nations to maintain sufficient supply so that their operations remain profitable and low oil-producing nations do not suffer from a lack of competitiveness. When certain countries increase their production (for instance, to boost their economy), the excess is balanced by reducing the quotas of the others.

The biggest rival of OPEC+ is the US. Notably, WTI is costlier for its properties and due to higher transportation costs, since the oil is extracted from landlocked regions. Therefore, OPEC+ limits supply just enough to keep prices competitive.

Traders watch out for OPEC+ updates to determine changes in supply. They speculate on oil prices movements as the demand-supply equilibrium dwindles.

4. International Energy Agency (IEA) Reports

The IEA is an intergovernmental organisation, established to stabilise oil supply internationally. That was when oil was the primary source of energy. Now, the organisation’s mission has expanded to guiding nations to develop renewable energy supplies.

However, oil is still the dominant source of energy, and the IEA publishes detailed statistics and forecasts on global supply and demand, inventories, refining activity and prices. Its oil market reports (OMRs) are the most trusted and authoritative sources of data on the global energy markets. Oil traders, analysts and investors use these reports to make informed decisions. While the reports are published every month, they often include annual and quarterly forecasts, which medium- and long-term traders find useful. Traders also use the energy outlook reports published by the agency to gauge how developments in alternative energy sources may impact oil demand and, hence, prices.

5. BPD or BBL/D

Barrels per day (BPD) and billion barrels per day (bbl/d) are measures of the amount of oil produced from oil rigs. Oil is produced, refined and transported in massive quantities. The consumption of nations and oil deals are also measured in barrels or billion barrels per day.

1 barrel = 42 US gallons = 158.9873 litres

Usually, the price of oil is negatively correlated with the bpd and bbl/d measures. Using this relationship, OPEC+ often cuts production to keep oil prices higher so that Middle Eastern nations can earn profits from their production.

6. Settlement

Settlement in commodity trading refers to the completion of a trade. The seller hands over the commodity while the buyer pays the price. Oil imports and exports are popularly done by determining a future date and price to settle the trade, eliminating the risk of market uncertainty.

Popularly, oil traders use derivative instruments, such as contracts for difference (CFDs), to trade oil without needing to own or actually move the commodity. They speculate on the direction of price movement and amount of change to take advantage of market uncertainties. The trade is settled between the two parties by paying the difference between the price at the time of beginning and end of the contract. This allows oil traders to take advantage of both rising and falling prices.

To Sum Up

- WTI is the benchmark for the US oil market while Brent is for global oil markets.

- The EIA reports US inventory statistics, which traders use to speculate on oil price movements.

- OPEC+ is one of the most influential organisations in the oil market and moves prices by altering supply.

- BPD and bbl/d are measures of the amount of oil produced from oil rigs.

- Settlement refers to the completion of a trade, when the price is paid and the commodity changes hands.

- CFD trading allows traders to take advantage of rising and falling oil prices without needing to own or exchange the commodity.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information here in contained. Reproduction of this information, in whole or in part, is not permitted.