How Quantitative Tightening Affects the Financial Markets

The Bank of England (BoE) seems to have gotten off to a smooth start to its quantitative tightening (QT) process in early November 2022. After years of quantitative easing (QE), it could have been a tricky process to sell the central bank’s vast UK government bond holdings. Through the period of QE, the central bank had pumped a whopping £838 billion into the nation’s financial system via bond purchases. Now, the BoE has become the first major central bank to actively reduce its bond holdings.

The US Federal Reserve has also undertaken fast-paced interest rate hikes and a reduction of its balance sheet. This has led to a decline in liquidity across financial markets, along with a surge in uncertainty and volatility. Morgan Stanley expects the Fed’s QT to lead to the S&P 500 declining 15% by March 2023.

Image Source: Charles Schwab

In the meantime, the president of the European Central Bank (ECB), Luis de Guindos, mentioned in early November 2022 that the bank intends to continue to raise interest rates in an attempt to curb inflation. He also stated that the timing of the ECB’s QT programme could overlap with the process of normalising interest rates.

So, what is quantitative tightening and how could it impact the financial markets? Here’s what you need to know.

What is Quantitative Tightening?

QT could well be called the evil twin of quantitative easing. It is a “contractionary” monetary policy, undertaken by central banks to reduce liquidity, money supply and the general economic activity level in a nation. So, QE injects liquidity into the financial markets through bond-buying activities undertaken by the central banks, supporting bond prices and preventing bond yields from surging too quickly. QT, on the other hand, is when these banks undertake a reduction in their asset holdings by allowing them to mature without repurchasing them or through a sale of their assets. The result usually is a decline in bond prices and an increase in yields.

Now, why would central banks want to reduce liquidity and economic activity? They only undertake such measures when it is the only way to deal with soaring inflation and the concomitant rise in the price of goods and services.

Did you know?

The US Fed undertook quantitative tightening in 2017 and 2019 by allowing its Treasury and mortgage-backed securities to mature without replacing them. The Fed’s portfolio holdings of Treasury securities declined by $6 billion in 2017.

How Quantitative Tightening Works

Central banks aim to normalise their balance sheets via QT. The main objectives of this initiative are:

- Spur deflation by reducing the money supply.

- Increase borrowing costs and benchmark interest rates.

- Bring inflation or an overheated economy under control without destabilising the financial markets.

As mentioned earlier, QT is usually done by reducing central banks’ bond holdings, either through a sale in the secondary markets or allowing them to mature without buying them back. This leads to a significant increase in bond supply in the market, along with a rise in bond yield, which encourages investment in bonds across the economy.

On the other hand, rising yields tend to increase borrowing costs, while lowering the borrowing appetite of individuals and corporations. A decline in borrowing then leads to lower spending and a decrease in economic activity. This, in turn, leads to asset prices cooling. The selling of bonds tends to remove liquidity from the markets, which then spurs households and businesses to become cautious about their spending.

How is Tapering Different from Quantitative Tightening

Tapering refers to the period of transition between easing and tightening, when central banks begin to cut back on their large-scale bond purchases. So, the buying is tapered till it comes to a complete halt. Also, while the proceeds from maturing bonds are reinvested in buying new bonds, such reinvestments are reduced, till they come down to zero during the tapering phase.

Did you know?

Investors can have a massive reaction to central banks slowing bond purchases or allowing their holdings to mature. They could react by panic selling off their own bond holdings. This was last seen in 2013, when the US Fed announced its intention to taper off its bond purchases. The financial media called it a “taper tantrum.”

The Impact of Quantitative Tightening

From 2012 to 2022, asset returns have shared a positive correlation with central banks’ securities purchases. The most recent impact of QT was seen in December 2018, when the Federal Reserve’s balance sheet run-off was seen as a key driver of a sharp sell-off in risk assets, leaving the S&P 500 down almost 20% from its peak. So, quantitative tightening tends to spark investor concerns, which then impacts the financial markets.

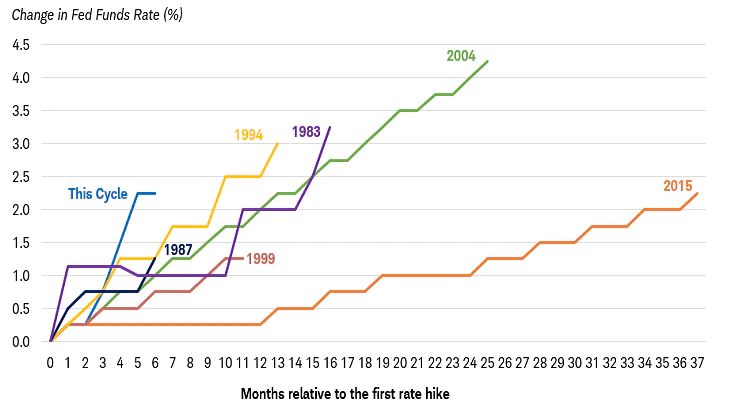

In addition, a QT programme, in combination with interest rate hikes, tends to lower market liquidity. This is because, as mentioned earlier, higher borrowing costs lead to tighter purse strings for both individuals and corporations, including those participating in the markets. The rate hikes undertaken by the US Fed in 2022 have been among the most rapid in history, with the Federal Funds Rate rising from 0.0%-1.25% at the beginning of the year to an expected 4.4% by the year-end.

Also, risk assets, such as stocks, tend to share a high correlation with bond purchases by central banks. When QT takes place, it could lead to an increase in volatility in such assets. If liquidity is removed too quickly from the markets, it could even spook market participants, which could then lead to a further spike in volatility.

This time around, the central banks are expected to reduce their balance sheets by a significantly smaller percentage than the increases during the QE phase. This could lead to a limited impact on the financial markets. However, it is still prudent for traders to ensure robust research before making trading decisions. Risk management measures also become indispensable during such times.

Key Takeaways

- Quantitative tightening is an initiative undertaken by central banks to bring inflation under control and cool an overheated economy.

- During QT, central banks either allow their asset holdings to mature without buying them back or actively sell their holdings in the secondary market.

- QT can impact market sentiment and lead to panic selling of risk assets.

- Combined with interest rate hikes, QT can lead to a decline in liquidity and a rise in volatility in the financial markets.

- Adequate research and risk management are crucial while trading during these times.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.

References:

- https://in.investing.com/news/bank-of-englands-quantitative-tightening-off-to-a-smooth-start-3399878

- https://www.bloomberg.com/news/articles/2022-11-28/big-s-p-500-bear-case-sees-15-drop-on-fed-balance-sheet-unwind

- https://www.reuters.com/markets/europe/ecbs-de-guindos-quantitative-tightening-start-sure-2023-2022-11-08/

- https://www.investopedia.com/terms/t/taper-tantrum.asp

- https://www.ubs.com/global/en/wealth-management/insights/chief-investment-office/market-insights/2019/quantitative-tightening-impact.html

- https://www.visualcapitalist.com/comparing-the-speed-of-u-s-interest-rate-hikes/