How the Fed’s Interest Rate Hikes Impact the Forex & Equity Markets

The US Federal Reserve (Fed) works to control the money supply in the domestic markets to keep inflation under control and boost the economy. The central bank does this by raising or lowering interest rates. The Federal Funds Rate is the most significant benchmark for the United States, and therefore the global economy.

The forex and equity markets, being the most active and responsive markets to economic developments, react quickly to changes in the federal funds rate. For traders, the induced volatility generates plenty of market opportunities.

The Anatomy of Interest Rate Decisions

The Fed or any other central bank hikes or reduces interest rates to directly impact economic growth. Factors such as inflation, GDP, consumer spending, industrial production, financial crises, and global economic and geopolitical conditions are all considered before making such decisions.

Rate Reduction

Slowing economic growth requires stimulation. This is when the Fed (or any other central bank) reduces interest rates. Remember how economic activity declined dramatically worldwide in the wake of the pandemic in 2020? The stock markets fell at one of the highest recorded rates. To help the struggling US economy, the Fed slashed interest rates. This led to an escalation in business loans and credit, boosting growth, especially for the stock market.

Rate Hike

When economic growth is too fast, inflation soars. When inflation surpasses the targeted levels, the monetary policymakers usually decide to raise interest rates. The Fed raised interest rates 13 times in the 18 months from March 2022 to August 2023, taking the rate from near 0 to 5.5%, the highest in 22 years. This was done to curtail the 40-year-high inflation rate of 8.5%, bringing it down to 3.18% by the end of August 2023.

Interest Rates Determine Economic Activity

Banks take loans from each other and the central bank to meet their liquidity needs. The overnight rates are calculated based on the federal funds rate. This rate has ripple effects across all kinds of loans, affecting anyone that borrows from banks and financers.

High borrowing costs exert downward pressure on the demand for money. Business owners tend to push out projects that require financing and limit expansion plans. Simultaneously, high interest rates discourage people from spending and encourage them to save more. This is because credit card and mortgage interest rates rise, especially affecting those with long-term variable interest rate plans.

All this affects the demand for goods, services, and labour, and results in an overall reduction in money in circulation, which helps the economy cool off.

Interest Rate Hikes Impact Currency Values

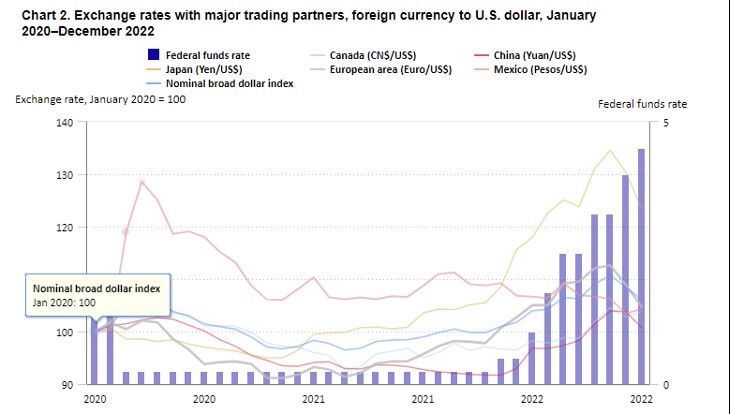

When the Fed increases interest rates, returns on the greenback increase, making it attractive for global investors. Driven to buy the high-yielding currency, investors sell off other currencies and move to the US dollar. This leads to the appreciation of the US dollar and a depreciation in other currencies. For instance, after the aggressive rate hike from March to September 2022, the US dollar index rose 11.4%, peaking on September 27, 2022.

Image Source: https://www.bls.gov/opub/btn/volume-12/how-currency-appreciation-can-impact-prices-the-rise-of-the-us-dollar.htm

As the greenback strengthened, the Canadian dollar, euro, Mexican peso, and Chinese yuan began depreciating against the US dollar. The most impacted were the currencies of emerging economies. But currencies of other developed economies are not immune either. Despite many other nations and the EU hiking interest rates, the aggressive American stance offset their efforts and the dollar climbed much higher relative to other currencies. Due to this, the struggle against inflation intensified in other nations, especially emerging ones. This is because over half of the global cross-border loans and all international debt securities are denominated in USD.

However, by Q4 2022, the US dollar depreciated due to recessionary fears, while the yuan, yen, and euro strengthened against it.

Interest Rate Hikes Weigh on the Stock Markets

The private sector has high debt denominated in the US dollar. Tightening domestic monetary policy and the strengthening dollar compound the pressure on companies in emerging economies and start-ups in the US. It creates a fear of debt distress.

In the economic aftermath of the pandemic, a decade of low interest rates and moderate inflation ended. The starkly contrasting aggressive rate policy took centre stage and became a dominant influence on the global financial markets. Since the corporate sector, especially the small caps, are more vulnerable to rate hikes, investor behaviour is also sensitive to it.

This is because the current interest rate serves as the discount rate on future cash flows. Consequently, a higher interest rate lowers the current value of future earnings of stocks. This directly influences investor psychology. Traders tend to sell off stocks and turn towards defensive instruments, without waiting for the rate hike to play through the cycle of affecting businesses and their investment returns.

Such decisions exert downward pressure on the stock markets. The impact can be so high that after the announcement by Fed Chair Jerome Powell of continued rate hikes in November 2022, even before the actual rate hikes, the DJIA slid 1.55%, the S&P 500 declined 2.5% and the Nasdaq Composite lost 3.36%. This resulted in high trading volumes and volatility across the global equity markets.

The stock markets, therefore, are often the first responders to rate hikes.

What Does All This Mean for Traders?

Traders need to understand that not all monetary policy changes will impact them. But keeping tabs on such policy decisions by their domestic central bank, as well as the biggest banks of the world, such as the Fed, ECB and BoE, is critical. This allows you to plan your trades and align your portfolio to mitigate the impact of unfavourable rate updates. Using an economic calendar is the best way to prepare for interest rate decisions. The calendar has data on the next announcement, the previous figure and the consensus expectations regarding the impending decision. You can also track meetings of the FOMC and other central bank committees and their announcements to get an idea of what might lie in store.

Many countries, including Australia, Canada, India, Indonesia, Singapore and South Korea, turned dovish as 2023 began, due to concerns that extraordinarily aggressive rate hikes might slow down growth more than required. However, the US continued to adjust interest rates to bring inflation to its target of 2%. This led to speculations that the Fed would hike interest rates at least by 50 basis points in the fourth quarter of 2023 and for the rates to remain elevated through 2024, despite some rather insignificant cuts. This “higher for longer” stance further fuelled speculations related to increased debt costs for businesses and consumers, which could slow economic activity down. These speculations were reflected in a decline in stock prices while treasury yields rose.

Information is power in the financial markets. So, make sure you stay updated on the latest Fed moves before making forex or stock trading decisions.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.