Do Sharpe Ratio or Sortino Ratio Matter?

There’s no denying that forex trading is a risky business thanks to its massive market size and absence of a centralized body. But the risk is no deterrent for the bold trader looking for high risk/return investment opportunities. However, prudent traders, in their quest for high rewards, are also on the lookout for strategies that may help them minimise the risk or improve the risk-reward ratio of a trade.

Which is just what the Sharpe Ratio and the Sortino Ratio do. They are used by investors and forex traders to make risk adjusted evaluations of returns on an investment. But remember, no measure can guarantee fixed and positive returns, and traders should always be prepared to accept all possible outcomes of their trading decisions. Here’s a look at the Sharpe and the Sortino ratios and their importance in forex trading.

The Sharpe Ratio

Measurement of risk and reward is key to any investment or trade. Sharpe Ratio aims to measure the excess return per unit of deviation in an investment, asset or trading strategy. Developed by Nobel laureate William F. Sharpe, this ratio is useful in comparing the change in a portfolio’s overall risk returns, taking into account a new asset or asset class. It also helps identify whether the returns are emanating from good decisions or high risk. So, the Sharpe ratio helps a trader know about the change in the risk-reward of a portfolio, following the addition of a new component.

Sharpe ratio = (Mean portfolio return – Risk- freerate)/Standard deviation of portfolio return.

By using this ratio, a trader can estimate how a new type of investment will perform, compared to a risk-free investment. But a major drawback of this ratio is that it can be applied only to portfolios that have normal distribution of expected returns. This ratio also does not consider the direction of deviation. It’s failure to analyze the non-linear risks associated with holding options or warrants makes its usage limited. Another thing to remember while using this ratio is that it will always give much better results for an asset with very low volatility compared to something that offers high returns.

A significant feature of this ratio is that it is independent of the leverage a trader uses, but only while the standard deviation is small. While risk and reward increase proportionally for an increase in leverage of the initial level, the benefit of leverage decreases as the standard deviation gets larger. And at some point of time, the increasing leverage will actually lead to a decrease in return, since the amount lost on bad days or months will not be compensated for during good days or months.

When using this ratio for evaluating or comparing a forex trading strategy, remember that the higher the ratio, the better is the expected return, in relation to the possible risk associated with it. Similarly, when comparing two trading strategies with the same return, the one with the higher Sharpe ratio has had less volatility in the past. Now, what if you wish to compare two trading strategies with different returns? In this case, you choose the strategy with a higher Sharpe ratio, even when the past return is smaller, since this will help mitigate impulsive decisions when dealing with draw downs.

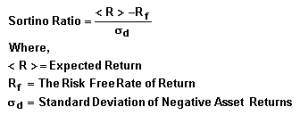

The Sortino Ratio

Another ratio, the Sortino Ratio, is also used to measure the risk adjusted return of an individual asset or portfolio. But in this case, the volatility is calculated by taking the standard deviation of the negative returns. A high ratio is an indicator that the probability of incurring large losses is low.

This ratio, since it gives only the volatility of negative returns, is preferred by many investors or traders, who tend to ignore positive volatility. The Sortino Ratio is quite effective in comparing high volatile portfolios over shorter periods of time, but does not prove to be satisfactory in a situation when the volatility of returns is low due to insufficient data. Although this ratio overcomes the shortcomings of the Sharpe Ratio, it also does not guarantee any future returns. Also, one cannot actually ignore the upside volatility completely.

Most analysts prefer to use the Sharpe ratio to evaluate low-volatility investment portfolios and the Sortino variation to evaluate high-volatility portfolios. But, as is the case with all other indicators and measures, these ratios, when used in isolation, are inadequate. The results of these ratios need to be confirmed or matched with some other indicator to develop a better forex trading strategy.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than your invested capital.