MT4 vs MT5

If you have decided to foray into forex trading, you need access to a stable trading environment. A powerful, reliable, fast and feature-rich trading platform could make a huge difference to your long-term trading success.

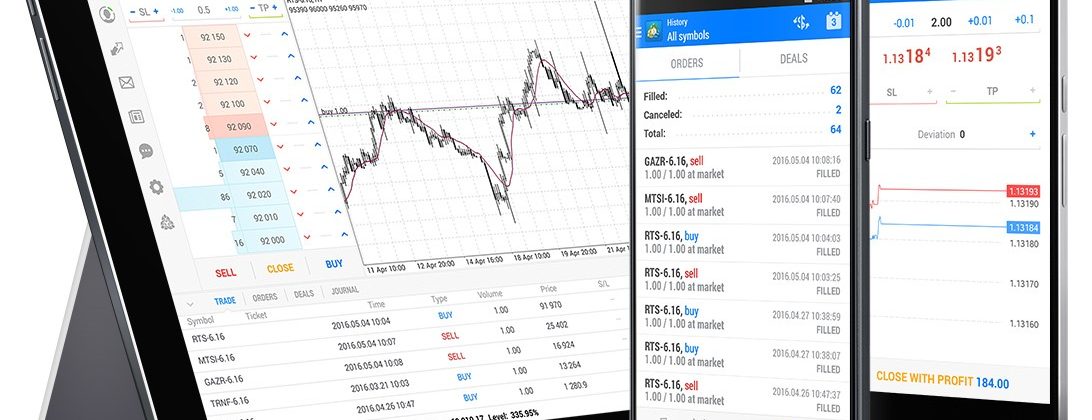

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are both trusted names in this regard. They are multi-asset platforms, with user-friendly interfaces, multi-device operability and equipped with strong tools for fundamental and technical analysis. Moreover, they are ingrained with robust security protocols, making transactions and trading extremely safe.

But, there are some common misconceptions. For instance, MetaTrader 5 is not just a superior version of MetaTrader 4, it is loaded with improved functions. Obviously, there are a large number of similarities between the platforms, but many differences too. Let’s take a closer look at them.

Trading Assets

MT4 is one of the most popular forex trading platforms. Traders can gain access to many currency pairs or forex CFDs from the same platform. The interface is simpler and easier to understand. MT4 offers a wide range of functionalities, suitable for FX traders of all skill levels. With various execution modes and order types, traders have the flexibility to create their own strategies. Brokers can offer real-time price quotes for price analysis, and multi timeframe interactive forex charts can be opened simultaneously.

In contrast, MT5 has been designed to offer access to a wider range of markets, including forex. Traders can access stocks and commodities too, since the platform can connect to a centralised exchange. Unlike forex, which is a decentralised market, stocks and commodities have to be traded on central trading exchanges. Commodities, especially, are mostly traded through futures. MT5 is, thus, a true exchange market platform, while MT4 is a specialised one.

Programming Languages

MT4 uses the MQL4 programming language, but MT5 is based on MQL5. Both these languages are “developer friendly,” which means that they are easy to use, for creating trading robots or custom indicators. The basic difference is that while MQL4 uses the order system to develop trading programs, MQL5 implements a positional system.

The lack of backward compatibility should be known. Programs designed for MQL4 cannot run on MQL5. This poses a problem for traders who wish to upgrade from MT4 to MT5.

However, many traders believe that MQL4 is a simpler language than MQL5, for new developers. But, MQL5 has superior back testing capabilities. It can allow multi-currency pair back testing simultaneously, speeding up the back-testing functions considerably.

Technical and Fundamental Analysis

MT5 offers all the technical indicators provided by MT4, and many more. MT4 has 30 in-built technical indicators, 31 analytical objects, along with 2,000 free custom indicators and 700 paid ones. In comparison, MT5 has 38 inbuilt indicators and 44 analytical objects. Chart analysis on MT5 can be done in 21 timeframes, compared to just 9 in MT4. Also, MT5 allows traders to open unlimited number of charts at the same time. Another feature absent on MT4 is the Depth of Market feature, where real-time tick charts of all financial instruments, along with trading volumes, can be seen.

MetaTrader 5 comes with an ingrained economic calendar, which is missing in MT4. This economic calendar offers valuable financial market news and data releases from major countries that can impact the prices of financial instruments. Traders can even set email alerts, when a particular economic indicator is released. Market scanners help traders identify potential trading opportunities.

Order Types and Execution Modes

MT5 offers 4 types of order execution modes and 6 types of pending orders, while MT4 provides 3 order execution modes and 4 pending order types. For the uninitiated, pending orders are types of trade orders which instruct to buy or sell a security at a pre-defined price in the future.

MT5 allows partial order filling. If, for instance, the maximum volume of a trade has been reached and the order hasn’t been filled yet, traders could opt to cancel out the remaining volume.

MT5 also supports two accounting modes. For exchange markets, the netting mode can be used, while for forex it provides the hedging system. In contrast, MT4 allows only hedging, since it doesn’t offer access to non-forex markets. But, MT4 is more suitable for hedging purposes than MT5. MetaTrader 4 registers every trade individually and allows traders to manage all positions separately. MT5, in contrast, aggregates all positions (netting).

On MT5, access to the hedging functionality is “by request.” While this is suitable for the US markets, where hedging is legally prohibited and the FIFO accounting system is to be used, in other parts of the world this could be a pain point.

In short, MT5 was designed to cater to the US and non-forex markets, but that doesn’t necessarily make either platform any less than the other.

Which Platform to Choose?

It all depends on your trading personality. If you want a platform exclusively for FX trading, MT4 is the better choice. But, if you are someone who relies on back-testing strategies a lot, MT5 can be a good solution. But, MT5 implements FIFO on default, which could be a hindrance, unless you are a US-based trader.

Both platforms have similar intuitiveness in user interface, and the look and feel is the same too. But, new traders might find MT5 a little difficult to navigate. MT5 is more refined, but traders might prefer the simplicity of the original.

In either case, it is good to start practising on a demo account before entering the live markets. This way, traders can familiarise themselves with the functionalities and check whether which platform suits them best.

Reference Links

- https://reachfinancialindependence.com/difference-between-metatrader-4-and-metatrader-5/

- https://www.daytrading.com/metatrader

- https://www.metatrader5.com/en

- https://www.metatrader4.com/en