How Would a No-Deal Brexit Impact the Pound?

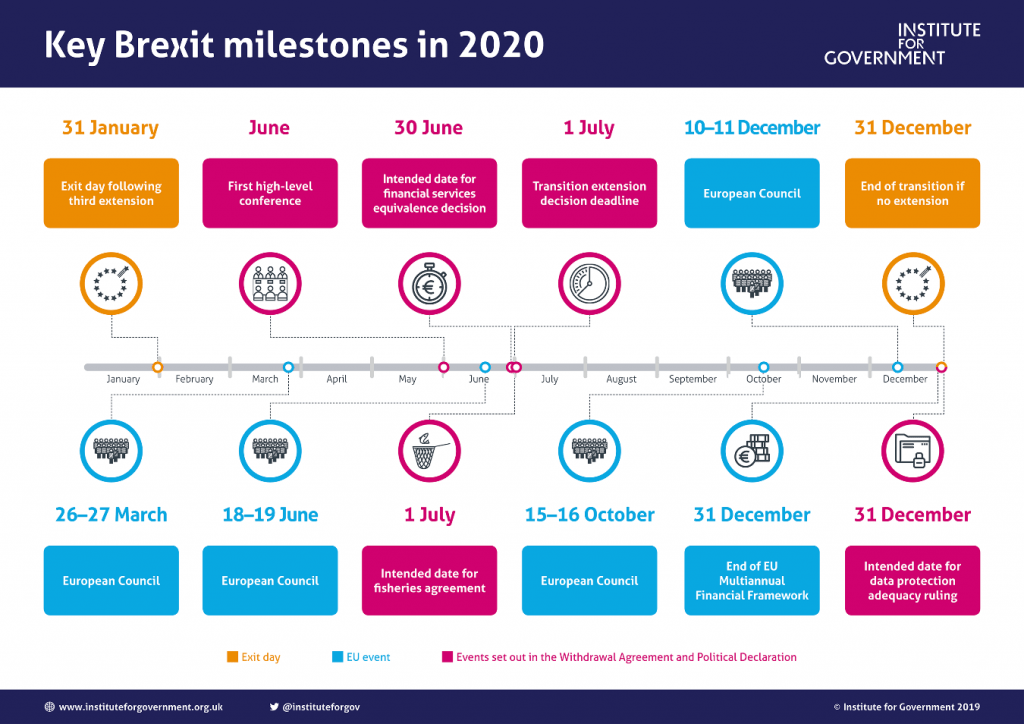

Brexit talks are down to the wire now. With the beginning of November, the UK and EU have less than two months to come to a mutual agreement. The UK officially left the EU on January 1, 2020, with the understanding that the two parties would finalise a free trade agreement by December 31, 2020. Unfortunately, the two sides haven’t been able to see eye-to-eye on most issues.

Surprisingly traders didn’t seem too upset when Prime Minister Boris Johnson cancelled the October 15 negotiation meeting with the EU or when he said that the UK should prepare for a no-deal Brexit. In fact, the Great British Pound (GBP) was up 0.8% following this news. Have traders learned how to filter out the noise from the markets? After all, it has been four long years of deadlines and negotiations, associated with Brexit. Then there’s the pandemic that has taken up a lot of focus. So, how would the Pound Sterling react if the UK did end up with a no-deal Brexit?

Will They Meet in the Middle?

Although the UK wants to maintain the single market access, the nation also wishes to assert its “sovereignty” by not being bound by the EU regulations. This makes it seem that a deal would be almost impossible to reach. One thing that the UK government has been insisting on is a deal similar to that signed between the EU and Canada. On the other hand, Boris Johnson has also stressed that the UK could “prosper mightily” if UK-EU trade could be based on the terms set out by the World Trade Organisation.

The UK’s director of the European Centre for International Political Economy, David Henig, has told The Financial Times that for a deal to be finalised, the UK would need to:

- Agree on not claiming all the fish in its territorial waters

- Agree on not subsidizing British companies or undercutting social and environmental rules of the EU, and

- Withdraw its threats to disregard international law associated with the rules set up for Northern Ireland in the Brexit withdrawal agreement.

On the other side, the EU member states do want to sign a free trade deal with the UK, but they are unwilling to settle for what they perceive as a raw deal. President Emmanuel Macron of France stated in October, “It just so happens that making the British prime minister happy isn’t the vocation of the sovereign leader of the 27 member states that chose to stay in the EU.”

However, there still is hope for some sort of compromise, so that at the very least, a narrow deal can be agreed upon. For instance, the UK might agree to accept EU regulations for key sectors for a specified period of time or joint oversight committees could be established to monitor the arrangements.

Analysts agree that if a trade deal is signed, regardless of how narrow it is, the Pound Sterling could rise by as much as 5%, since this would eliminate the risk of a no-deal Brexit. On the other hand, if there is no deal, the GBP could decline as much as 10%.

Source: Institute for Government

Will the Pound Take a Pounding?

The short-term impact of a no-deal Brexit could be significant for both the UK and the EU. Even with a trade deal, the trading relations between the two sides would become much more distant from 2021. The movement of people and goods between the two economies would be subject to major checks, paperwork and regulations. In short, it will become difficult to sell many services across borders.

The impact of all this is likely to be much greater on the UK than on the EU, not the least of which would be rising costs. According to the latest report by the Office of Budget Responsibility, one-third of the Brexit impact, equivalent to 1.4% of the national income, has already been felt due to a decline in business investment since 2016. Another third of the impact would be felt during 2021-2025, with the remainder of the impact occurring in the decade that follows.

The EU is the largest export partner for the UK, accounting for 46% of the nation exports. In addition, 53% of all imports to the UK are from the EU, as of 2018. That’s not all. The services sector is a major contributor, accounting for 79% of the UK economy and 45% of the nation’s exports. The services sector would be hit hard by a no-deal Brexit, while London’s standing as a global financial hub could also come under threat.

Without a trade agreement, the result would be imports becoming much more expensive for the UK, while demand for its exports could decline. With a no-deal Brexit, the UK will be liable to pay various duties and taxes, while ensuring customs checks on goods moving to and from the EU. All this would have a direct impact on the demand for the GBP and therefore its valuation.

The pound sterling declined 7.80% against the euro, following the Brexit vote in June 2016. Since then, the GBP/EUR rate has been unable to cross the 1.20 mark for any significant amount of time. In fact, this 1.20 level has almost become a barrier that the pound attempts to test each time it sees a recovery. With a no-deal Brexit, the usual suspects in the depreciation of a currency’s value will come into play.

On the other hand, if a deal is struck, things could be very different for the UK currency. Some analysts predict that the EUR/GBP rate may surge above the 1.20 barrier, driven by the optimism that would hit the market if a trade agreement in struck.

Having said, market confidence is already fragile. With no end in sight to Covid-19 and the UK going into a second national lockdown, risk sentiment is already low. Any hiccups in the negotiations between the EU and UK would only adversely impact market sentiment further. Whether traders will still be able to see beyond the political noise at this time is yet to be seen.