What are Shark Harmonic Patterns?

When it comes to harmonics, forex trading has a lot in common with the animal world. After butterflies and crabs, sharks have come to share their name with famous five-point patterns used in trading. A relatively new pattern, the shark was discovered by Scott Carney in 2011, and is very similar to the crab and the Cypher patterns.

As harmonic pattern trading gains popularity amongst retail and institutional traders, the shark pattern has proved to be a stellar addition in the harmonic pattern arsenal. Its role in trading is just as decisive and effective as a shark bite.

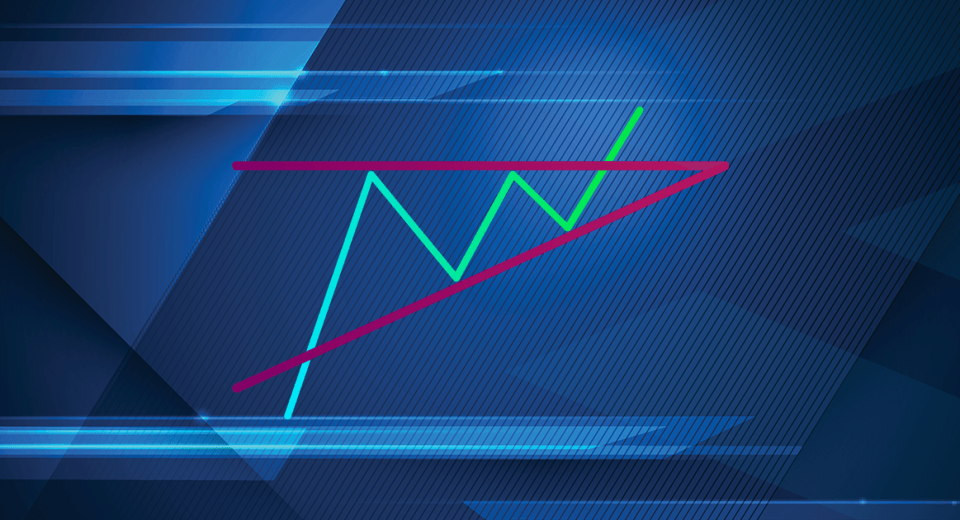

Structure of Shark Pattern

The pattern was created by combining Fibonacci numbers and the Elliott Wave theory. The structure of a shark pattern includes an impulse leg (X-A), and a retracement leg (B), where the latter has no specific value. The continuation leg (C) must reach a Fibonacci extension of 113% of the B-A leg, but shouldn’t exceed the 161.8% mark.

Now, a retracement for X-C follows. The shark pattern so obtained must reach an extension of 88.6% of this retracement, but shouldn’t be more than 113%. The next Fibonacci extension will be B-C, which is an extension of the A-X leg, within the 161.8-224% range. However, as far as entering trades goes, there is a difference vis-à-vis other harmonic patterns, for instance:

- Entry is to be made at an extension of 88.6% of the O-X leg, and the stops will come in at point C

- Targets can be at 61.8% of the B-C leg

- Now, it is easy to find the zone to enter trades. This is the area where the X-C Fibonacci retracement and the B-C Fibonacci extension overlap.

Bearish and Bullish Shark Patterns

A bearish shark often illustrates entry and exit points. Most real-time samples won’t have absolutely accurate ratios between OXABC. Another interesting aspect of the shark pattern is its volatility, which makes it similar to the crab pattern. In a bearish state, shark patterns usually have a long series of candlestick bodies and long spikes, formed very close to the PRZ level of C. In contrast, a bullish shark pattern illustrates the volatility created close the PRZ zone of D.

Trading Shark Patterns

To identify a buy signal, confirm point D in a bullish shark harmonic pattern. Now, place the stop loss at the next Fibonacci retracement level, for instance, 141%. For this order, the take profit can be placed at 38.2%, 50%, 61.8%, 88.6%, or 100% of the retracements of C.

In case of a sell signal, it can be placed at point C, under the condition that the point reaches an extension of 161.8% of the retracement of point A. For such an order, the stop loss can be tight, with the take profit being placed at D.

The cherry on the cake is that this highly tradable pattern gives rise to other patterns and trading possibilities. The first is the 5-0 arrangement that everybody knows about, which allows entering a trade in the opposite direction from the point D. Additionally, in a 5-0 pattern, the shark metamorphoses into a bat, or even a crab, as the BCD often becomes the XAB of an approaching bat or crab pattern! At this point, one needs to stay watchful and hope for a C point to be made, which then allows a BAMM trade to be entered.

The shark is truly a complex harmonic pattern, and a lot different compared to other ‘M’ and ‘W’ shaped patterns. The secret of successfully trading them lies in prioritizing the risk/reward ratio above all.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than your invested capital.