How to Trade in the Bear Market?

A bearish market is one that is experiencing a downtrend for a certain time period. One of the commonly accepted definitions is a market that has declined 20% or more from its peak, over a period of two months or more. This is quite different from a market correction. Here, low investor confidence escalates the downward spiral, as more traders start selling assets, causing the prices to witness sharp declines as buyers retreat from the market. Price action continues to decline until the selling pressure reduces and investor confidence returns, leading to an increase in the number of buyers.

These sharp sell-offs are easily identifiable on the charts, in the form of large red candles, indicating selling pressure for an extended timeframe. Prices get pushed through stop-losses, already set below the important support levels. Forex traders generally resort to selling off less-liquid currencies, such as those belonging to the emerging markets. Typically, the demand for safe haven currencies like the US Dollar and Japanese Yen increases, as traders start selling riskier assets and investing in safe havens instead.

Forex Offers Trading Opportunities in All Market Conditions

Forex trading is always done in currency pairs, which is why even if one currency is falling, the other is likely to be strengthening, allowing traders to take positions in both bear and bull markets. This is especially true of forex contracts for difference (CFDs), which allow traders to take positions in both rising and falling markets.

Traders can take both bullish and bearish positions on the same trade. For instance, if the US Dollar is strengthening and the Japanese Yen is weakening, they could take a long position on the USD/JPY. Effectively, the trader now holds two positions at once, a long position on the USD and a short position on the JPY. Hence, a forex trader is always short-selling one currency.

However, traders should be aware of bull and bear markets, since such conditions can determine currency trends. This also helps with an understanding of how to manage risk, and when and where to enter and exit trades. Let’s look at some technical indicators that can help identify down trends.

The Hanging Man Pattern to Trade Reversals

Hanging man is a candlestick formation, indicating sharp selling pressure at the peak of an existing trend. This happens when a large number of market participants feel that the market has reached its highest levels, and will soon decline, resulting in a large number of “bears,” as compared to “bulls.” The hanging man has a small real body, with a barely visible upper shadow, and a lower shadow almost twice the length of the real body.

A small upper shadow indicates that some traders are still trying to maintain the current uptrend, before the price drops significantly for a currency pair. A longer lower shadow indicates significant sell-off, until the bulls try to force the closing price closer to the opening levels. But, the closing price is still down for the given time period.

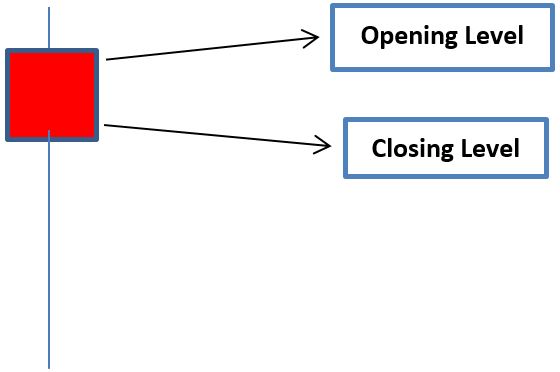

A red hanging man candle is a bearish indicator. We can normally see the closing level below the opening level, which indicates a bearish hanging man pattern.

Trading the Hanging Man Pattern

If, subsequently, the chart shows that the following candle moves down further below the short-term upward trend line, a downward long-term trend is confirmed. A possible entry level here could be the point where the market has moved past the low of the candle pattern.

By using multiple timeframe analysis, a trader can view the formation with respect to the long-term trend. One can start looking at longer timeframe charts, such as daily charts, to see where the market is headed. This helps to avoid placing a trade in a direction opposite to the long-term trend.

After this, a shorter timeframe chart, say a 4-hour chart, can be used to identify the entry point. Additionally, traders can use other technical indicators, such as the 20-SMA and 50-SMA, where, when the former crosses over the latter, a downtrend is indicated. The Relative Strength Index (RSI) can also be used to find out whether the market has reversed to start a downtrend.

Once a downtrend has been confirmed, the entry point could be the low of the hanging man candlestick. If the market is indeed bearish, traders will see declining subsequent price action, and enter into short positions.

So, a confirmation of a short-selling signal would be:

- Downtrend for longer term

- Hanging man pattern observed near significant support/resistance levels

- Hanging man pattern formation near the peak of short-term uptrend

- Subsequent candles making lower highs and lower lows.

The hanging man pattern is a popular one in the forex markets, especially due to its immense liquidity, although it appears in all markets.

Don’t Forget Risk Management

Risk management is vital under all market conditions. Most traders keep the distance between the entry level and profit level twice the distance between the entry level and the stop-loss level, making a 1:2 risk reward ratio. Stops can be placed at the resistance levels, in case the market goes against the trader. Stop-loss can also be put above the hanging man high.

Shorting a currency always carries significant risk. In long positions, the worst case scenario is the currency value falling to zero, in which case the losses would be limited, since the value of the currency cannot go lower than that.

But, in case of a short position, the trader is assuming that the currency price will fall, whereas the markets could turn and prices could begin climbing. The increase in currency price has no limits, so the loss of money has no limits either.

This is why forex CFDs are an effective way to enter short trades in a bearish market. In case of a loss, one has to pay the difference in the value of the contract between the entry and exit dates, which won’t be higher than the position value.