Trading USD/CAD Amid Trump Tariffs on Canada

Second-time US President, Donald Trump, confirmed the imposition of 25% blanket tariffs and 10% energy tariffs on Canadian imports. Trump’s tariffs may adversely hit the Canadian economy, which is deeply tied to trade with the US for its growth. The tariff-induced trade war has weakened optimism around Canada’s economic recovery. Unfortunately, this could potentially translate into an existential fight for the Great White North.

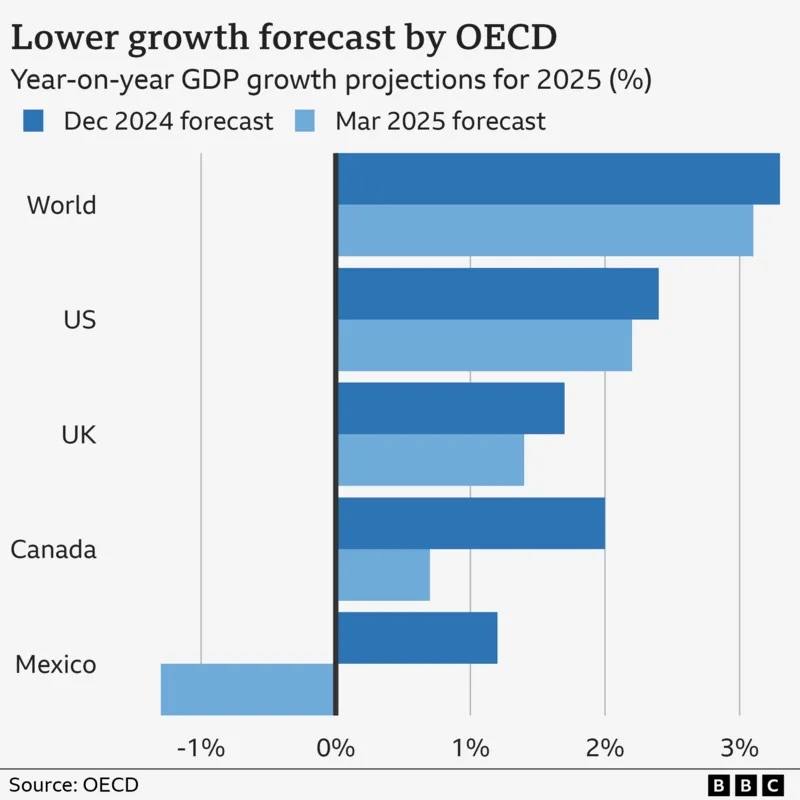

OECD Lowers GDP Growth Projections Amid Multi-Lateral Trade Wars

Source: BBC

How US Trade Tariffs May Impact Canada

Trump’s tariffs have come at a time when the Canadian economy is already battling high living and housing costs and a strained healthcare system. The country’s CPI had risen 2.6% y-o-y in February 2025, from 1.9% the previous month. Trade related economic uncertainties have created downward pressure on the Canadian dollar (CAD). By March 20, 2025, the currency had declined 3.5% from its November 5, 2024 level, when Trump won the US elections. At 0.5641, the USD/CAD hit its lowest since 2003 in December 2024. Here is what is to come:

- The OECD has highlighted that trade restrictions could stir up economic uncertainty globally and has lowered its growth forecasts for the world, Mexico, Canada and the US. It expects Canada’s GDP to grow by only 0.7%, instead of 2%, in 2025 and 2026.

- Heavily tariffed US exports account for nearly 20% of Canada’s GDP. Given the tariffs, the GDP is expected to decline by 2.5% to 3%.

- Some bearish estimates project that the Trump-imposed tariffs could lead to about 1.5 million people losing their jobs.

- Canada’s technology, industrials and utilities sectors heavily rely on US exports and will bear the most brunt of the tariffs. The country’s benchmark index, the S&P/TSX Composite Index, has been extremely volatile since the 47th US President took oath.

- The energy and auto sectors are the most dependent on revenues from the US and are expected to be severely hit in the short term.

Canada Responds

The Canadian House of Commons rejected Trump’s tariff justification. It claims the allegations of illegal immigrants and fentanyl supply are “absolutely false.” Instead, it alleges that the flow of illegal drugs and guns from the US to Canada has surged. Justin Trudeau, the former Prime Minister, who resigned in January 2025, stated that Trump intends to trigger a “total collapse of the Canadian economy because that will make it easier to annex us.” After all, Trump has been talking about making Canada the 51st US state.

Canadians have gone all out to criticise the US government. They were seen booing the American national anthem and cancelling trips to their southern neighbour. But unity alone cannot support the economy. Canada is expected to strengthen its trade ties with the EU, as the two jointly defend themselves against US tariffs. The former may fortify its military through deals to improve the latter’s access to mining products.

The somewhat positive news is that the new Prime Minister, Mark Carney, might prove pivotal in determining the course of the Canadian economy because, unlike Trudeau, he does not have a history of conflict with Trump. Having a finance background and specialisation in crisis management, Carney is also uniquely suited for the current economic situation in the country.

The Great White North has already imposed proportional retaliatory tariffs on the US. Canada slapped $30 billion worth of tariffs on US imports worth $155 billion on March 4, 2025, the day on which the Trump administration confirmed that the tariffs would go ahead as planned. Canada may also impose tariffs on electricity exports to the US.

The Canadian government is expected to provide fiscal support to stabilise the economy while the Bank of Canada (BoC) continues its monetary easing. The Canadian central bank cut the key interest rate by 25 basis points to 2.75% on March 12, 2025. This is a direct response to an anticipated economic slowdown and declining domestic demand, given the surge in inflation.

Trading the USD/CAD

The combination of tariffs and monetary easing is set to weigh on the CAD. The USD/CAD may continue to chart lower highs and lower lows. In addition to the impact of tariffs on the country’s trade, the BoC’s interest rate decisions will remain a critical volatility-inducing factor for the USD/CAD. In case inflation persists, the BoC may make two more 25 bps rate cuts through Q2 and Q3 2025. The increasing interest rate differential against USD may weigh on CAD demand.

Canada is the fifth largest producer of crude oil and holds the third highest proven reserves globally. Dampening oil prices tend to weaken CAD demand, pushing the USD/CAD lower. This is quite likely now, given America’s “Drill, Baby, Drill” mission. Simultaneously, OPEC may curb production cuts starting April 2025, further increasing supply. Plus, the Russian supply may flood the markets as sanctions are lifted, given that initiatives to restore peace are intensifying.

Prime Minister Carney has also announced snap elections in April, which adds more uncertainty to the mix. New leadership and its policies may introduce new vectors of volatility.

For traders, any kind of volatility can translate into an opportunity. A popular strategy to capture such opportunities is trading the USD/CAD with derivative instruments, such as contracts for difference (CFDs). CFDs can be traded in rising as well as falling markets. This multiplies the opportunities you can explore. But remember, trading with leverage requires robust risk management.

To Sum Up

- Trump has slapped a 25% blanket and 10% energy tariffs on Canada.

- Canada has announced retaliatory tariffs and may hold further negotiations with the US.

- Canada’s economic growth is set to slow down through 2025 and 2026.

- The Canadian government may provide fiscal support to the economy.

- The USD/CAD will remain volatile.

- Monetary easing in Canada is expected to weigh on the Loonie.

- CFDs offer the opportunity to trade a declining USD/CAD.

- Risk management is critical while using leverage.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information here in contained. Reproduction of this information, in whole or in part, is not permitted.