US Dollar Hits Multi-Year Lows

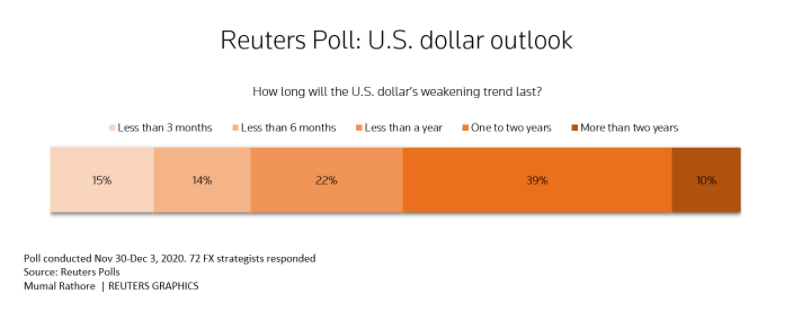

US Dollar hits multi-year lows and forecasts regarding the performance of the US dollar in 2021 seem to share the same theme – further weakening could be on the cards, at least for the first half of the year. This, against a backdrop of successful vaccine roll outs across the world and a recovering global economy. In fact, a Reuters poll, published in December 2020, revealed that currency strategists believe that the USD could continue to weaken over the first six months of 2021, as investors seek out riskier assets in hopes of higher returns.

Analysts point out that even before the Covid-19 pandemic, the US economy has been faltering, a situation that was made much worse by the slowdown in economic activities due to prolonged lockdowns. Well-known American economist Stephen Roach has gone so far as to predict there is a greater than 50% probability of the US dollar collapsing by the end of 2021.

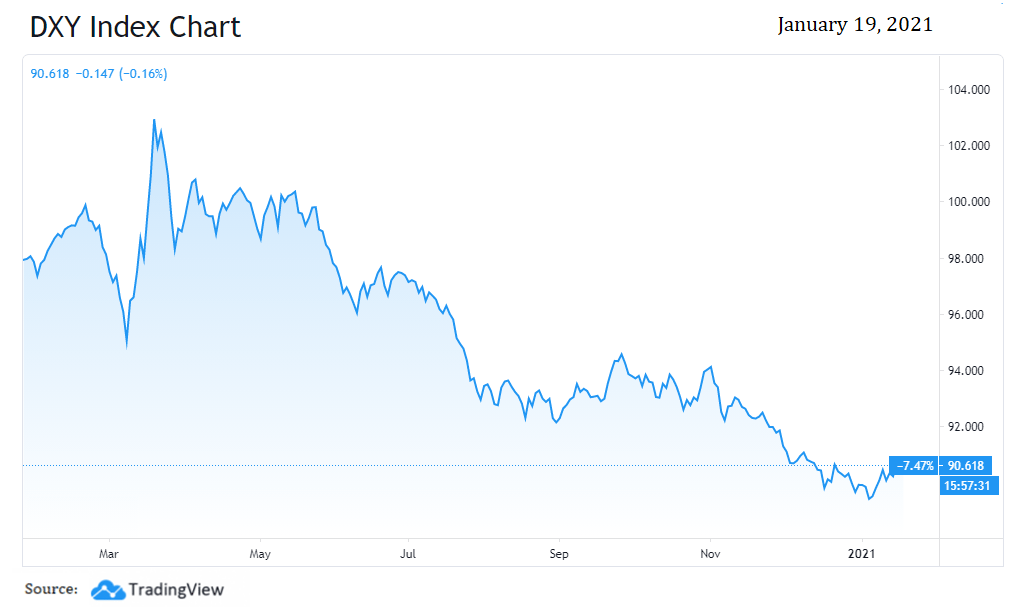

His forecast doesn’t seem too off the mark, given the continued plunge of the US dollar index (DXY), which dropped to its lowest since May 2018, closing in on 91, in December 2020. Seeing the dollar weakening significantly, Goldman Sachs had cautioned that the USD could well be at risk of losing its status as the world’s reserve currency.

So, what lies behind this agreement among analysts that the American currency could continue to weaken 2021? Here’s a look at some of the key reasons.

A Shaky Safe Haven

Historically, the greenback has strengthened during periods of crisis, with investors flocking to it to safeguard themselves against economic turmoil. The beginning of the coronavirus pandemic seemed to evoke this sentiment among investors, as they liquidated holdings in other assets, especially stocks, for the US dollar.

Of course, the currency had suffered over the past three years, impacted by the Trump administration’s protectionist policies, the trade war with China and disagreements with the EU and other nations. Despite all this, the USD emerged as a popular choice of safe haven assets, especially during the second quarter of 2020.

Once the emergency appeared to have passed, lockdowns began to ease and economic activities gradually resumed, investors moved on to higher risk assets, leaving the US dollar to continue on its downward trajectory of recent years. Positive news regarding vaccine trials and roll outs didn’t help either. Despite the pandemic continuing to rage on in the US, the domestic currency wasn’t the asset people were turning to.

Now, in 2021, with optimism being the overall market sentiment, analysts believe that risk appetites could continue to rise, which is bad news for the USD. Higher risk, higher yield assets, including emerging market currencies, are likely to perform better. ING analysts predict that the greenback could lose up to 10% of its value against other major currencies in 2021.

However, the ING report also stated, “It will not be a straight-line sell-off in the dollar – the legacy of Covid-19 in both Europe and the US will see to that.”

Impact of US Monetary Policy

In an attempt to bolster the economy, the Federal Reserve resorted to large scale money printing and lowering of interest rates, which put downward pressure on the dollar. In addition, the continued rise in Covid-19 cases in the United States and the re-introduction of containment measures would come at a huge economic cost.

In addition, the nation is facing large budget and current account deficits. While this does not necessarily translate into dollar weakness, analysts have warned that this time it is likely to put downward pressure on the domestic currency.

If unemployment is further pushed up and economic activities weaken, the US dollar could remain vulnerable. The Fed would be forced to drop interest rates to historic lows and monetary policy would continue to be loose. Reflation could take over and weigh on the USD, robbing it of its purchasing power.

Analysts believe that the Fed is likely to let inflation run on, following the adoption of flexible average inflation targets. While the central bank keeps borrowing costs close to zero, the yield curve could rise sharply, with analysts expecting the 10-year benchmark government borrowing costs potentially testing the 1.5% mark during 2021.

The Biden Era and the Greenback

All said and done, the tariffs imposed by the Trump administration helped the dollar strengthen to some extent. The trade war with China and resultant penalties on exports created uncertainties that sent investors flocking to safe havens, like the USD. Now, with Joe Biden in charge, tensions are expected to abate between the US and several countries. While this is great news for the global economy, it is likely to weigh on the dollar.

Biden has already promised further stimulus checks and prioritised the creation of jobs for the millions who lost theirs during the pandemic. In order to do so, the new POTUS is likely to focus on improvements associated with infrastructure and energy. Given that the Democrats have taken charge of both houses of Congress, the President is likely to get the green light for most of his plans. All this has evoked fears of reflation, which, as mentioned earlier, would add to the dollar’s downward momentum.

According to Peter Schiff, “2021 could be the year that Americans begin to find how much all this free government actually costs. The bill for the bailouts and stimulus will come in the form of a collapse in the value of savings and incomes, as the cost of living begins a long overdue explosive move higher.”

Is it Really All Bad?

Depreciation of the dollar might not be a bad thing all around. It could, in fact, prove to be a boon for global economic recovery. A weaker dollar helps the emerging economies, many of which hold dollar-denominated debt. Also, as the greenback weakens, demand for US exports rises. When the emerging markets have more buying power, the demand for commodities receives a boost.

On the other hand, a declining dollar means that other major currencies, including the euro, appreciate. Unless the respective central banks monitor their currencies closely, it could lead to instability. The euro rose 10% against the dollar between April and December 2020. Unless the ECB intervenes, Deutsche Bank believes that the EUR could go up to 1.30 against the USD by the end of 2021.