How Would the US Presidential Elections Impact the US Dollar?

Elections to choose a nation’s premier have typically caused volatility in the country’s stock market and currency. After all, the premier and winning party have a huge impact on the country’s economy, judicial system, diplomatic relations with other nations, investments into the future and even business and consumer sentiment. So, when experts predict the US dollar and other financial markets to remain volatile in the runup to naming the next President, it shouldn’t come as a surprise. While that holds true, there are several aspects that make the 2020 US Presidential elections an incredibly important event.

With so many variables to consider, what can measure the overall impact of the US Presidential elections? There is a barometer for this. It’s the country’s currency – the US dollar.

What’s Different This Year?

Election Day in the US has historically been the most important day for the financial markets. The results start coming in on the same day and, by early the next day, the winner is announced. This year will be very different, owing to the ongoing pandemic. A massive spike in mail-in voting is expected and the winner could be announced two to three weeks after Election Day.

Also, President Donald Trump has threatened to dispute the result on claims of voter fraud if Democratic nominee Joe Biden wins. This could add to US dollar volatility, with significant downside risk.

How Will the US Dollar Respond Before the Election Result is Announced?

There are some factors that can continue exerting pressure on the US dollar as the markets await the result. The pandemic-induced economic distress will continue to be a major concern for traders and investors. The rising covid-19 numbers does not provide any solace for the US dollar either. Ironically, the greenback could even respond negatively versus the euro in the event of further lockdowns in Europe.

The EUR/USD pair has historically followed this rule – when markets are bearish and falling, the US dollar outperforms, and when markets are bullish and rising, the euro rises. This rule has also been defied in 2020. The US dollar’s safe-haven status has been waning with America facing an economic crisis. With this, traders and investors have found refuge in the euro, which has exhibited resilience amid the pandemic, while the US dollar has tested and breached support barriers.

The Federal Reserve’s commitment to keeping interest rates near zero also does not bode well for the greenback. Expectations of a stimulus plan being announced after the elections could lend some support to the US dollar. This may well be short-lived, however, as a relief package worsens America’s already troubling debt-to-GDP ratio.

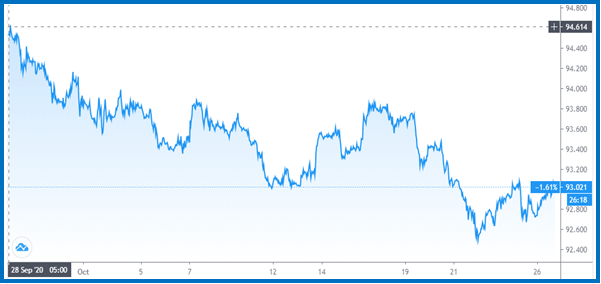

In the week ending October 23, the US dollar index (which measures the performance of the greenback against its major rivals) remained range-bound, with some bearish momentum. Trading in the American currency is likely to remain muted after the November 3 Election Day and before the result is announced.

How Will the US Dollar Respond When the Election Result is Announced?

The US dollar has historically gained between 2% and 12% following a US Presidential election every year since 1980. This is because markets respond favourably to the end of political uncertainty. However, the only exception to this was in 2008, when the US was combating a financial crisis. It would have been safer to assume that the USD would appreciate after the 2020 elections, irrespective of who won, had the pandemic not battered the economy.

“Since 1932, an incumbent US president has never failed to win re-election unless a recession has occurred during their time in office,” JPMorgan analyst Maria Paola Toschi noted. This suggests a Biden win. Markets seem to have already responded to the national polls and media reports predicting a Joe Biden victory. The US dollar has been on a sharp downtrend since the final week of September.

However, let’s not forget that the US polls have limited predictive power. So, if the Republicans win, we could see the dollar regaining some lost ground.

Looking at the Most Important Factors Impacting the US Dollar

Among the many factors that impact the US dollar, here are the most important and how the Presidential election outcome influences them.

America’s Trade Relations: Biden is expected to strengthen America’s relationship with its allies and have a more diplomatic approach to China. CNBC quoted Nathan Sheets, former Treasury undersecretary for international affairs, as saying that Biden could “focus on reform of the World Trade Organization and lead a coordinated effort to address China’s trade practices,” rather than Trump’s trade war and tariffs approach. This could have a stabilising to positive impact on the US economy and its currency.

Fiscal Stimulus: The Democrats may be more conservative about the size of the fiscal stimulus than the Republicans. The greenback has historically responded very favourably to governments that have contested quantitative easing. But remember that this year is atypical, and markets have been looking forward to a covid-19-relief package. This, too, suggests upside to the USD if Trump wins.

Business Environment: The Republicans are viewed as being more favourable to business, which is the main focus in the current pandemic scenario. Business growth means job creation and improving consumer spend, which can trigger a more sustainable economic rebound. Moreover, markets are typically wary of the Democrats due to them favouring large government spends and higher corporate taxation rates. This suggests the US dollar could remain subdued in the event of a Biden win and recover significantly if President Donald Trump is re-elected.

Interest Rates: Neither parties are expected to contest the Federal Reserve’s decision to keep interest rates low.

There are mixed expert projections for the US dollar for both a Trump and Biden win. What is for certain is that the market will soon stop responding to the US Presidential elections and focus on the economy. Rising covid-19 numbers will have more of an impact on the USD, irrespective of who occupies the Oval Office. Despite the pressure, the dollar is still the currency of the world’s largest economy and experts expect it to hold its status as a reserve currency. With the US dollar having shed around 10% from its multiyear highs reached in March, further correction could be limited.