What is Depth of Market? How to Use DoM to Place Orders in MT5

Depth of Market (DoM) is the extent to which a large order can impact the price of a security. Securities with deeper markets are less susceptible to price fluctuations on large orders, as compared to those with low market depth. It is a trading tool for short-term traders in liquid markets, such as the forex market.

Interpreting DoM

Most platforms/brokerages display market depth as the current bid-ask listing of a security. Real-time data about the activity in the market associated with that security aids traders in estimating the demand and supply ratio. It is an essential metric, especially while trading low-volume instruments. Institutional traders use it to predict whether a large trade will move the market, while retail traders use it to assess general liquidity, make trading decisions and take positions accordingly. Notably, even if individual traders do not inherently possess the capacity to move the markets, they can impact prices of thinly traded assets.

In general, the price of a security tends to move in the direction in which the order book is skewed. For instance, if the order book has 70% buy orders and 30% sell, the price is likely to go up due to the buying pressure.

Did you know?

Institutional traders often execute Secret Orders. Algorithmic trading enables them to discover trading opportunities a little before manual traders. Powerful technology lets them execute high-speed orders anonymously.

Additionally, DoM helps identify market sentiment and recognise key areas of confluence.

Identifying Support and Resistance Levels

Traders can identify the support level as the price where buy orders start to overtake sell orders, whereas the level at which sell orders overtake buy orders is taken as the resistance level.

Factors that Influence the DoM of a Security

Tick Size

This is the minimum price gain allowed for a security, and impacts trader motivation to post advance orders. A larger tick size means more incentive to place orders in advance. A smaller tick size allows smaller traders to fill their orders with little price difference, defeating the purpose of taking positions ahead of time.

Minimum Margin Requirements

The margin affects the leverage a trader gets. High minimum margin requirements restrict large orders. It lowers the depth of the asset’s market.

Price Movement Restrictions

Sometimes, the price of certain assets, such as certain commodities, are not allowed to move freely due to their sheer nature. This restricts how fast prices can move with increasing market depth. This, ultimately, impacts trader decisions regarding order size.

Trading Restrictions

To prevent individual traders from controlling the market, the maximum quantity of certain assets that an individual may own is capped.

Market Transparency

Lack of transparency in the markets raises concerns among traders, diminishing their willingness to place orders.

Did you know?

Depth of market is usually different on exchanges than in the OTC markets.

Market Depth and Asymmetry of Information

When a large order is placed, the market tends to be inclined to do the same. It is generally believed that those who place larger orders have more information and, hence, smaller traders rush to join in. The assumption makes them believe that the market sentiment is in favour of that order. This eventually raises volatility and liquidity in the asset’s market.

Word of Caution

The accessibility of a market feature’s depth depends on the broker and there is no guarantee of its correlation with exchange instruments.

How to View the Depth of Market

Viewing the market depth of an asset is fairly straightforward:

Directly from the chart

- Click the Chart tab on the Menu bar

- Select the “Depth of Market” option

From Market Watch

- Right-click on the asset to open the Options list

- Select “Depth of Market” to open the window

Did you know?

You can use the ALT + B key combination to open the DoM window in MT5.

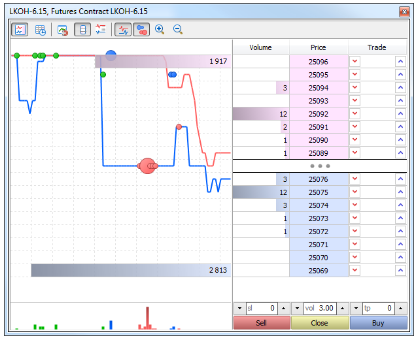

Working with Depth of Market on MT5

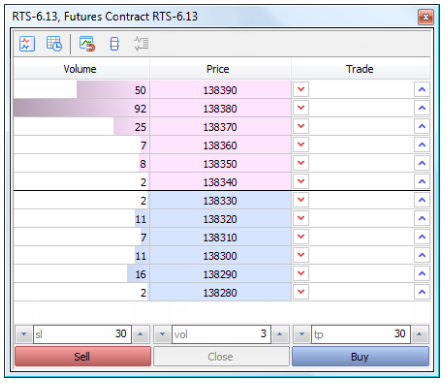

MetaTrader 5 allows one-click orders directly from the DoM chart. Traders can make a market operation or a pending trade request using market depth data.

Buying/Selling a Financial Instrument

- On the Market Watch window, set the stop loss (sl), take profit (tp) and the volume.

- Click the trade command of your choice (Buy or Sell)

If one-click trading is enabled for your account, the trade will be initiated as a Fill or Kill request. Otherwise, a dialog box specifying the conditions will be displayed.

The trade is executed with the closest market bids. However, if the trader specifies the price with the order, the trade goes through only if the mentioned amount is available at the stated price, otherwise it is killed.

Creating a Pending Order

A pending order is created when an order is to be placed for a certain number of lots at a price point currently not on the list. This request gets added to the DoM table, adding to the available liquidity and deepening the market.

Placing Various Types of Orders on MT5

If one-click orders are enabled, you can open multiple positions from the DoM chart:

- Click the up arrow in the Bid price area, to place a Buy Limit order

- Click the up arrow in the Ask price area, to place a Buy Stop order

- Click the down arrow in the Ask price area, to place a Sell Limit order

- Click the down arrow in the Bid price area, to place a Sell Stop order

Deleting an Order

- Hover the mouse over the up or down arrow.

- The cursor will change to an ‘X’.

- Click the button to delete your order.

When multiple orders are placed at a given price, the oldest one gets deleted first.

To Sum Up

- Depth of market is a volume indicator showing the potential of the market to absorb a large order.

- A security with a deep market means enough volume of pending orders on both the bid and ask sides, preventing one large order from significantly moving the price.

- Level 2 price quotes available in the order book help ascertain the market depth.

MetaTrader 5 facilitates placing orders directly from the Market Watch and DoM windows.