Ways to Trade the Cup and Handle Pattern

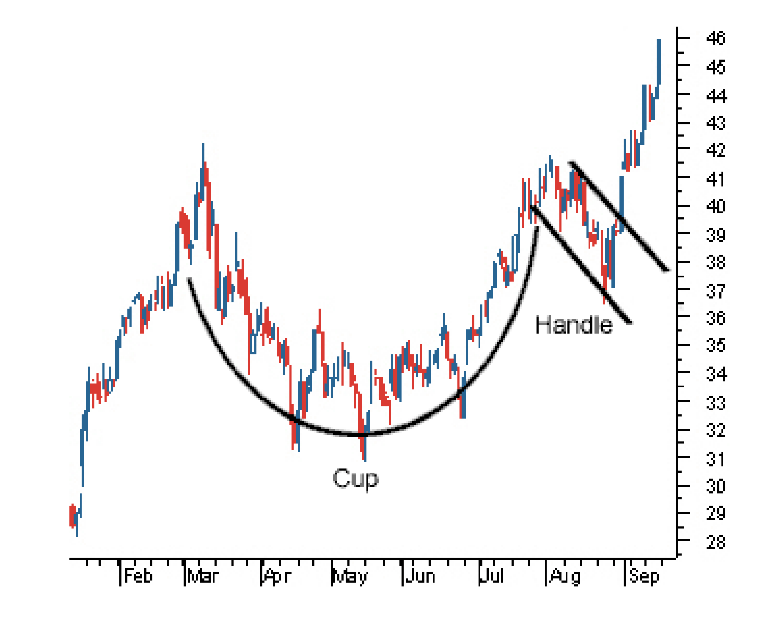

The ability to read and interpret chart patterns is a useful skill for traders. These patterns can signal logical entry/exit points, and positions for placing stop-loss and take-profit orders. The cup and handle pattern is characterised by a U-shaped cup and a slight downward drift in price action, which is the handle.

It is a bullish continuation pattern, useful for traders to identify opportunities to go long on. Some traders also use it to trade breakouts. Breakouts occur when the price of an asset crosses below the support level or moves above the resistance level. American entrepreneur William J. O’Neil defines 4 stages of the cup and handle breakout in his book, How to Make Money in Stocks:

- The asset price rallies in a significant uptrend.

- There is a price pullback that graphically creates the shape of a “U,” which is the cup. This is sized up to 50% retracement of the previous trend.

- The price breaks out, but fails to reach the prior high. A pullback takes place again that holds near the resistance level. Price consolidation takes place to form the handle.

- Price goes back to the resistance level for the second time and breaks out. This breakout is equal to the depth of the cup.

The handle sometimes takes the shape of a triangle, but it should not be at the lower level of the cup. In some cases, price consolidates to form a rectangle. This pattern can form both in short-term and long-term chart timeframes. For stocks, the pattern may appear over a few weeks to a few years. The cup can form over 1 to 6 months, while the handle forms over 1 to 4 weeks.

Image Source: Scholar.Harvard.Edu

Let’s see how the pattern can be used to place entry and exit points.

Placing Entry in a Cup and Handle Pattern

The handle needs to form before you enter a position. The pattern is complete when the price moves out of the handle. Price is usually expected to surge from here onwards.

The handle usually forms over a descending trendline. When price breaks above this trendline, entry can be planned. Along with that, the volume function should be used in stock trading, since increasing volume indicates the probability of a price breakout. The volume aspect can be skipped for forex trading, although forex traders prefer to use it to confirm trend continuation or breakout.

The price is expected to rise from here, but it doesn’t do so all the time. It can move sideways as well, or it could decline after entry. This is why a stop-loss is essential.

Setting a Stop-Loss for the Cup and Handle

A stop-loss can control the risk if the price declines to a huge extent, to make the pattern invalid. It can be placed at the lowest point of the handle. The stop-loss can also be placed below the most recent swing low, if the price fluctuates significantly within the handle.

An ideal stop-loss position is one that doesn’t end up in the lower part of the cup. This is because the handle needs to form in the upper part of the cup to validate the pattern. By placing the stop-loss in the upper third of the cup, it is positioned closer to the entry point. This helps enhance the risk-reward ratio of the trade. The target here is the reward portion.

Placing an Exit Point or Profit Target

The height of the breakout handle is added to the height of the cup to get the target figure.

If the two parts of the cup are of different heights, the lower height can be added to the breakout handle to achieve a conservative target. More aggressive traders can also use the larger height.

Another method to plan the target is by using Fibonacci extensions. The extension can be plotted from the base of the cup to the starting point of the handle, and then to the low point of the handle. For a conservative price target, 100% of the extension can be considered. For an aggressive price target, 162% of the extension can be considered.

Important Points to Remember

- While cups with a more “U” shaped bottom are preferred, “V” shaped bottom cups are also traded. Opponents, however, argue that a V-shaped bottom indicates lack of price stability before bottoming. This means that the price may go back to test the level.

- An inverted cup and handle formation can be used to locate selling opportunities. This is a bearish continuation pattern.

- The cup and handle should not be too deep. The best ones have a shallow retracement on the handle, about one-third of the cup. Also, the handle needs to form in the upper half of the cup.

- At the base of the cup, the volume needs to be lower than average. It rises when the price increases to test the previous high.

- The pattern should form after a prior uptrend. If it forms after a downtrend, it can indicate potential reversal. Traders can look for the price waves getting smaller as it approaches the cup and handle pattern. This indicates that selling pressure is tapering off. So, when the price breaks above the handle, there is a strong possibility of an upside move.

- Some traders like to add a buffer of 1 ATR (Average True Range) below the handle, rather than placing the stop-loss at the exact low of the handle. This is because traders don’t want to get stopped out prematurely.

- During the handle formation, tighter volatility contraction could be better.

Pros and Cons of Trading the Cup and Handle Formation

There are certain limitations of this pattern. New traders might find it difficult to identify the pattern. It can also take long timeframes for the pattern to form completely. Often, other indicators may need to be used to confirm signals.

However, the cup and handle pattern provides measurable parametres for price movements and offers a good risk-reward ratio. With proper planning of entry and exit positions, the pattern could be a valuable technical analysis tool for both equity and forex traders.