Why Support and Resistance Levels Are So Important

Support and Resistance (S&R) levels are two critical price points in technical analysis for informed trading in any financial market. They are popularly known as points where supply and demand forces meet in the trading community. Read on to learn all about resistance and support and why they are so important for traders.

What is Support?

The price point where the downtrend may halt or reverse is the support level. During a ranging market, the price stays above this level. Price trending below the support level indicates that the asset is oversold.

What is Resistance?

An asset price level at which an uptrend may pause or reverse is the resistance level. During a ranging market, the price stays below this level. The price of an overbought asset remains above the resistance level.

Trading with Support and Resistance

Traders either trade a bounce or a breakout at these key levels.

Trading at Support

A common technique that uses support as a trading signal is to buy at support (trade the bounce towards resistance) if you have not yet taken a position and sell if you hold the asset already (trade a breakout below the support).

Trading at Resistance

Traders holding an asset commonly short at resistance (to take advantage of the bounce) to take profit if they had opened a long position. This is because it is a potential reversal point, which means it could be safe to take profits, at least partially. If the price breaks out, it is still a win and if it reverses, losses are minimised.

Support and Resistance in Ranging Markets

When the price is ranging, i.e., the market is moving sideways, the price fluctuates between the support and resistance levels.

Support and Resistance after a Breakout

If the price breaks out below the support, this level becomes the new resistance, and a new support level is established below it. On the other hand, if the price breaks out above resistance, it becomes the new support, and a new resistance level is set up above it.

Ways to Identify Support and Resistance Levels

There are several ways through which traders can identify support and resistance levels, such as:

Rounding Off

Human psychology understands round numbers better than fractional ones. Therefore, if the price of an asset is trading at $13.50, $13.70 and $13.20, traders consider $13 as the support and $14 as a resistance level. However, this is not a very common scenario in the financial markets, since multiple factors are at play, moving asset prices.

Trendlines

A trendline drawn at the lower wick of every candle in a candlestick chart shows the support level, while the trendline at the top edge of the upper shadow is the resistance level. Traders need to keep in mind that not all wick ends need to fall in a single line. There may be a few crossing over the resistance and falling below the support level.

Fibonacci

Fibonacci levels are used as reversal indicators in trending markets and are useful when support and resistance are shifting frequently due to market volatility.

The highest and lowest prices in a volatile market are considered 1 and 0, respectively (in a market moving largely upwards). Multiple levels are drawn at the prices marking Fibonacci percentages, such as 23.6%, 38.2%, 61.8% and 78.6%. Some traders also use 50%, while others prefer not to. This technique is used by scalpers and high-frequency traders. Support and resistance levels shift between the various Fibonacci levels, indicating price reversal or extension.

Using Technical Indicators

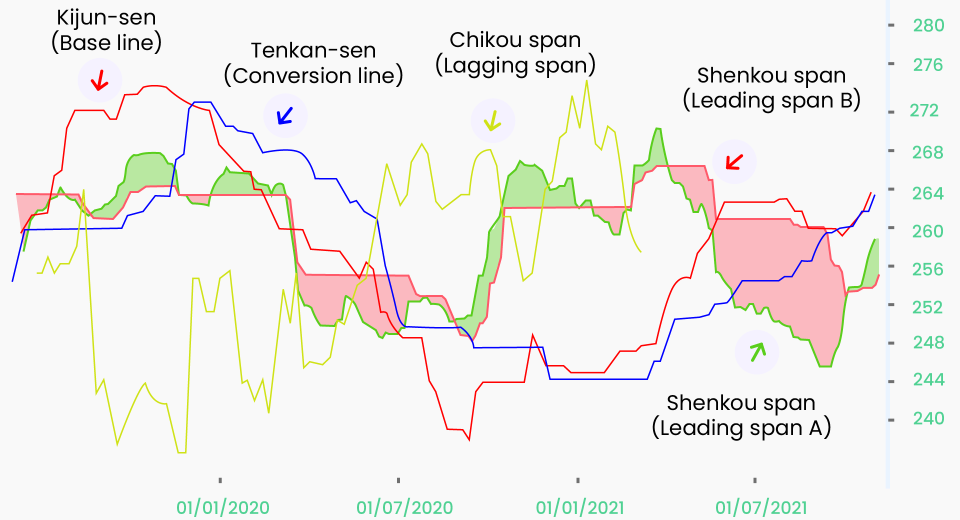

Support and resistance levels can be identified with the help of technical indicators, such as the Relative Strength Index (RSI), Bollinger Bands and Stochastic Oscillator.

Why do Support and Resistance Matter?

The two levels are indicators of market sentiment and serve as anchors for traders to make trading decisions. They affect trader psychology and, hence, how the price moves when it interacts with other market forces, such as news events. The two levels are studied in detail in behavioural finance. Here’s a snapshot:

The 3 types of traders at any time in the market are:

- Those who open short positions in hopes that the price of an asset will fall.

- Those who open long positions with the belief that the price will rise.

- Conservative traders, who prefer the trend to set in and then ride it.

Psychology of Support and Resistance Trading

Consider that a trader has opened a buy position when the asset price was close to the resistance level and expects the price to break out and continue to rise. However, the price ends up declining slightly. As a result, the trader questions their judgment and quickly sells to cut losses.

But as he sells, the patiently waiting buyers immediately buy, increasing the demand for the asset and raising its price. The trader is then left in regret. The essence here is that their previous rational judgment was correct, and some traders were waiting for the price to decline little below resistance, which means they took advantage of the trader’s paranoia.

Another scenario could be that as the trader sells, there are many others who also sell and the price goes down due to increased supply, bounces back off resistance rather than breaking out. In such a scenario, those to sell first could have lower losses while those selling later could incur higher losses, while the buyers might regret their decision.

As can be seen from the above example, it is market sentiment that matters at key levels. Therefore, it is critical to gauge market sentiment while also taking into account other factors that impact price movements. This can be done by using other indicators to support technical analysis. Some indicators that work well with support and resistance are moving average crossovers and candlestick patterns.

To Sum Up

- Support and resistance mark the key levels of a trend reversal or a breakout.

- In case of a breakout, these levels must be re-established.

- The two levels can be plotted in multiple ways, such as rounding off, Fibonacci ratios and indicators, such as RSI, Bollinger Bands and Stochastic Oscillators.

Support and resistance are key levels that affect and are affected by market sentiment, which is usually a consequence of other factors, such as economic releases, news events and geopolitical developments.

Disclaimer:

All data, information and materials are published and provided “as is” solely for informational purposes only, and is not intended nor should be considered, in any way, as investment advice, recommendations, and/or suggestions for performing any actions with financial instruments. The information and opinions presented do not take into account any particular individual’s investment objectives, financial situation or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions in accordance to their personal risk appetite. Blackwell Global endeavours to ensure that the information provided is complete and correct, but make no representation as to the actuality, accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global or its management, shareholders, and affiliates. Any projections or views of the market provided may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global assumes no liability for any loss arising directly or indirectly from use of or reliance on such information herein contained. Reproduction of this information, in whole or in part, is not permitted.